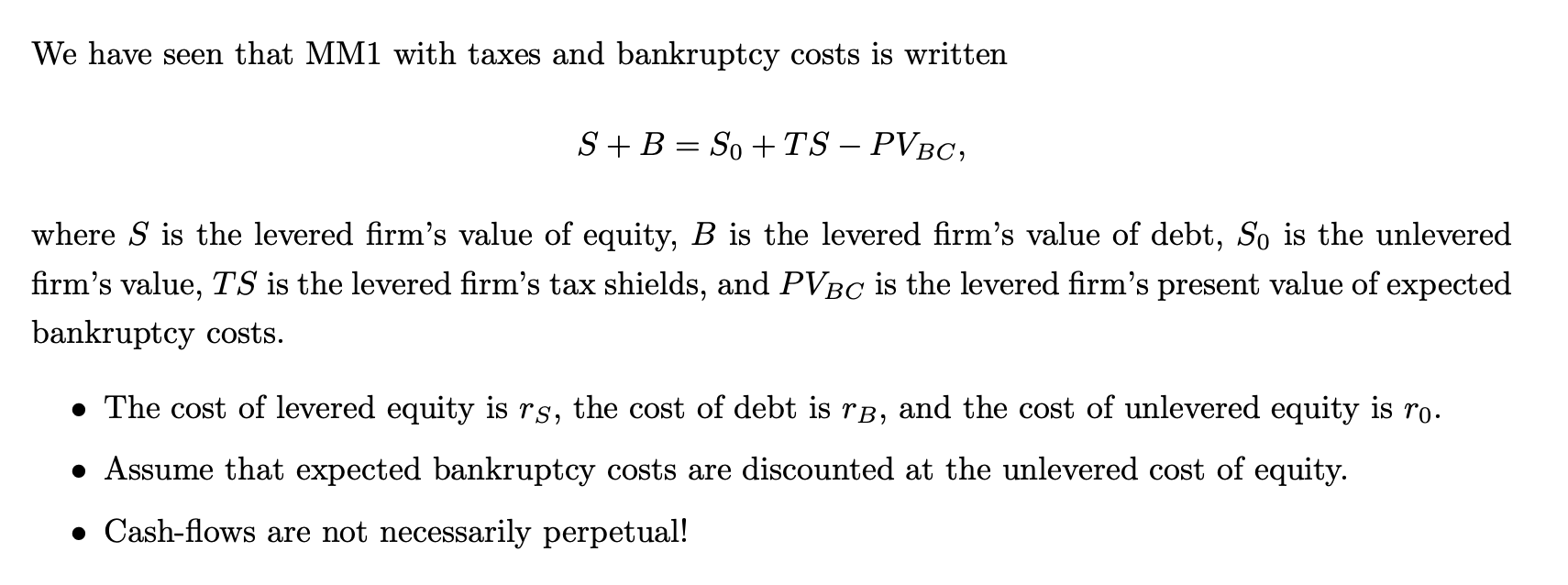

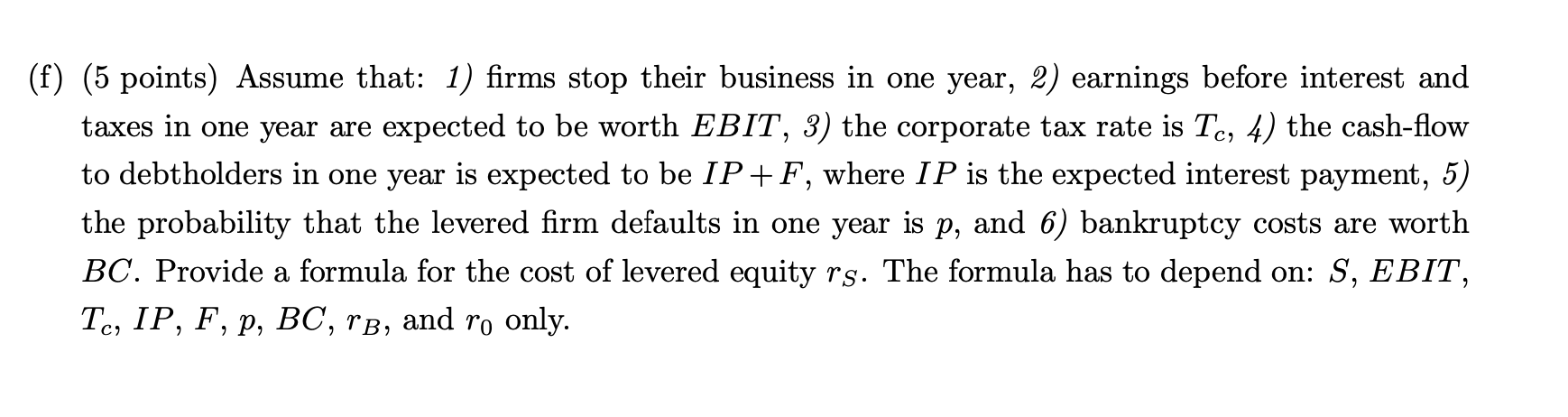

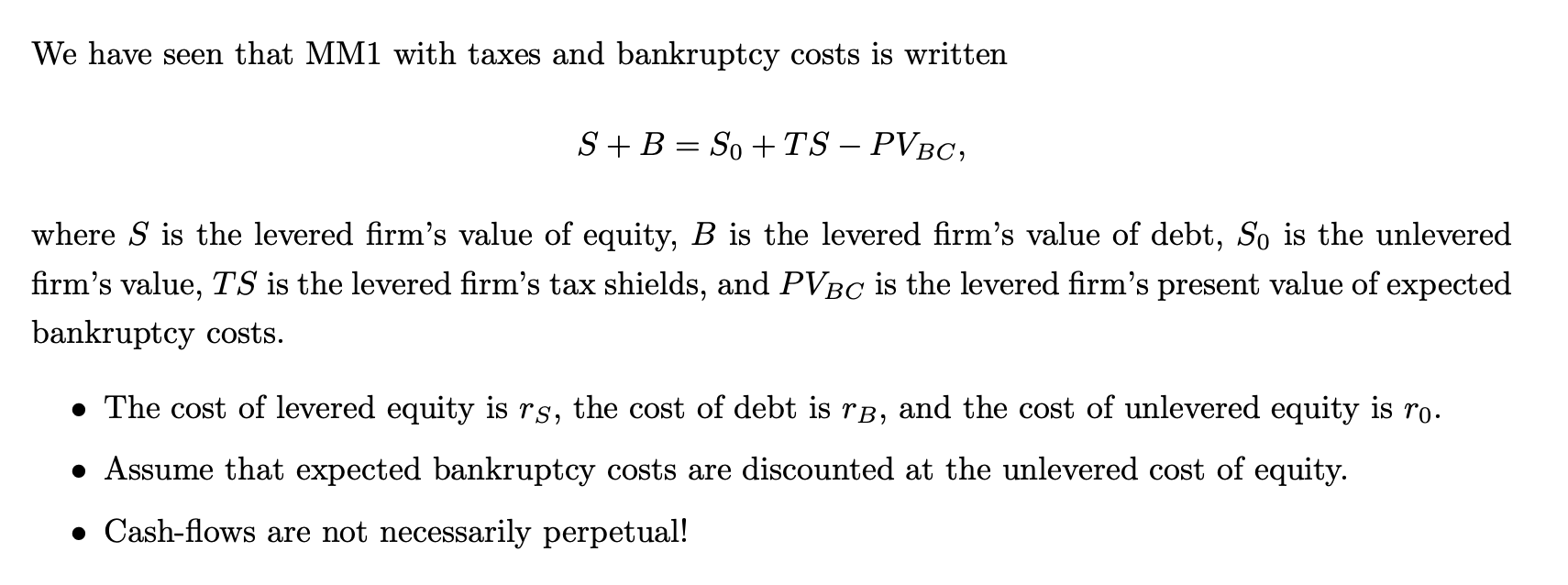

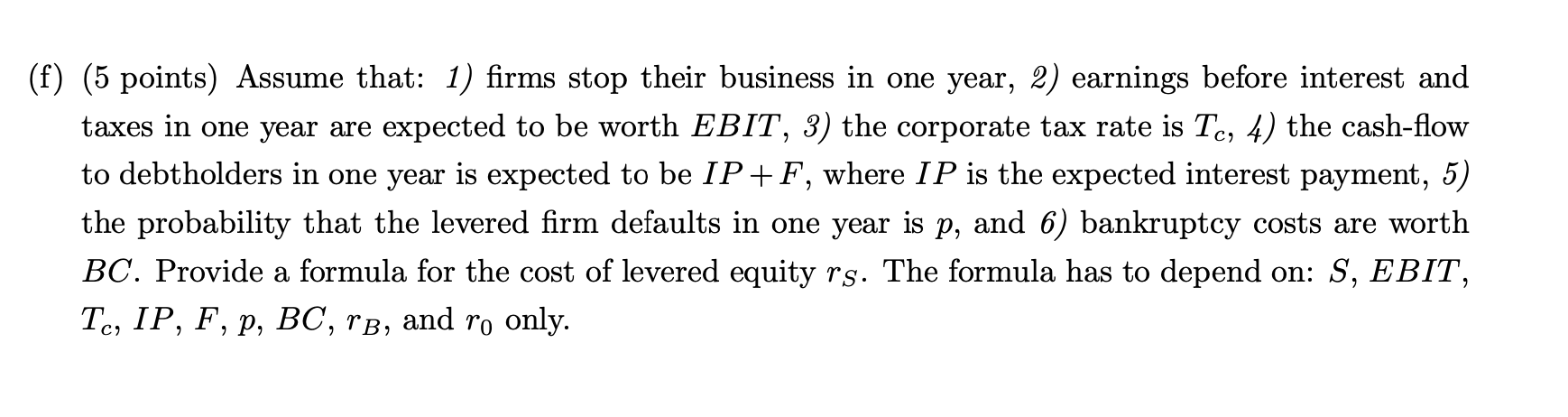

We have seen that MM1 with taxes and bankruptcy costs is written S+B = So +TS PVBC, where S is the levered firm's value of equity, B is the levered firm's value of debt, So is the unlevered firm's value, TS is the levered firm's tax shields, and PVBC is the levered firm's present value of expected bankruptcy costs. The cost of levered equity is rs, the cost of debt is rb, and the cost of unlevered equity is ro. Assume that expected bankruptcy costs are discounted at the unlevered cost of equity. Cash-flows are not necessarily perpetual! (f) (5 points) Assume that: 1) firms stop their business in one year, 2) earnings before interest and taxes in one year are expected to be worth EBIT, 3) the corporate tax rate is Tc, 4) the cash-flow to debtholders in one year is expected to be IP +F, where IP is the expected interest payment, 5) the probability that the levered firm defaults in one year is p, and 6) bankruptcy costs are worth BC. Provide a formula for the cost of levered equity rs. The formula has to depend on: S, EBIT, Tc, IP, F, P, BC, rb, and ro only. We have seen that MM1 with taxes and bankruptcy costs is written S+B = So +TS PVBC, where S is the levered firm's value of equity, B is the levered firm's value of debt, So is the unlevered firm's value, TS is the levered firm's tax shields, and PVBC is the levered firm's present value of expected bankruptcy costs. The cost of levered equity is rs, the cost of debt is rb, and the cost of unlevered equity is ro. Assume that expected bankruptcy costs are discounted at the unlevered cost of equity. Cash-flows are not necessarily perpetual! (f) (5 points) Assume that: 1) firms stop their business in one year, 2) earnings before interest and taxes in one year are expected to be worth EBIT, 3) the corporate tax rate is Tc, 4) the cash-flow to debtholders in one year is expected to be IP +F, where IP is the expected interest payment, 5) the probability that the levered firm defaults in one year is p, and 6) bankruptcy costs are worth BC. Provide a formula for the cost of levered equity rs. The formula has to depend on: S, EBIT, Tc, IP, F, P, BC, rb, and ro only