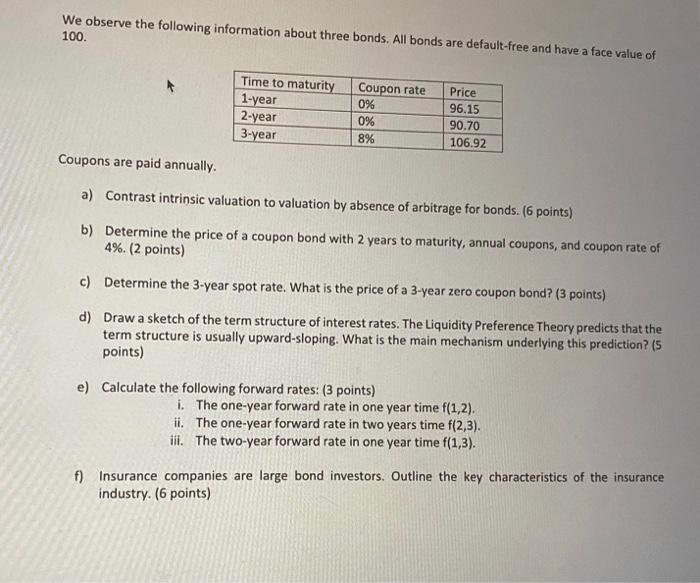

We observe the following information about three bonds. All bonds are default-free and have a face value of 100. Price Time to maturity 1-year 2-year 3-year Coupon rate 0% 0% 8% 96.15 90.70 106.92 Coupons are paid annually. a) Contrast intrinsic valuation to valuation by absence of arbitrage for bonds. (6 points) b) Determine the price of a coupon bond with 2 years to maturity, annual coupons, and coupon rate of 4%. (2 points) c) Determine the 3-year spot rate. What is the price of a 3-year zero coupon bond? (3 points) d) Draw a sketch of the term structure of interest rates. The Liquidity Preference Theory predicts that the term structure is usually upward-sloping. What is the main mechanism underlying this prediction? (5 points) e) Calculate the following forward rates: (3 points) 1. The one-year forward rate in one year time f(1,2). ii. The one-year forward rate in two years time f(2,3). it. The two-year forward rate in one year time f(1,3). f) Insurance companies are large bond investors. Outline the key characteristics of the insurance industry. (6 points) We observe the following information about three bonds. All bonds are default-free and have a face value of 100. Price Time to maturity 1-year 2-year 3-year Coupon rate 0% 0% 8% 96.15 90.70 106.92 Coupons are paid annually. a) Contrast intrinsic valuation to valuation by absence of arbitrage for bonds. (6 points) b) Determine the price of a coupon bond with 2 years to maturity, annual coupons, and coupon rate of 4%. (2 points) c) Determine the 3-year spot rate. What is the price of a 3-year zero coupon bond? (3 points) d) Draw a sketch of the term structure of interest rates. The Liquidity Preference Theory predicts that the term structure is usually upward-sloping. What is the main mechanism underlying this prediction? (5 points) e) Calculate the following forward rates: (3 points) 1. The one-year forward rate in one year time f(1,2). ii. The one-year forward rate in two years time f(2,3). it. The two-year forward rate in one year time f(1,3). f) Insurance companies are large bond investors. Outline the key characteristics of the insurance industry. (6 points)