Answered step by step

Verified Expert Solution

Question

1 Approved Answer

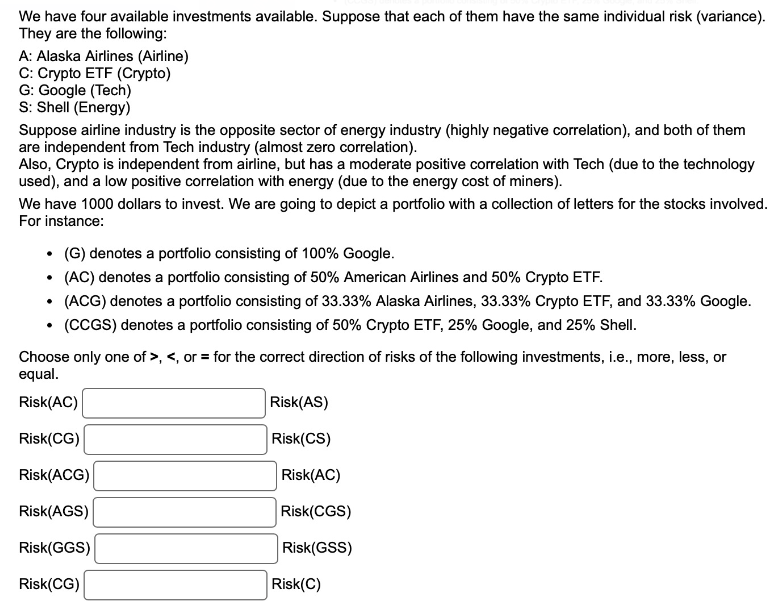

We have four available investments available. Suppose that each of them have the same individual risk ( variance ) . They are the following: A:

We have four available investments available. Suppose that each of them have the same individual risk variance

They are the following:

A: Alaska Airlines Airline

C: Crypto ETF Crypto

G: Google Tech

S: Shell Energy

Suppose airline industry is the opposite sector of energy industry highly negative correlation and both of them

are independent from Tech industry almost zero correlation

Also, Crypto is independent from airline, but has a moderate positive correlation with Tech due to the technology

used and a low positive correlation with energy due to the energy cost of miners

We have dollars to invest. We are going to depict a portfolio with a collection of letters for the stocks involved.

For instance:

G denotes a portfolio consisting of Google.

AC denotes a portfolio consisting of American Airlines and Crypto ETF.

ACG denotes a portfolio consisting of Alaska Airlines, Crypto ETF, and Google.

CCGS denotes a portfolio consisting of Crypto ETF, Google, and Shell.

Choose only one of or for the correct direction of risks of the following investments, ie more, less, or

equal.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started