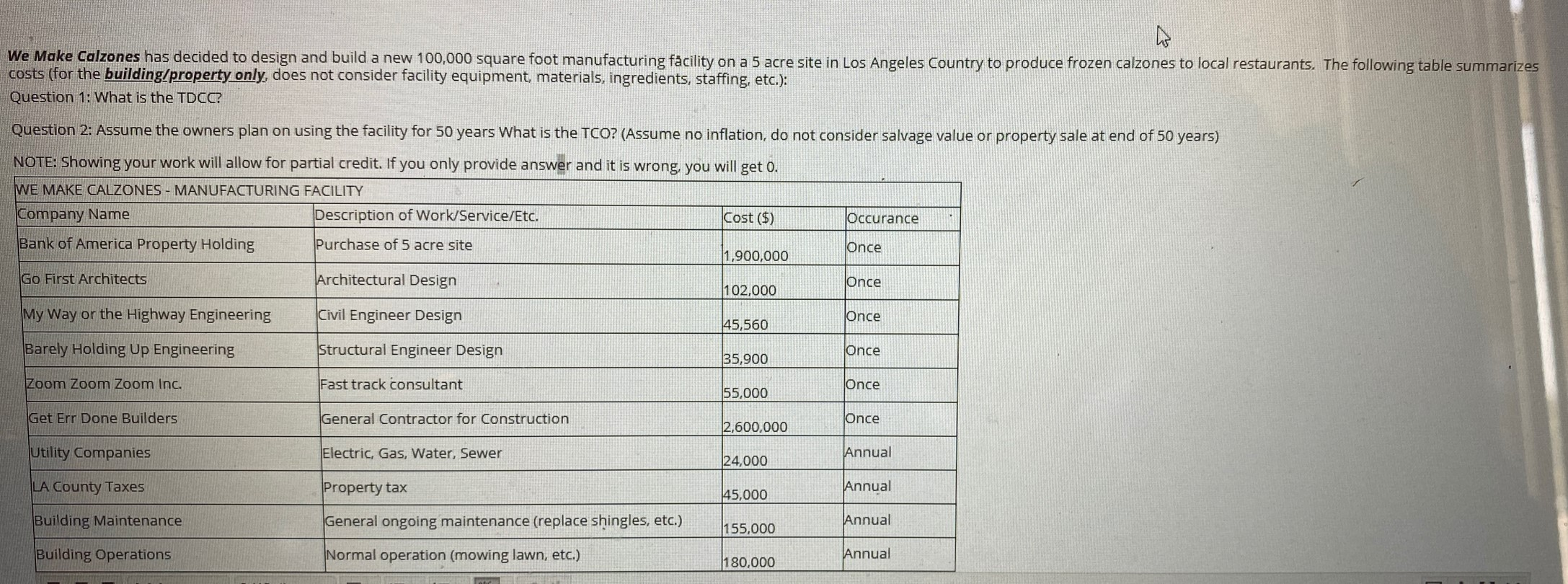

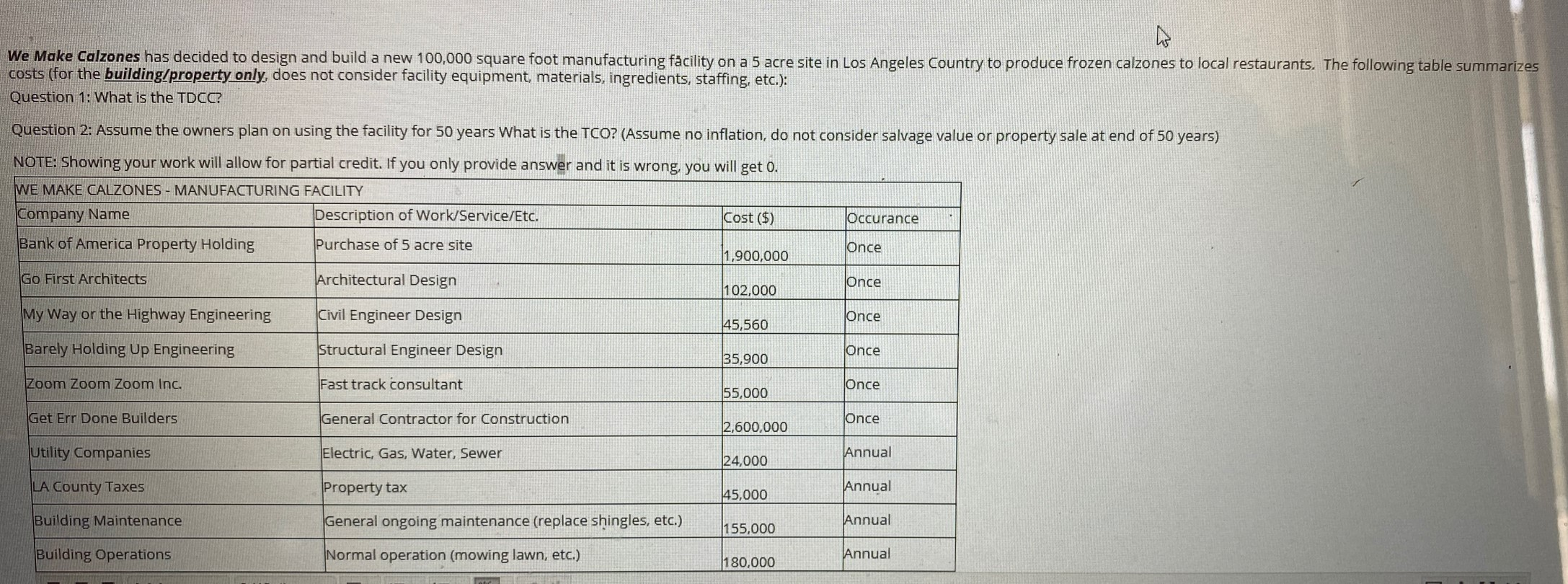

We Make Calzones has decided to design and build a new 100,000 square foot manufacturing facility on a 5 acre site in Los Angeles Country to produce frozen calzones to local restaurants. The following table summarizes costs (for the building property only, does not consider facility equipment, materials, ingredients, staffing, etc.): Question 1: What is the TDCC? Question 2: Assume the owners plan on using the facility for 50 years What is the TCO? (Assume no inflation, do not consider salvage value or property sale at end of 50 years) NOTE: Showing your work will allow for partial credit. If you only provide answer and it is wrong, you will get 0. WE MAKE CALZONES - MANUFACTURING FACILITY Company Name Description of Work Service/Etc. Cost ($) Bank of America Property Holding Purchase of 5 acre site 1,900,000 Occurance Once Go First Architects Architectural Design Once 102,000 My Way or the Highway Engineering Civil Engineer Design Once 45,560 Barely Holding Up Engineering Structural Engineer Design Once 35,900 Zoom Zoom Zoom Inc. Fast track consultant Once 55,000 Get Err Done Builders General Contractor for Construction Once 2,600,000 Utility Companies Electric, Gas, Water, Sewer Annual 24,000 LA County Taxes Property tax Annual 45,000 Building Maintenance General ongoing maintenance (replace shingles, etc.) Annual 155,000 Building Operations Normal operation (mowing lawn, etc.) Annual 180,000 We Make Calzones has decided to design and build a new 100,000 square foot manufacturing facility on a 5 acre site in Los Angeles Country to produce frozen calzones to local restaurants. The following table summarizes costs (for the building property only, does not consider facility equipment, materials, ingredients, staffing, etc.): Question 1: What is the TDCC? Question 2: Assume the owners plan on using the facility for 50 years What is the TCO? (Assume no inflation, do not consider salvage value or property sale at end of 50 years) NOTE: Showing your work will allow for partial credit. If you only provide answer and it is wrong, you will get 0. WE MAKE CALZONES - MANUFACTURING FACILITY Company Name Description of Work Service/Etc. Cost ($) Bank of America Property Holding Purchase of 5 acre site 1,900,000 Occurance Once Go First Architects Architectural Design Once 102,000 My Way or the Highway Engineering Civil Engineer Design Once 45,560 Barely Holding Up Engineering Structural Engineer Design Once 35,900 Zoom Zoom Zoom Inc. Fast track consultant Once 55,000 Get Err Done Builders General Contractor for Construction Once 2,600,000 Utility Companies Electric, Gas, Water, Sewer Annual 24,000 LA County Taxes Property tax Annual 45,000 Building Maintenance General ongoing maintenance (replace shingles, etc.) Annual 155,000 Building Operations Normal operation (mowing lawn, etc.) Annual 180,000