Answered step by step

Verified Expert Solution

Question

1 Approved Answer

We have three options in replacing our fleet of vehicles. Option one is to use high-end vehicles that cost $95,000 dollars, require maintenance of

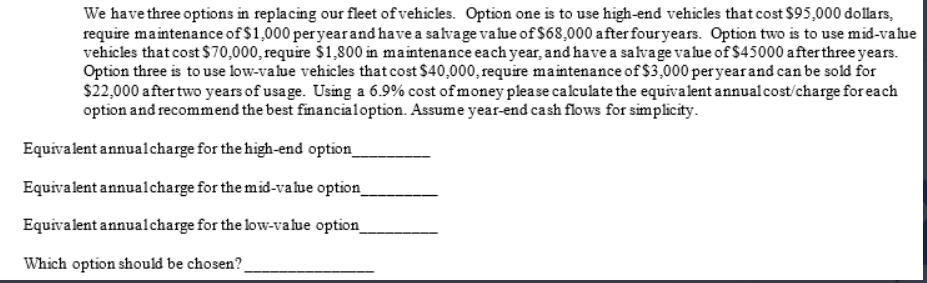

We have three options in replacing our fleet of vehicles. Option one is to use high-end vehicles that cost $95,000 dollars, require maintenance of $1,000 per year and have a salvage value of $68,000 after four years. Option two is to use mid-value vehicles that cost $70,000, require $1,800 in maintenance each year, and have a salvage value of $45000 after three years. Option three is to use low-value vehicles that cost $40,000, require maintenance of $3,000 per year and can be sold for $22,000 after two years of usage. Using a 6.9% cost of money please calculate the equivalent annual cost/charge for each option and recommend the best financial option. Assume year-end cash flows for simplicity. Equivalent annual charge for the high-end option_ Equivalent annualcharge for the mid-value option_ Equivalent annualcharge for the low-value option_ Which option should be chosen?_

Step by Step Solution

★★★★★

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer To calculate the equivalent annual costcharge for each option we need to consider the initial cost maintenance costs salvage value and the cost of money The equivalent annual costcharge is the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started