Answered step by step

Verified Expert Solution

Question

1 Approved Answer

We project unit sales for a new household - use laser - guided cockroach search and destroy system as follows: The new system will be

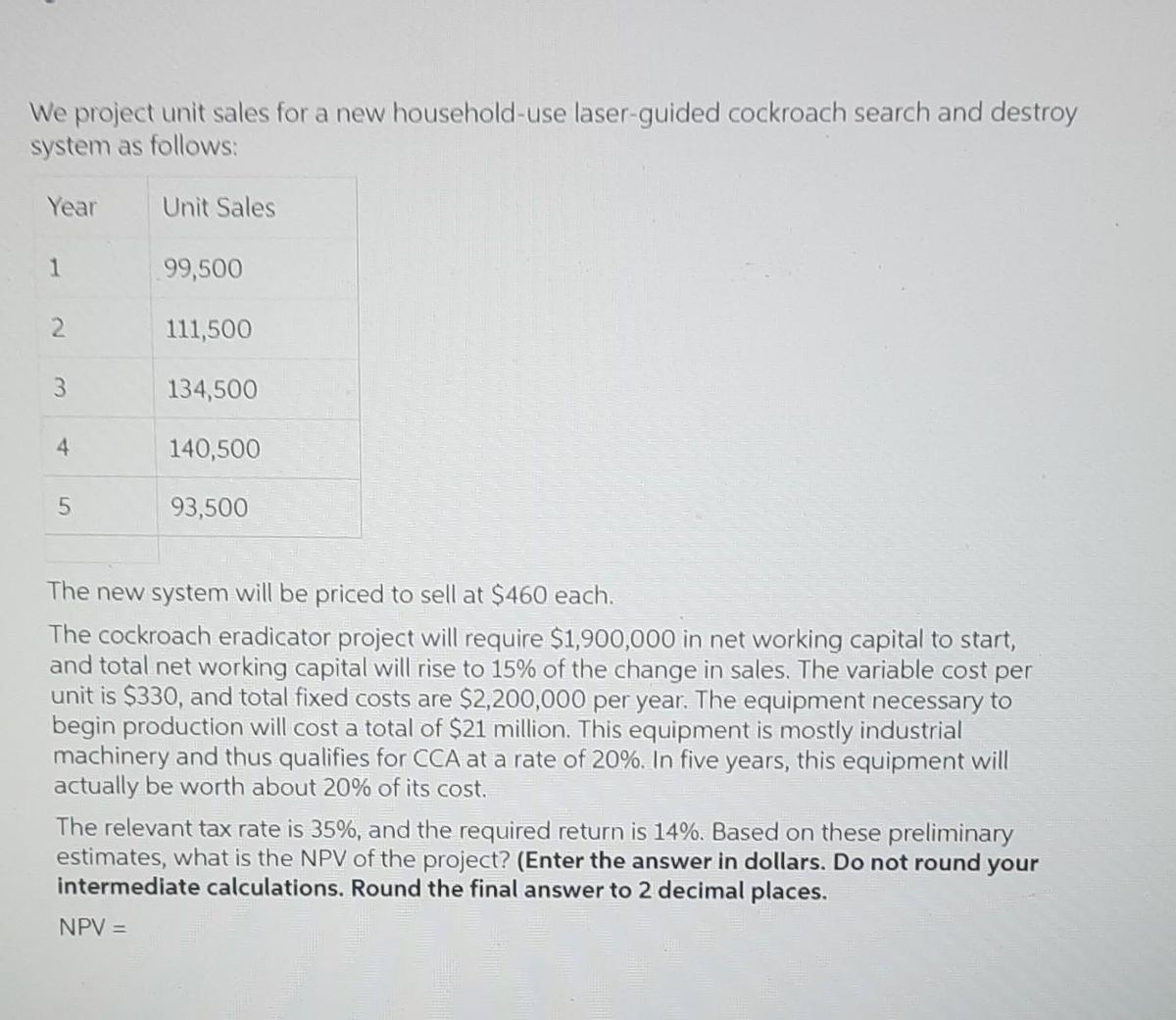

We project unit sales for a new householduse laserguided cockroach search and destroy

system as follows:

The new system will be priced to sell at $ each.

The cockroach eradicator project will require $ in net working capital to start,

and total net working capital will rise to of the change in sales. The variable cost per

unit is $ and total fixed costs are $ per year. The equipment necessary to

begin production will cost a total of $ million. This equipment is mostly industrial

machinery and thus qualifies for CCA at a rate of In five years, this equipment will

actually be worth about of its cost.

The relevant tax rate is and the required return is Based on these preliminary

estimates, what is the NPV of the project? Enter the answer in dollars. Do not round your

intermediate calculations. Round the final answer to decimal places.

NPV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started