Answered step by step

Verified Expert Solution

Question

1 Approved Answer

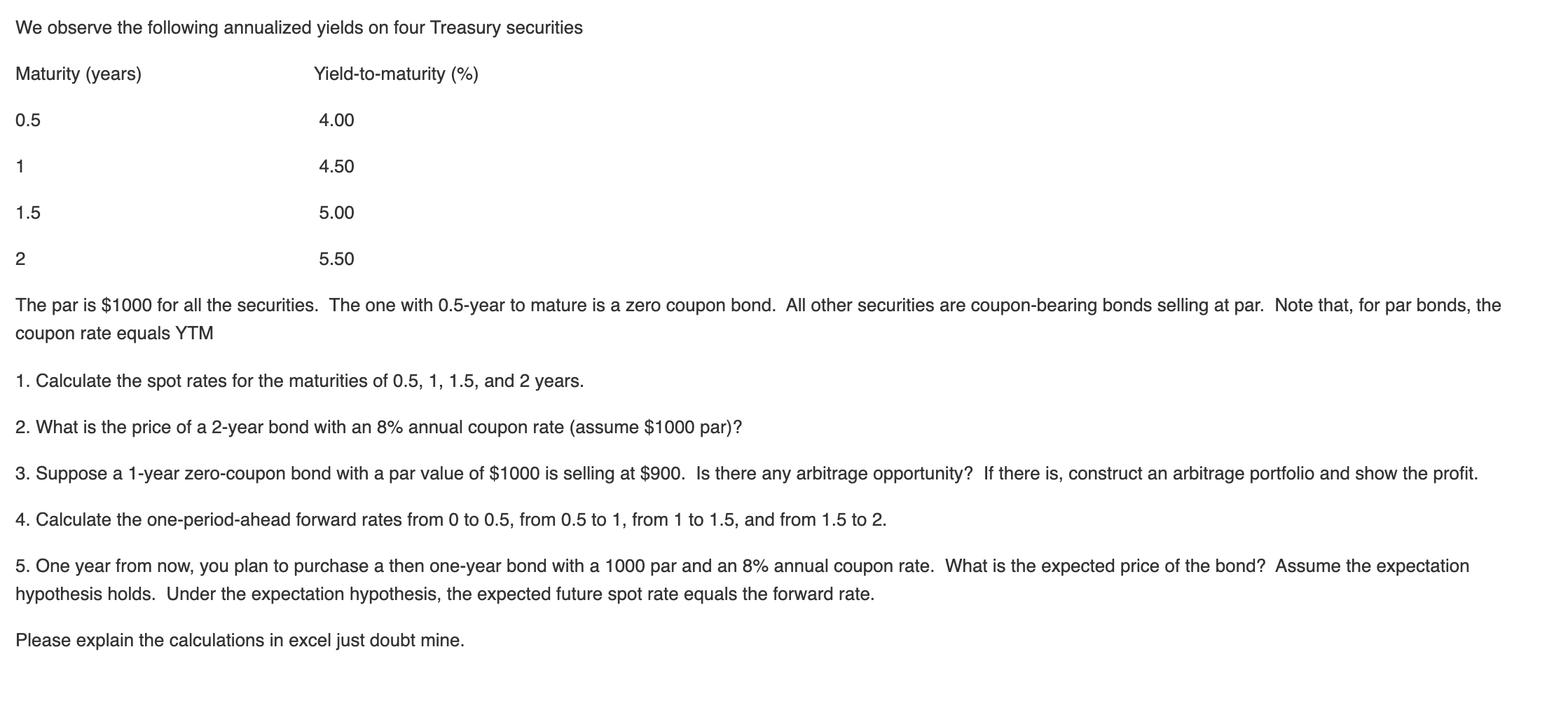

We observe the following annualized yields on four Treasury securities Maturity (years) Yield-to-maturity (%) 0.5 4.00 1 4.50 1.5 5.00 2 5.50 The par is

We observe the following annualized yields on four Treasury securities Maturity (years) Yield-to-maturity (%) 0.5 4.00 1 4.50 1.5 5.00 2 5.50 The par is $1000 for all the securities. The one with 0.5-year to mature is a zero coupon bond. All other securities are coupon-bearing bonds selling at par. Note that, for par bonds, the coupon rate equals YTM 1. Calculate the spot rates for the maturities of 0.5, 1, 1.5, and 2 years. 2. What is the price of a 2-year bond with an 8% annual coupon rate (assume $1000 par)? 3. Suppose a 1-year zero-coupon bond with a par value of $1000 is selling at $900. Is there any arbitrage opportunity? If there is, construct an arbitrage portfolio and show the profit. 4. Calculate the one-period-ahead forward rates from 0 to 0.5, from 0.5 to 1, from 1 to 1.5, and from 1.5 to 2. 5. One year from now, you plan to purchase a then one-year bond with a 1000 par and an 8% annual coupon rate. What is the expected price of the bond? Assume the expectation hypothesis holds. Under the expectation hypothesis, the expected future spot rate equals the forward rate. Please explain the calculations in excel just doubt mine. We observe the following annualized yields on four Treasury securities Maturity (years) Yield-to-maturity (%) 0.5 4.00 1 4.50 1.5 5.00 2 5.50 The par is $1000 for all the securities. The one with 0.5-year to mature is a zero coupon bond. All other securities are coupon-bearing bonds selling at par. Note that, for par bonds, the coupon rate equals YTM 1. Calculate the spot rates for the maturities of 0.5, 1, 1.5, and 2 years. 2. What is the price of a 2-year bond with an 8% annual coupon rate (assume $1000 par)? 3. Suppose a 1-year zero-coupon bond with a par value of $1000 is selling at $900. Is there any arbitrage opportunity? If there is, construct an arbitrage portfolio and show the profit. 4. Calculate the one-period-ahead forward rates from 0 to 0.5, from 0.5 to 1, from 1 to 1.5, and from 1.5 to 2. 5. One year from now, you plan to purchase a then one-year bond with a 1000 par and an 8% annual coupon rate. What is the expected price of the bond? Assume the expectation hypothesis holds. Under the expectation hypothesis, the expected future spot rate equals the forward rate. Please explain the calculations in excel just doubt mine

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started