Question

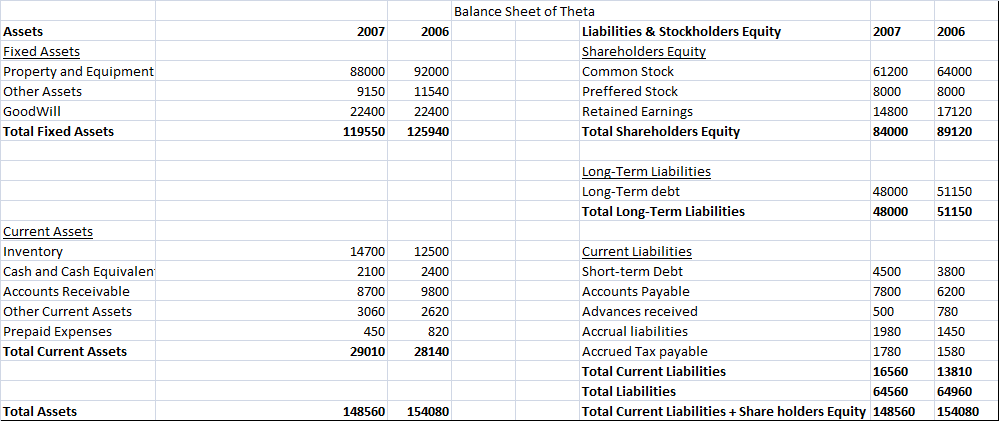

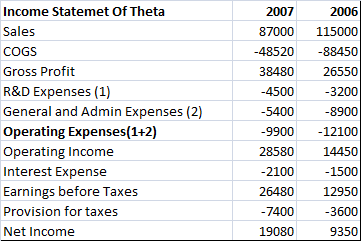

We have the following balance sheet for Theta Company for years 2007,2006 (in thousands of euro) We also have the following income statement for years

We have the following balance sheet for Theta Company for years 2007,2006 (in thousands of euro)

We also have the following income statement for years 2007,2006 (in thousands of euro)

We also know the following about Theta Company

Lamda decided that the total preferred dividends for 2007 are 740.000 EUR and for 2006 are 430.000 EUR

The total assets of Theta Company for 2005 are 135.450.000 EUR and the total stockholder's equity amounts to 70.450.000 Euro

How can we calculate the three basic components of the Dupont Analysis regarding the ROE for Theta Company for 2007 and 2006 and ROE based on Dupont Equation for 2007and 2006?

Balance Sheet of Theta Assets Fixed Assets Property and Equipment Other Assets GoodWill Total Fixed Assets Liabilities & Stockholders Equity Shareholders Equi Common Stock Preffered Stock Retained Earnings Total Shareholders Equity 2007 2006 2007 2006 92000 915011540 22400 22400 119550 125940 88000 61200 64000 8000 1480017120 84000 89120 8000 Long-Term Liabilities Long-Term debt Total Long-Term Liabilities 48000 51150 48000 51150 Current Assets Invento Cash and Cash Equivalen Accounts Receivable Other Current Assets Prepaid Expenses Total Current Assets 14700 12500 2400 9800 2620 820 2901028140 Current Liabilities Short-term Debt Accounts Payable Advances received Accrual liabilities Accrued Tax payable Total Current Liabilities Total Liabilities Total Current Liabilities Share holders Equity 148560 154080 2100 8700 3060 450 4500 7800 500 1980 1780 16560 64560 3800 6200 780 1450 1580 13810 64960 Total Assets 148560 154080 Income Statemet Of Theta Sales COGS Gross Profit R&D Expenses (1) General and Admin Expenses (2) Operating Expenses(1+2) Operating Income Interest Expense Earnings before Taxes Provision for taxes Net Income 2006 87000 115000 48520 -88450 8480 26550 3200 8900 9900-12100 28580 14450 1500 26480 12950 3600 9350 2007 -4500 5400 2100 7400 19080 Balance Sheet of Theta Assets Fixed Assets Property and Equipment Other Assets GoodWill Total Fixed Assets Liabilities & Stockholders Equity Shareholders Equi Common Stock Preffered Stock Retained Earnings Total Shareholders Equity 2007 2006 2007 2006 92000 915011540 22400 22400 119550 125940 88000 61200 64000 8000 1480017120 84000 89120 8000 Long-Term Liabilities Long-Term debt Total Long-Term Liabilities 48000 51150 48000 51150 Current Assets Invento Cash and Cash Equivalen Accounts Receivable Other Current Assets Prepaid Expenses Total Current Assets 14700 12500 2400 9800 2620 820 2901028140 Current Liabilities Short-term Debt Accounts Payable Advances received Accrual liabilities Accrued Tax payable Total Current Liabilities Total Liabilities Total Current Liabilities Share holders Equity 148560 154080 2100 8700 3060 450 4500 7800 500 1980 1780 16560 64560 3800 6200 780 1450 1580 13810 64960 Total Assets 148560 154080 Income Statemet Of Theta Sales COGS Gross Profit R&D Expenses (1) General and Admin Expenses (2) Operating Expenses(1+2) Operating Income Interest Expense Earnings before Taxes Provision for taxes Net Income 2006 87000 115000 48520 -88450 8480 26550 3200 8900 9900-12100 28580 14450 1500 26480 12950 3600 9350 2007 -4500 5400 2100 7400 19080Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started