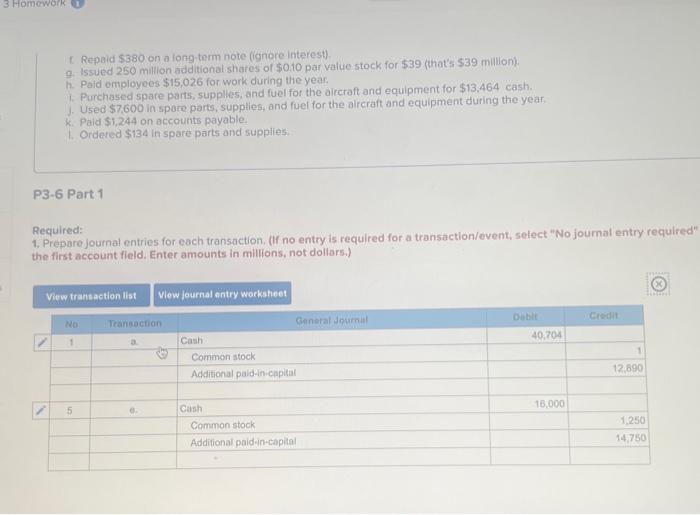

we have to create a general journal for parts A to L

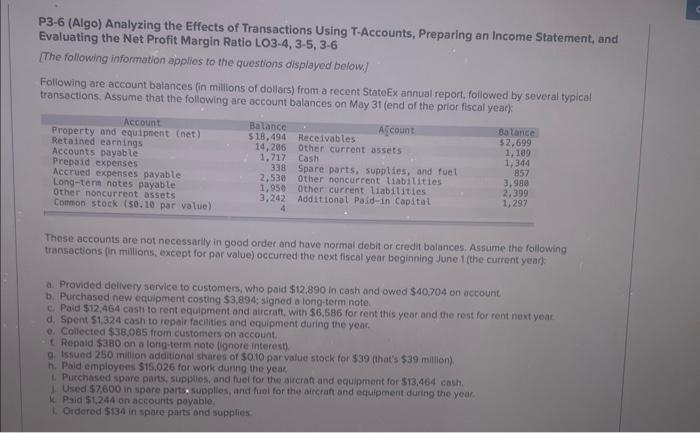

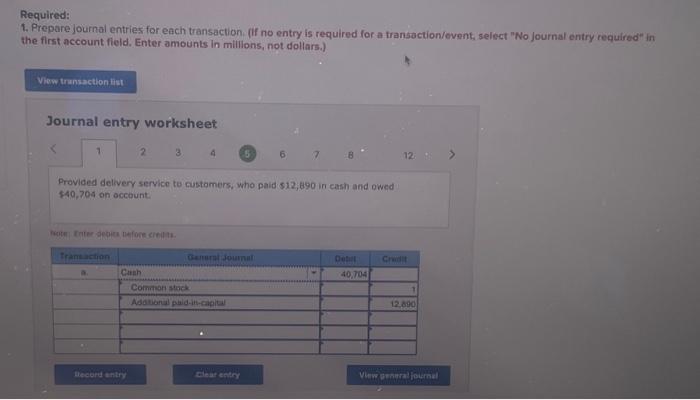

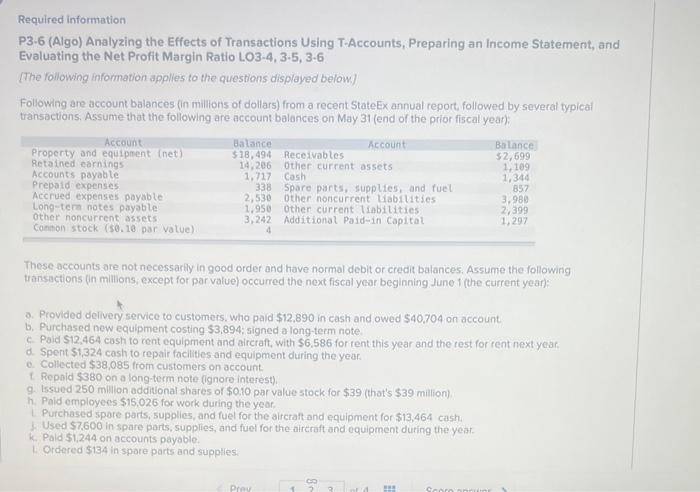

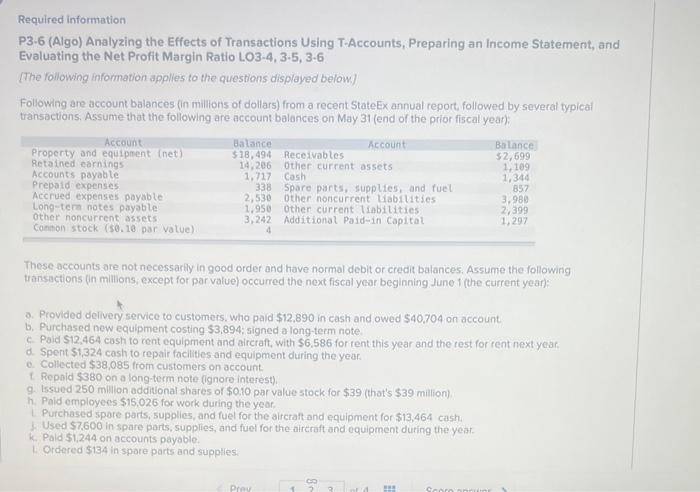

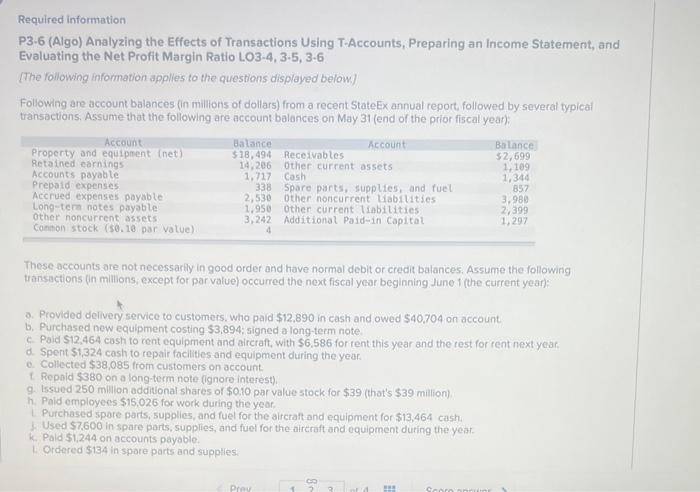

P3-6 (Algo) Analyzing the Effects of Transactions Using T-Accounts, Preparing an Income Statement, and Evaluating the Net Profit Margin Ratio LO3-4, 3-5, 3-6 [The following information applios to the questions displayed below.] Following are account baiances (in milions of dollars) from a recent StateEx annual report, followed by several typical transactions. Assume that the following are account balances on May 31 (end of the prior fiscal year): These accounts are not necessarily in good order and have normal debit or credit balances. Assume the following transactions (in millions, exeept for par value) occured the next fiscal year beginning June 1 (the current year): a. Provided delivery service to customers, who paid $12.890 in cash and owed $40.704 on eccount b. Purchased new equipment costing $3,894 signed a long-term note. c. Paid $12,464 cosht to rent equipment and aircraft, with $6,586 for rent this yeor and the rest for rent noxt yeac. d. Spent S1,324 cosh to repair facilites and equipment during the yoar. e. Collected $38,085 from customers on account. t. Repald $380 on a long term nate (lgnore interest) g. Issued 250 million additional shares of $010 par value stock for $39 (that's $39 milion). h. Paid employees $15,026 for work dunng the yeak 1. Purchased spare parts, supplios, and fuel for the aireraft and equipmont for $13,464 cash. . Used 57,600 in spare parts, supplies, and fuel for the airctaf and equipment during the year. 1. Paid 51,244 on accounts poyable. 1. Ordered $134 in spare parts ond supplies: Required: 1. Prepare journal entries for each transaction. (if no entry is required for a transaction/event, select "No journal entry required" in the first account field, Enter amounts in millions, not dollars.) Journal entry worksheet Provided delivery service to customers, who paid $12,690 in cash and owed {40,704 on occount Tacter friter jebotes nefone creilits. Required information P3.6 (Algo) Analyzing the Effects of Transactions Using T-Accounts, Preparing an income Statement, and Evaluating the Net Profit Margin Ratio LO3-4, 3-5, 3-6 [The following information applies to the questions displayed below]. Following are account balances (in millions of dollars) from a recent StateEx annual report, followed by: several typicai transactions. Assume that the following are account balances on May 31 (end of the prior fiscal year): These accounts are not necossartly in good order and have normal debit or credit balances. Assume the following transactions (in millions, except for par value) occurred the next fiscal year beginning June 1 (the current year): a. Provided delivery service to customers, who paid $12,890 in cash and owed $40,704 on account b. Purchased new equipment costing $3,894; signed a long-term note c. Paid $12,464 cash to rent equipment and aircraft, with $6,586 for rent this year and the rest for rent next year. d. Spent $1,324 cash to repair facilities and equipment during the year. e. Collected $38,085 from customers on account. 1. Repaid $380 on a iong-term note (ignore interest). 9. Lssued 250 million additional shares of $0.10 par value stock for $39 (that's $39 milion). h. Paid employees $15,026 for work during the year. Purchased spare parts, supplies, and fuel for the aircraft and equipment for $13,464 cash. 1. Used $7,600 in spare parts, supplies, and fuel for the aireraft and equipment duting the yeat. k. Paid $1,244 on accounts payable. C Ordered $134 in spore parts and supplies. f. Repaid $380 on a long-term note (ignore interest). 9. Issued 250 million additional shares of $0.10 par value stock for $39 (that's $39 million). h. Paid employees $15,026 for work during the year. 1. Purchased spare parts, supplles, and fuel for the aircraft and equipment for $13,464 cash. 1. Used $7.600 in spare parts, supplies, and fuel for the alrcraft and equipment during the year. x. Paid $1,244 on accounts payable. 1. Ordered $134 in spare parts and supplies: P3-6 Part 1 1. Prepare journal entries for each transaction. (If no entry is required for a transaction/event, select "No joumal entry requirec Required: the first account field. Enter amounts in millions, not dollars.) P3-6 (Algo) Analyzing the Effects of Transactions Using T-Accounts, Preparing an Income Statement, and Evaluating the Net Profit Margin Ratio LO3-4, 3-5, 3-6 [The following information applios to the questions displayed below.] Following are account baiances (in milions of dollars) from a recent StateEx annual report, followed by several typical transactions. Assume that the following are account balances on May 31 (end of the prior fiscal year): These accounts are not necessarily in good order and have normal debit or credit balances. Assume the following transactions (in millions, exeept for par value) occured the next fiscal year beginning June 1 (the current year): a. Provided delivery service to customers, who paid $12.890 in cash and owed $40.704 on eccount b. Purchased new equipment costing $3,894 signed a long-term note. c. Paid $12,464 cosht to rent equipment and aircraft, with $6,586 for rent this yeor and the rest for rent noxt yeac. d. Spent S1,324 cosh to repair facilites and equipment during the yoar. e. Collected $38,085 from customers on account. t. Repald $380 on a long term nate (lgnore interest) g. Issued 250 million additional shares of $010 par value stock for $39 (that's $39 milion). h. Paid employees $15,026 for work dunng the yeak 1. Purchased spare parts, supplios, and fuel for the aireraft and equipmont for $13,464 cash. . Used 57,600 in spare parts, supplies, and fuel for the airctaf and equipment during the year. 1. Paid 51,244 on accounts poyable. 1. Ordered $134 in spare parts ond supplies: Required: 1. Prepare journal entries for each transaction. (if no entry is required for a transaction/event, select "No journal entry required" in the first account field, Enter amounts in millions, not dollars.) Journal entry worksheet Provided delivery service to customers, who paid $12,690 in cash and owed {40,704 on occount Tacter friter jebotes nefone creilits. Required information P3.6 (Algo) Analyzing the Effects of Transactions Using T-Accounts, Preparing an income Statement, and Evaluating the Net Profit Margin Ratio LO3-4, 3-5, 3-6 [The following information applies to the questions displayed below]. Following are account balances (in millions of dollars) from a recent StateEx annual report, followed by: several typicai transactions. Assume that the following are account balances on May 31 (end of the prior fiscal year): These accounts are not necossartly in good order and have normal debit or credit balances. Assume the following transactions (in millions, except for par value) occurred the next fiscal year beginning June 1 (the current year): a. Provided delivery service to customers, who paid $12,890 in cash and owed $40,704 on account b. Purchased new equipment costing $3,894; signed a long-term note c. Paid $12,464 cash to rent equipment and aircraft, with $6,586 for rent this year and the rest for rent next year. d. Spent $1,324 cash to repair facilities and equipment during the year. e. Collected $38,085 from customers on account. 1. Repaid $380 on a iong-term note (ignore interest). 9. Lssued 250 million additional shares of $0.10 par value stock for $39 (that's $39 milion). h. Paid employees $15,026 for work during the year. Purchased spare parts, supplies, and fuel for the aircraft and equipment for $13,464 cash. 1. Used $7,600 in spare parts, supplies, and fuel for the aireraft and equipment duting the yeat. k. Paid $1,244 on accounts payable. C Ordered $134 in spore parts and supplies. f. Repaid $380 on a long-term note (ignore interest). 9. Issued 250 million additional shares of $0.10 par value stock for $39 (that's $39 million). h. Paid employees $15,026 for work during the year. 1. Purchased spare parts, supplles, and fuel for the aircraft and equipment for $13,464 cash. 1. Used $7.600 in spare parts, supplies, and fuel for the alrcraft and equipment during the year. x. Paid $1,244 on accounts payable. 1. Ordered $134 in spare parts and supplies: P3-6 Part 1 1. Prepare journal entries for each transaction. (If no entry is required for a transaction/event, select "No joumal entry requirec Required: the first account field. Enter amounts in millions, not dollars.)