Question

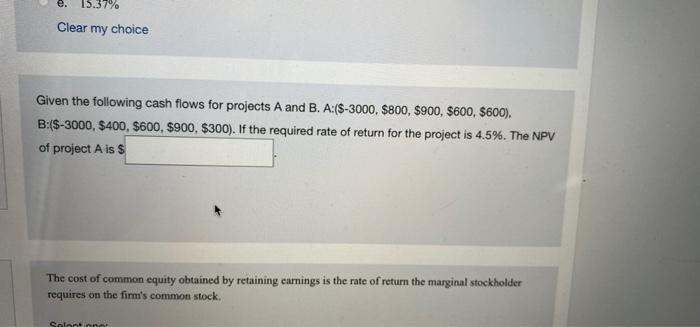

15.37% Clear my choice Given the following cash flows for projects A and B. A:($-3000, $800, $900, $600, $600), B:($-3000, $400, $600, $900, $300).

15.37% Clear my choice Given the following cash flows for projects A and B. A:($-3000, $800, $900, $600, $600), B:($-3000, $400, $600, $900, $300). If the required rate of return for the project is 4.5%. The NPV of project A is $ The cost of common equity obtained by retaining earnings is the rate of return the marginal stockholder requires on the firm's common stock. Select one

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

NPV is net present value of the project It is calculated as PV of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Automation Production Systems and Computer Integrated Manufacturing

Authors: Mikell P.Groover

3rd edition

132393212, 978-0132393218

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App