Answered step by step

Verified Expert Solution

Question

1 Approved Answer

we have to fill the missing figures all figures sre interconnected Acrobat Reader File Edit View Sign Window Help Home Tools Homework 2.pdf Homework 2-22...

we have to fill the missing figures all figures sre interconnected

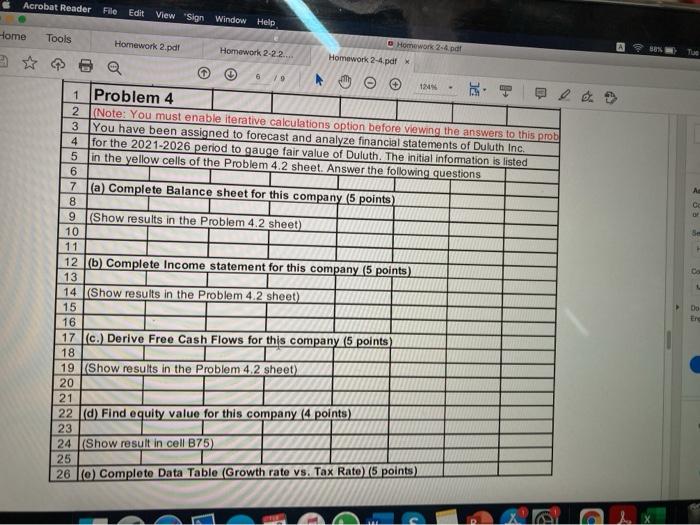

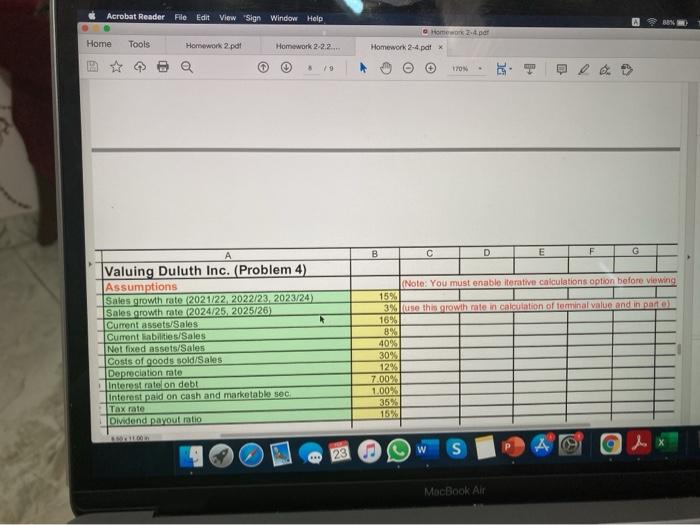

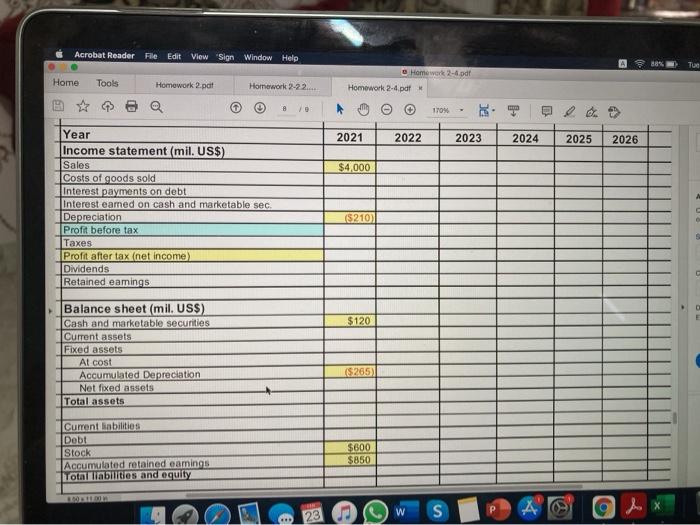

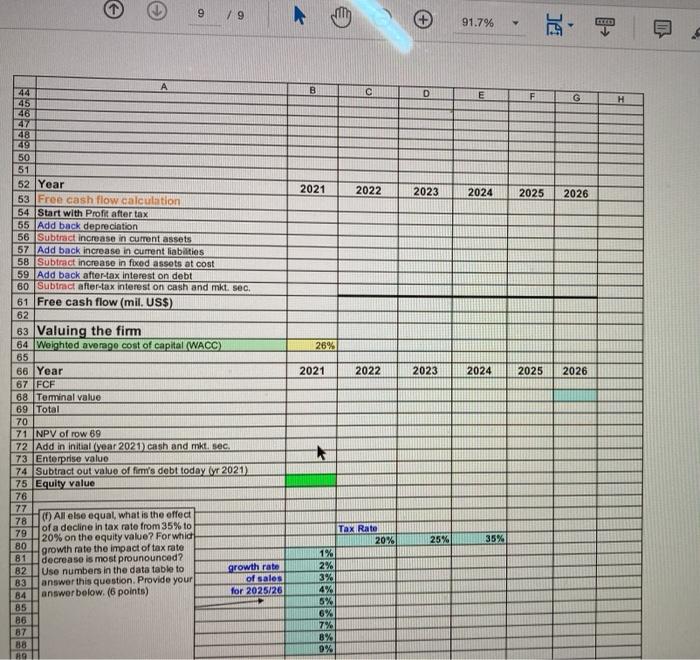

Acrobat Reader File Edit View Sign Window Help Home Tools Homework 2.pdf Homework 2-22... Homework 2.pdf Homework 2-4.pdf BOS 79 ce 124 1 Problem 4 2 (Note: You must enable iterative calculations option before viewing the answers to this prob 3 You have been assigned to forecast and analyze financial statements of Duluth Inc. 4 for the 2021-2026 period to gauge fair value of Duluth. The initial information is listed 5 in the yellow cells of the Problem 4.2 sheet. Answer the following questions 6 7 la Complete Balance sheet for this company (5 points) 8 9 (Show results in the Problem 4.2 sheet) 10 11 12 (b) Complete Income statement for this company (5 points) 13 14 (Show results in the Problem 4.2 sheet) 15 16 17 (c.) Derive Free Cash Flows for this company (5 points 18 19 (Show results in the Problem 4.2 sheet) 20 21 22 (d) Find equity value for this company (4 points) 23 24 (Show result in cell B75) 25 26 (0) Complete Data Table (Growth rate vs. Tax Rate 5 points) Do Ere Acrobat Reader File Edit View Sign Window Help Homewor Home Tools Homework 2.pdf Homework 2-22.. Homework 2.4.pdf X 7 79 124 1 2 em) 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 23 W ST Acrobat Reader File Edit View Sign Window Help BEN Homework par Home Tools Homework 2 pot Homework 2.2.2.. Homework 2-4.pdf e a 19 0 LYON => B D E F G Valuing Duluth Inc. (Problem 4) Assumptions Sales growth rate 2021/22 2022/23 2023/24) Sales growth rate (2024/25, 2025/26) Current assets/Sales Current abilities/Sales Not fixed assets/Sales Costs of goods sold/Sales Depreciation rate Interest rate on debt Interest paid on cash and marketable sec Tax rate Dividend payout to (Note: You must enable iterative calculations option before viewing 15% 3% lue this growth rate in calculation of terminal value and in parko 16% 8% 40% 30% 12% 7.00% 1.00% 35% le S 28 W MacBook Air Acrobat Reader File Edit View "Sign Window Help 88% Home Tools Homework 2.pdf Homework 2-6.pdf Homework 2-4.pdf Homework 2-22... 170 2021 2022 2023 2024 2025 2026 $4,000 Year Income statement (mil. US$) Sales Costs of goods sold Interest payments on debt Interest eamed on cash and marketable sec. Depreciation Profit before tax Taxes Profit after tax (net income) Dividends Retained eamings 18210) D E $120 Balance sheet (mil. USS) Cash and marketable securities Current assets Fixed assets At cost Accumulated Depreciation Net fixed assets Total assets $265) Current abilities Debt Stock Accumulated retained eamings Total abilities and equity $600 $850 A W 23 S *** 9 9 91.7% je B D E G H 1980 NOUS 2021 2022 2023 2024 2025 2026 26% A 44 45 146 47 48 49 50 51 52 Year 53 Free cash flow calculation 54 Start with Profit after tax 55 Add back depreciation 56 Subtract increase in current assets 57 Add back increase in current liabilities 58 Subtract increase in fixed assets at cost 59 Add back after-tax interest on debt 60 Subtract after-tax interest on cash and mkt. sec. 61 Free cash flow (mil. USS) 62 63 Valuing the firm 64 Weighted average cost of capital (WACC) 65 66 Year 67 FCF 68 Terminal value 69 Total 70 71 NPV of row 69 72 Add in initiallyear 2021) cash and mkt. sec. 73 Enterprise value 74 Subtract out value of fimm's debt today lyr 2021) 75 Equity value 76 77 78 (1) All else equal, what is the offect of a decline in tax rate from 35% to 79 20% on the equity value? For which 80 growth rate the impact of tax rate 81 decrease is most prounounced? 82 Use numbers in the date table to growth rate 83 answer this question. Provide your of sales 84 answer below. (6 points) for 2025/26 85 86 87 88 2021 2022 2023 2024 2025 2026 25% 35% Tax Rate 20% 1% 2% 3% 4% 5% 6% 7% 8% 0% Acrobat Reader File Edit View Sign Window Help Home Tools Homework 2.pdf Homework 2-22... Homework 2.pdf Homework 2-4.pdf BOS 79 ce 124 1 Problem 4 2 (Note: You must enable iterative calculations option before viewing the answers to this prob 3 You have been assigned to forecast and analyze financial statements of Duluth Inc. 4 for the 2021-2026 period to gauge fair value of Duluth. The initial information is listed 5 in the yellow cells of the Problem 4.2 sheet. Answer the following questions 6 7 la Complete Balance sheet for this company (5 points) 8 9 (Show results in the Problem 4.2 sheet) 10 11 12 (b) Complete Income statement for this company (5 points) 13 14 (Show results in the Problem 4.2 sheet) 15 16 17 (c.) Derive Free Cash Flows for this company (5 points 18 19 (Show results in the Problem 4.2 sheet) 20 21 22 (d) Find equity value for this company (4 points) 23 24 (Show result in cell B75) 25 26 (0) Complete Data Table (Growth rate vs. Tax Rate 5 points) Do Ere Acrobat Reader File Edit View Sign Window Help Homewor Home Tools Homework 2.pdf Homework 2-22.. Homework 2.4.pdf X 7 79 124 1 2 em) 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 23 W ST Acrobat Reader File Edit View Sign Window Help BEN Homework par Home Tools Homework 2 pot Homework 2.2.2.. Homework 2-4.pdf e a 19 0 LYON => B D E F G Valuing Duluth Inc. (Problem 4) Assumptions Sales growth rate 2021/22 2022/23 2023/24) Sales growth rate (2024/25, 2025/26) Current assets/Sales Current abilities/Sales Not fixed assets/Sales Costs of goods sold/Sales Depreciation rate Interest rate on debt Interest paid on cash and marketable sec Tax rate Dividend payout to (Note: You must enable iterative calculations option before viewing 15% 3% lue this growth rate in calculation of terminal value and in parko 16% 8% 40% 30% 12% 7.00% 1.00% 35% le S 28 W MacBook Air Acrobat Reader File Edit View "Sign Window Help 88% Home Tools Homework 2.pdf Homework 2-6.pdf Homework 2-4.pdf Homework 2-22... 170 2021 2022 2023 2024 2025 2026 $4,000 Year Income statement (mil. US$) Sales Costs of goods sold Interest payments on debt Interest eamed on cash and marketable sec. Depreciation Profit before tax Taxes Profit after tax (net income) Dividends Retained eamings 18210) D E $120 Balance sheet (mil. USS) Cash and marketable securities Current assets Fixed assets At cost Accumulated Depreciation Net fixed assets Total assets $265) Current abilities Debt Stock Accumulated retained eamings Total abilities and equity $600 $850 A W 23 S *** 9 9 91.7% je B D E G H 1980 NOUS 2021 2022 2023 2024 2025 2026 26% A 44 45 146 47 48 49 50 51 52 Year 53 Free cash flow calculation 54 Start with Profit after tax 55 Add back depreciation 56 Subtract increase in current assets 57 Add back increase in current liabilities 58 Subtract increase in fixed assets at cost 59 Add back after-tax interest on debt 60 Subtract after-tax interest on cash and mkt. sec. 61 Free cash flow (mil. USS) 62 63 Valuing the firm 64 Weighted average cost of capital (WACC) 65 66 Year 67 FCF 68 Terminal value 69 Total 70 71 NPV of row 69 72 Add in initiallyear 2021) cash and mkt. sec. 73 Enterprise value 74 Subtract out value of fimm's debt today lyr 2021) 75 Equity value 76 77 78 (1) All else equal, what is the offect of a decline in tax rate from 35% to 79 20% on the equity value? For which 80 growth rate the impact of tax rate 81 decrease is most prounounced? 82 Use numbers in the date table to growth rate 83 answer this question. Provide your of sales 84 answer below. (6 points) for 2025/26 85 86 87 88 2021 2022 2023 2024 2025 2026 25% 35% Tax Rate 20% 1% 2% 3% 4% 5% 6% 7% 8% 0% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started