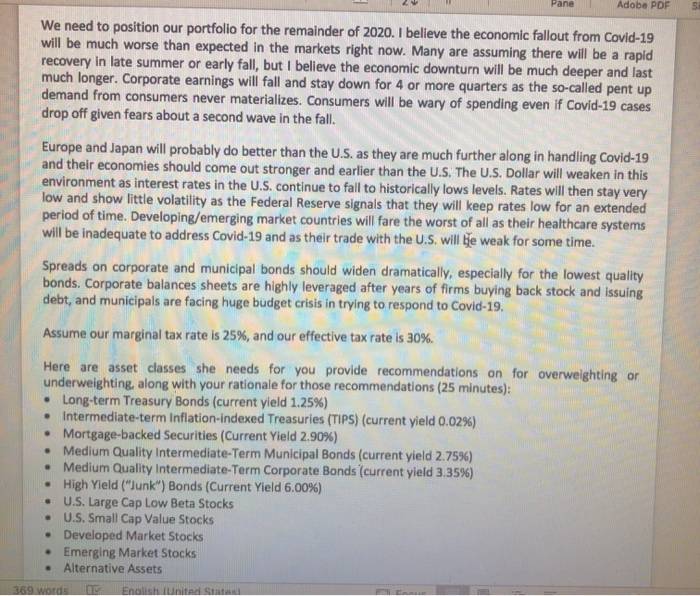

We need to position our portfolio for the remainder of 2020. I believe the economic fallout from Covid-19 will be much worse than expected in the markets right now. Many are assuming there will be a rapid recovery in late summer or early fall, but I believe the economic downturn will be much deeper and last much longer. Corporate earnings will fall and stay down for 4 or more quarters as the so-called pent up demand from consumers never materializes. Consumers will be wary of spending even if Covid-19 cases drop off given fears about a second wave in the fall. Europe and Japan will probably do better than the U.S. as they are much further along in handling Covid-19 and their economies should come out stronger and earlier than the U.S. The U.S. Dollar will weaken in this environment as interest rates in the U.S. continue to fall to historically lows levels. Rates will then stay very low and show little volatility as the Federal Reserve signals that they will keep rates low for an extended period of time. Developing/emerging market countries will fare the worst of all as their healthcare systems will be inadequate to address Covid-19 and as their trade with the U.S. will be weak for some time. Spreads on corporate and municipal bonds should widen dramatically, especially for the lowest quality bonds. Corporate balances sheets are highly leveraged after years of firms buying back stock and issuing debt, and municipals are facing huge budget crisis in trying to respond to Covid-19. Assume our marginal tax rate is 25%, and our effective tax rate is 30% Here are asset classes she needs for you provide recommendations on for overweighting or underweighting, along with your rationale for those recommendations (25 minutes): Long-term Treasury Bonds (current yield 1.25%) Intermediate-term Inflation-indexed Treasuries (TIPS) (current yield 0.02%) Mortgage-backed Securities (Current Yield 2.90%) Medium Quality Intermediate-Term Municipal Bonds (current yield 2.75%) Medium Quality Intermediate-Term Corporate Bonds (current yield 3.35%) High Yield ("Junk") Bonds (Current Yield 6.00%) U.S. Large Cap Low Beta Stocks U.S. Small Cap Value Stocks Developed Market Stocks Emerging Market Stocks Alternative Assets ben worden onlich united stateel