Answered step by step

Verified Expert Solution

Question

1 Approved Answer

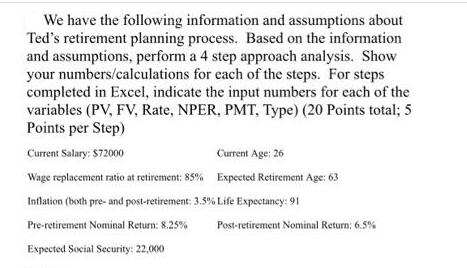

We have the following information and assumptions about Ted's retirement planning process. Based on the information and assumptions, perform a 4 step approach analysis.

We have the following information and assumptions about Ted's retirement planning process. Based on the information and assumptions, perform a 4 step approach analysis. Show your numbers/calculations for each of the steps. For steps completed in Excel, indicate the input numbers for each of the variables (PV, FV, Rate, NPER, PMT, Type) (20 Points total; 5 Points per Step) Current Salary: $72000 Current Age: 26 Wage replacement ratio at retirement: 85% Expected Retirement Age: 63 Inflation (both pre- and post-retirement: 3.5 % Life Expectancy: 91 Pre-retirement Nominal Return: 8.25% Expected Social Security: 22,000 Post-retirement Nominal Return: 6.5%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Step 1 Calculate the desired retirement income First we need to calculate the desired retirement income based on the wage replacement ratio and the cu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started