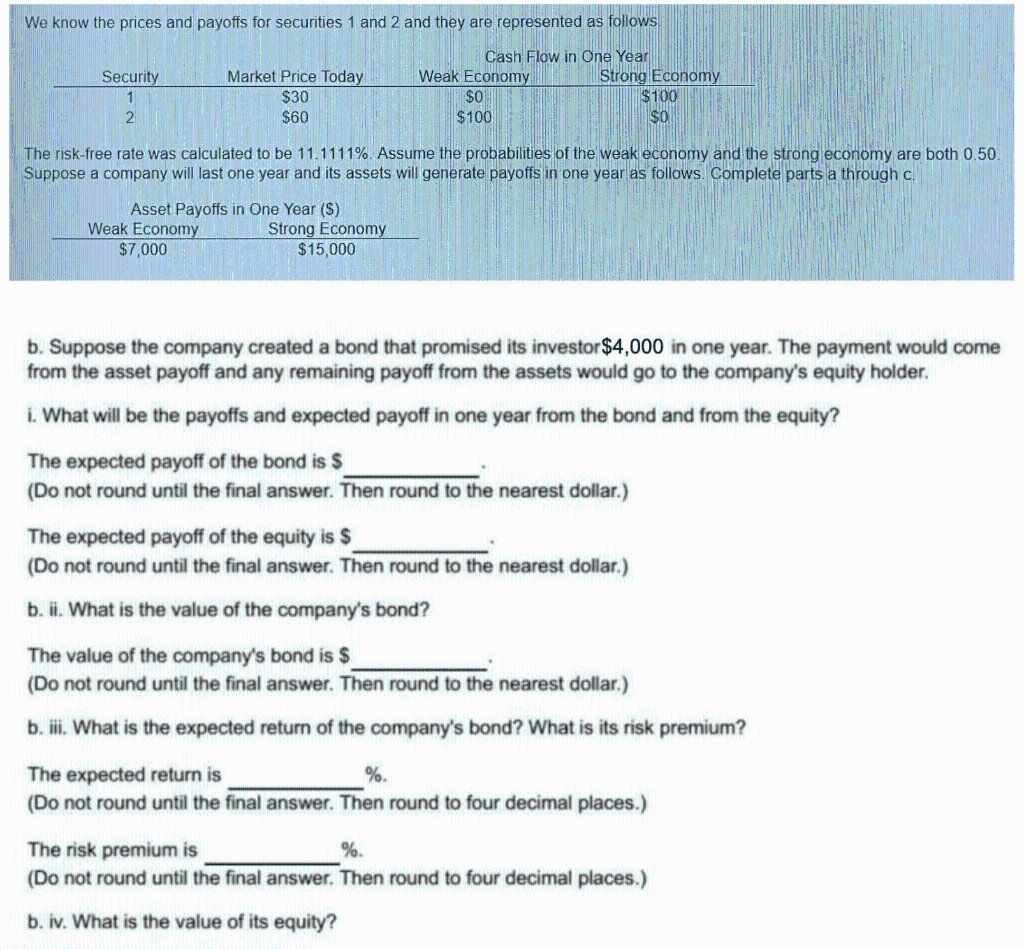

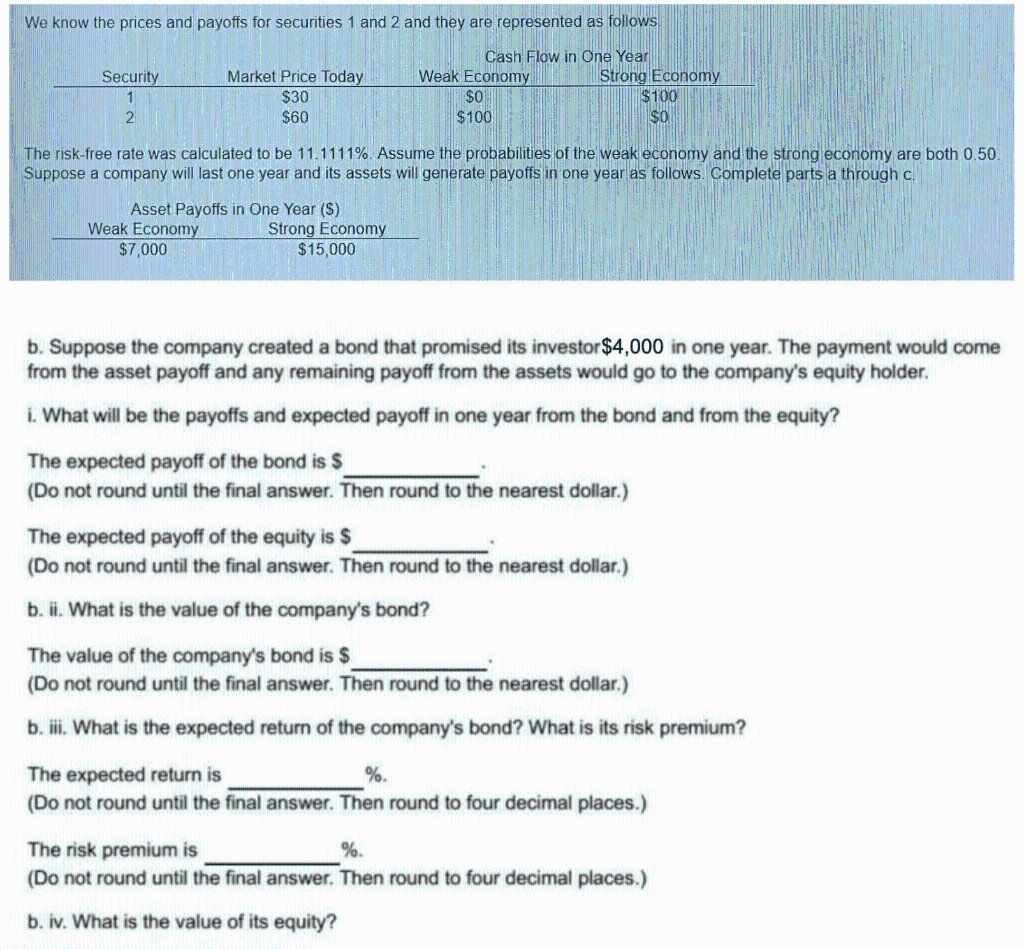

We know the prices and payoffs for securities 1 and 2 and they are represented as follows Security 1 2 Market Price Today $30 $60 Cash Flow in One Year Weak Economy Strong Economy $0 $100 $100 SO The risk-free rate was calculated to be 11.1111% Assume the probabilities of the weak economy and the strong economy are both 0.50 Suppose a company will last one year and its assets will generate payoffs in one year as follows. Complete parts a through c. Asset Payoffs in One Year ($) Weak Economy Strong Economy $7,000 $15,000 b. Suppose the company created a bond that promised its investor$4,000 in one year. The payment would come from the asset payoff and any remaining payoff from the assets would go to the company's equity holder. i. What will be the payoffs and expected payoff in one year from the bond and from the equity? The expected payoff of the bond is $ (Do not round until the final answer. Then round to the nearest dollar.) The expected payoff of the equity is $ (Do not round until the final answer. Then round to the nearest dollar.) b. ii. What is the value of the company's bond? The value of the company's bond is $ (Do not round until the final answer. Then round to the nearest dollar.) b. iii. What is the expected return of the company's bond? What is its risk premium? The expected return is % (Do not round until the final answer. Then round to four decimal places.) The risk premium is %. (Do not round until the final answer. Then round to four decimal places.) b. iv. What is the value of its equity? We know the prices and payoffs for securities 1 and 2 and they are represented as follows Security 1 2 Market Price Today $30 $60 Cash Flow in One Year Weak Economy Strong Economy $0 $100 $100 SO The risk-free rate was calculated to be 11.1111% Assume the probabilities of the weak economy and the strong economy are both 0.50 Suppose a company will last one year and its assets will generate payoffs in one year as follows. Complete parts a through c. Asset Payoffs in One Year ($) Weak Economy Strong Economy $7,000 $15,000 b. Suppose the company created a bond that promised its investor$4,000 in one year. The payment would come from the asset payoff and any remaining payoff from the assets would go to the company's equity holder. i. What will be the payoffs and expected payoff in one year from the bond and from the equity? The expected payoff of the bond is $ (Do not round until the final answer. Then round to the nearest dollar.) The expected payoff of the equity is $ (Do not round until the final answer. Then round to the nearest dollar.) b. ii. What is the value of the company's bond? The value of the company's bond is $ (Do not round until the final answer. Then round to the nearest dollar.) b. iii. What is the expected return of the company's bond? What is its risk premium? The expected return is % (Do not round until the final answer. Then round to four decimal places.) The risk premium is %. (Do not round until the final answer. Then round to four decimal places.) b. iv. What is the value of its equity