Answered step by step

Verified Expert Solution

Question

1 Approved Answer

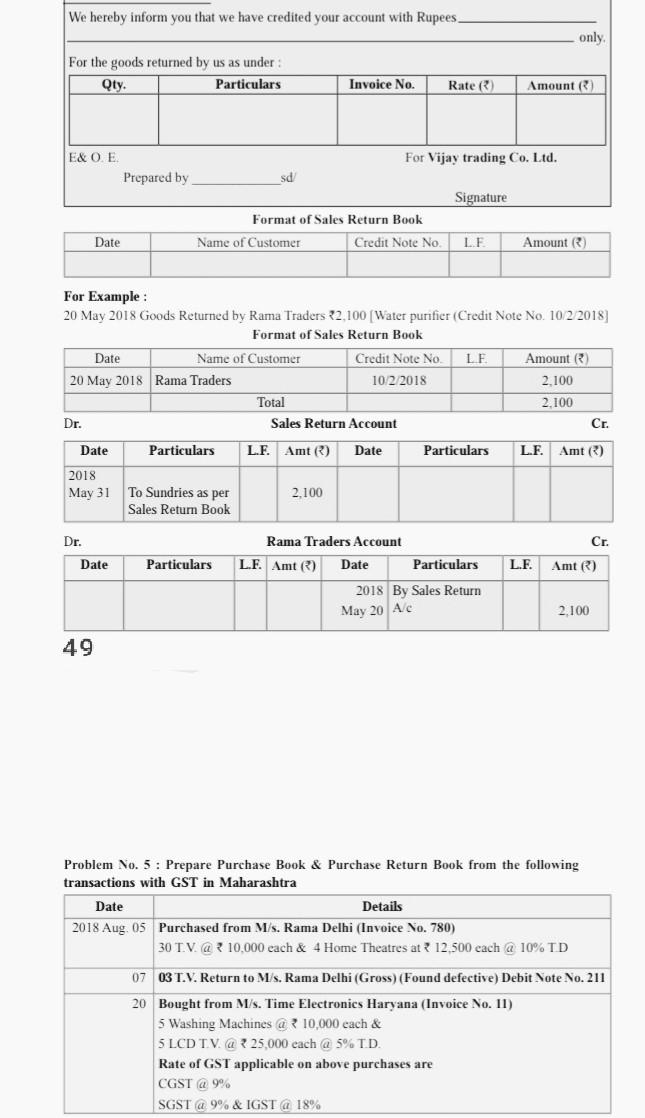

We hereby inform you that we have credited your account with Rupees only For the goods returned by us as under: Qty. Particulars Invoice No.

We hereby inform you that we have credited your account with Rupees only For the goods returned by us as under: Qty. Particulars Invoice No. Rate Amount) E&O E For Vijay trading Co. Ltd. Prepared by sd Signature Format of Sales Return Book Name of Customer Credit Note No. Date LE Amount) For Example : 20 May 2018 Goods Returned by Rama Traders 2,100 (Water purifier (Credit Note No. 10/2/2018 Format of Sales Return Book Date Name of Customer Credit Note No. LE Amount R) 20 May 2018 Rama Traders 10/2/2018 2.100 Total 2.100 Dr. Sales Return Account Cr. Date Particulars L.F. Amt) Date Particulars L.E. Amt) 2018 May 31 To Sundries as per Sales Return Book 2.100 Cr Dr. Date Particulars L.F. Amt R) Rama Traders Account L.F. Amt) Date Particulars 2018 By Sales Return May 20 AC 2.100 49 Problem No.5: Prepare Purchase Book & Purchase Return Book from the following transactions with GST in Maharashtra Date Details 2018 Aug. 05 Purchased from Ms. Rama Delhi (Invoice No. 780) 30 TV @ 10.000 each & 4 Home Theatres at 12.500 each @ 10% TD 07 03 T.V. Return to M/s. Rama Delhi (Gross) (Found defective) Debit Note No. 211 20 Bought from M/s. Time Electronics Haryana (Invoice No. II) 5 Washing Machines @ 10,000 each & 5 LCD TV @ 25,000 each @ 5% TD. Rate of GST applicable on above purchases are CGST a 9% SGST a 9% & IGST @ 18%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started