Answered step by step

Verified Expert Solution

Question

1 Approved Answer

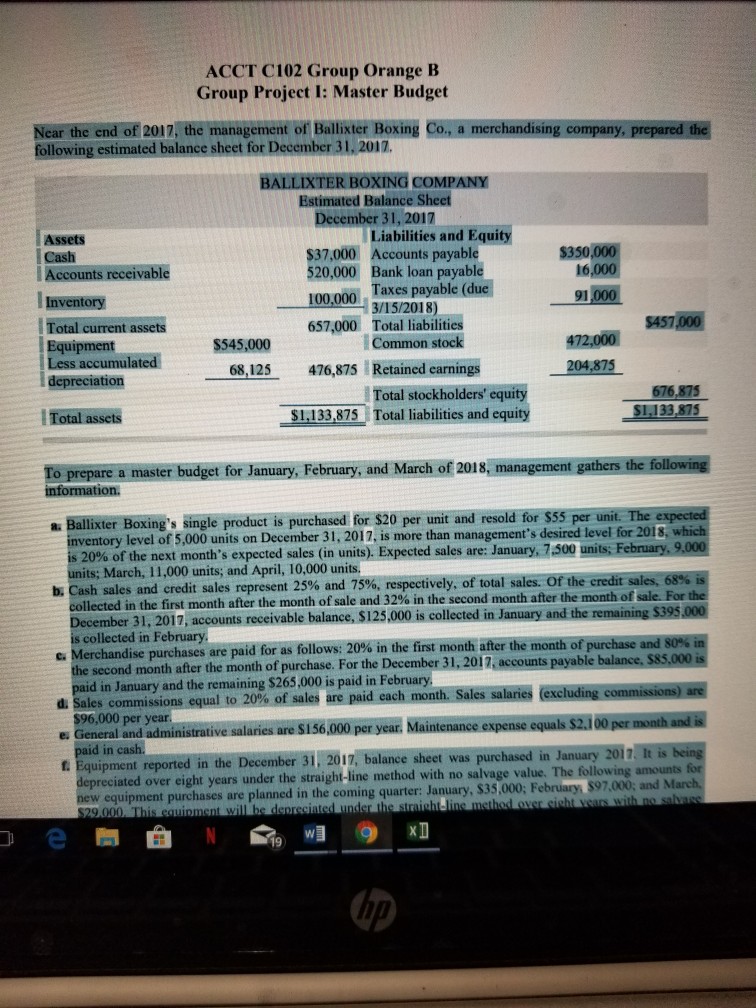

we have finished 1-5, need help 6-9 ACCT C 102 Group Orange B Group Project I: Master Budget Near the end of 2012, the management

we have finished 1-5, need help 6-9

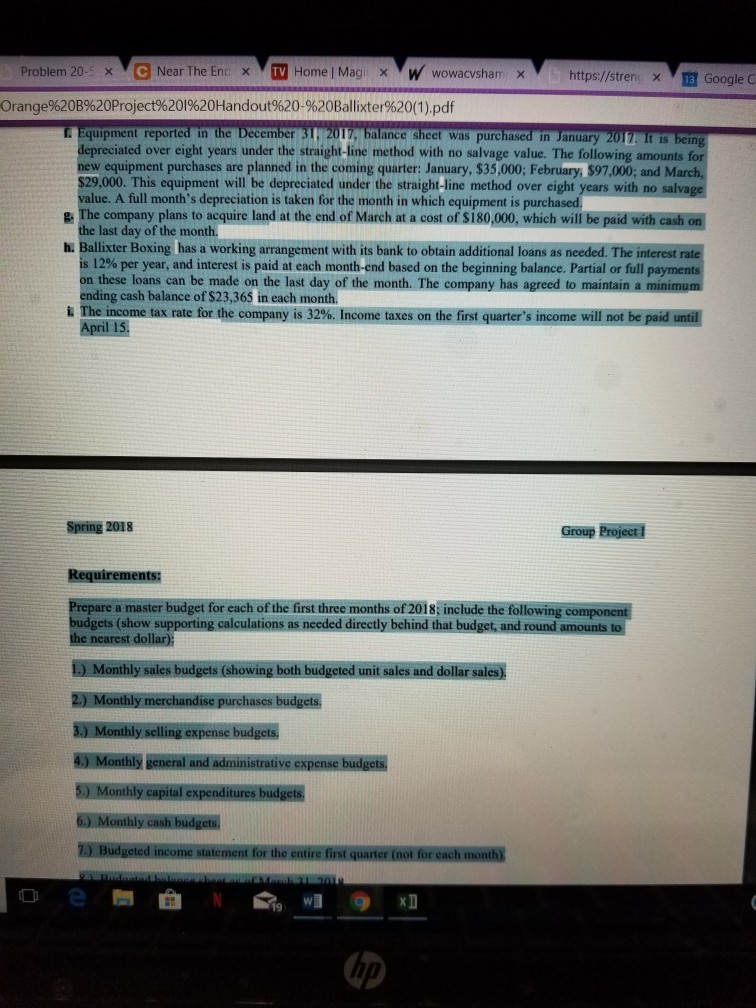

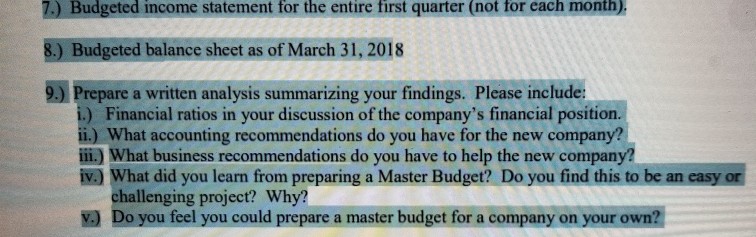

ACCT C 102 Group Orange B Group Project I: Master Budget Near the end of 2012, the management of Ballixter Boxing Co, a merchandising company, prepared the following estimated balance sheet for December 31. 2017. BALLIXTER BOXING cOMPANY Estimated Balance Sheet December 31, 2017 S37,000 Accounts payable 520,000 Bank loan payable 100,000 axes payable (due 657,000 Total liabilities Liabilities and Equity Assets Cash $350,000 l6 Accounts receivable 91 Inventory Total current assets Equipment 3/15/2018) 457,000 $545,000 68,125 476,875 Retained earnings 204,875 depreciation Total assets Total stockholders' equity $1-133,875 Total liabilities and equity 676,875 si,133.875 To prepare a master budget for January, February, and March of 2018, management gathers the following a Ballixter Boxing's single product is purchased for $20 per unit and resold for $55 per unit. The expected which ventory level of 5,000 units on December 31, 2017. is more than management's desired level for 2018, units February is 20% of the next month's expected sales (in units). Expected sales are: January,7,500 its; March, 11,000 units; and April, 10,000 units. b. Cash sales and credit sales represent 25% and 75%, respectively, of total sales of the credit sales, collected in the first month after the month of sale and 32% in December 31, 2017, accounts receivable balance, $125,000 is collected in January and the remaining $395,000 is collected in February Merchandise purchases are paid for as follows: 20% in the first month afterthe month the second month after the month of purchase. For the December 31, 2017, accounts payable paid in January and the remaining $265,000 is paid in February. the second month after the month of sale. For @ di Sales commissions equal to2 % ofsales are paid each month. Sales salaries excludingen m ss n 100 per month Gieneral and adminraive salaries re S156,000 per year. Maintenance expense d in cash. t Equipment reported in the December 31, 2017, balance sheet was purchased in January 2012. Itis depreciated over eight years under the straight-line method with no salvage value. The following amounts equipment purchases are planned in the coming quarter: January, $35,000; February $97,000; and 29.00O oment will he denreciaStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started