Answered step by step

Verified Expert Solution

Question

1 Approved Answer

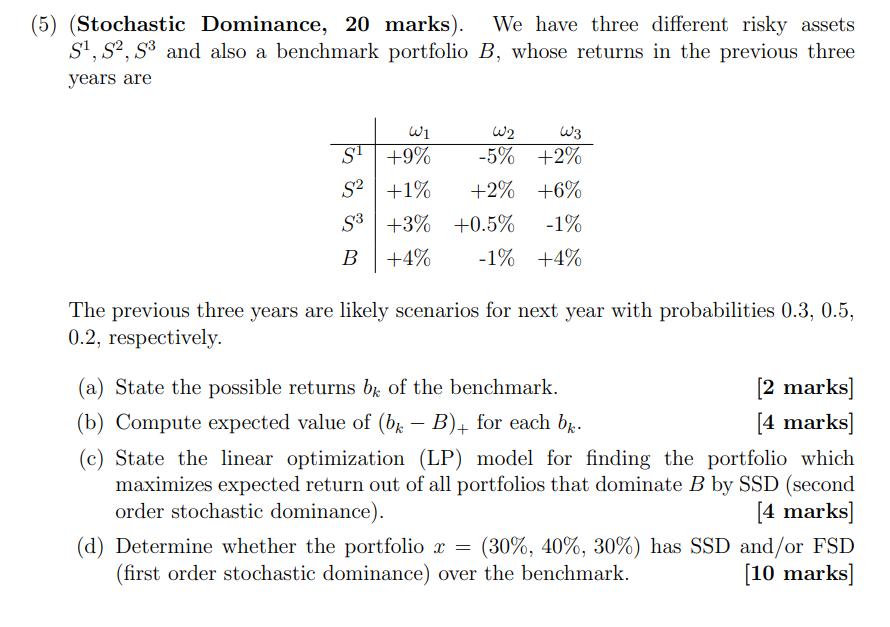

(5) (Stochastic Dominance, 20 marks). We have three different risky assets S, S, S and also a benchmark portfolio B, whose returns in the

(5) (Stochastic Dominance, 20 marks). We have three different risky assets S, S, S and also a benchmark portfolio B, whose returns in the previous three years are W2 W3 -5% +2% S +9% S +1% +2% +6% S3 +3% +0.5% -1% +4% -1% +4% B The previous three years are likely scenarios for next year with probabilities 0.3, 0.5, 0.2, respectively. (a) State the possible returns b of the benchmark. [2 marks] [4 marks] (b) Compute expected value of (bk - B)+ for each bk. (c) State the linear optimization (LP) model for finding the portfolio which maximizes expected return out of all portfolios that dominate B by SSD (second order stochastic dominance). [4 marks] (d) Determine whether the portfolio x = (30%, 40%, 30%) has SSD and/or FSD (first order stochastic dominance) over the benchmark. [10 marks]

Step by Step Solution

★★★★★

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a The possible returns of the benchmark are 1 4 and 1 b The expected value ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started