Answered step by step

Verified Expert Solution

Question

1 Approved Answer

We estimate that the expected Return is 2 . 8 percentage points higher for Mining stocks compared to Manufacturing stocks holding MarketCap constant.You are investing

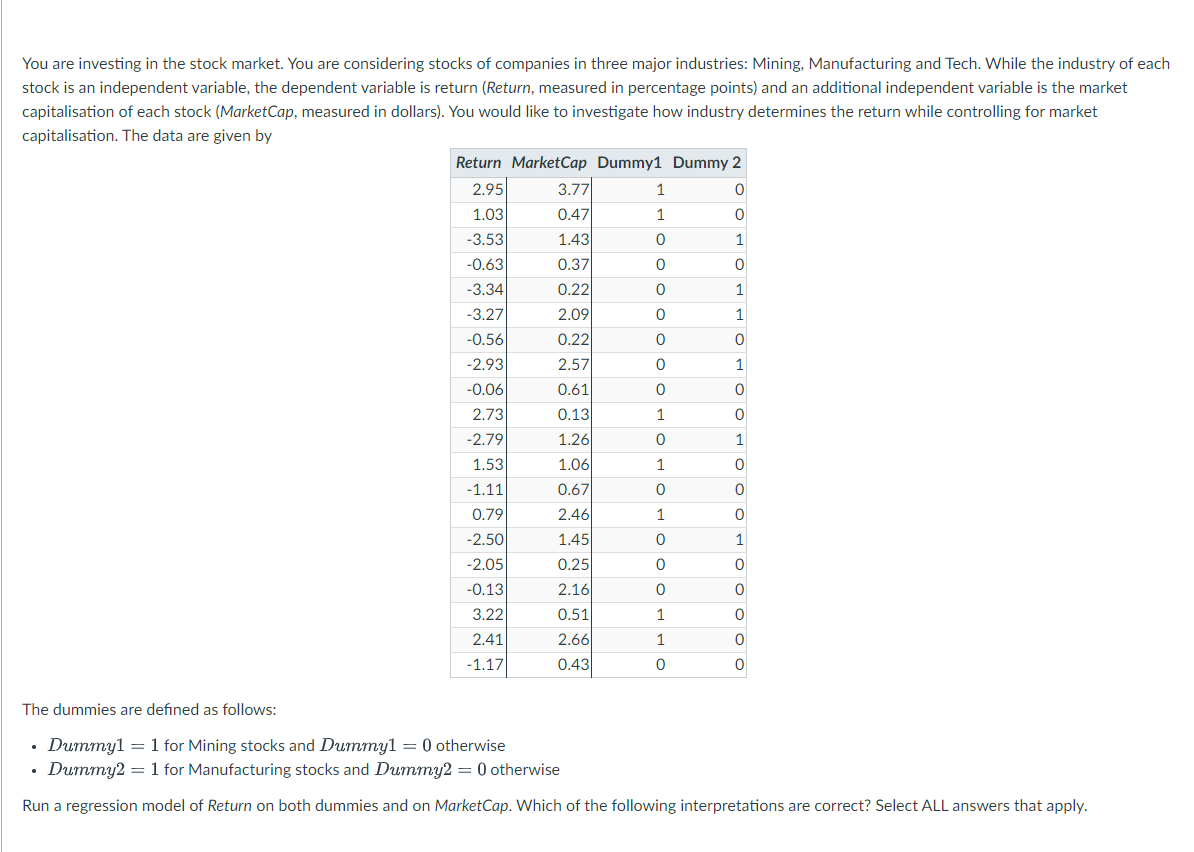

We estimate that the expected Return is percentage points higher for Mining stocks compared to Manufacturing stocks holding MarketCap constant.You are investing in the stock market. You are considering stocks of companies in three major industries: Mining, Manufacturing and Tech. While the industry of each

stock is an independent variable, the dependent variable is return Return measured in percentage points and an additional independent variable is the market

capitalisation of each stock MarketCap measured in dollars You would like to investigate how industry determines the return while controlling for market

capitalisation. The data are given by

The dummies are defined as follows:

Dummy for Mining stocks and Dummy otherwise

Dummy for Manufacturing stocks and Dummy otherwise

Run a regression model of Return on both dummies and on MarketCap. Which of the following interpretations are correct? Select ALL answers that apply.

We estimate that the expected Return is percentage points lower for Manufacturing stocks compared to Tech stocks holding MarketCap constant.

We estimate that the expected Return is percentage points lower for Manufacturing stocks compared to Mining stocks holding MarketCap constant.

We estimate that the expected Return is percentage points higher for Mining stocks compared to Tech stocks holding MarketCap constant.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started