Answered step by step

Verified Expert Solution

Question

1 Approved Answer

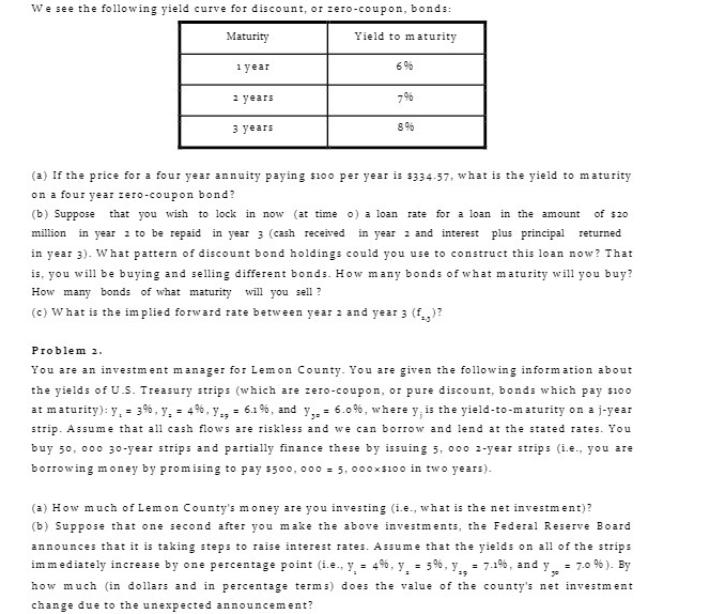

We see the following yield curve for discount, or zero-coupon, bonds: Maturity Yield to maturity 1 year 2 years 3 years 796 896 (a)

We see the following yield curve for discount, or zero-coupon, bonds: Maturity Yield to maturity 1 year 2 years 3 years 796 896 (a) If the price for a four year annuity paying s100 per year is 3334-37, what is the yield to maturity on a four year zero-coupon bond? (b) Suppose that you wish to lock in now (at time o) a loan rate for a loan in the amount of $20 million in year 2 to be repaid in year 3 (cash received in year 2 and interest plus principal returned in year 3). What pattern of discount bond holdings could you use to construct this loan now? That is, you will be buying and selling different bonds. How many bonds of what maturity will you buy? How many bonds of what maturity will you sell? (c) What is the implied forward rate between year 2 and year 3 (f.,)? Problem 2. You are an investment manager for Lemon County. You are given the following information about the yields of U.S. Treasury strips (which are zero-coupon, or pure discount, bonds which pay $100 at maturity): y = 3%, y = 496. y., = 6.1 %, and y,. = 6.0%, where y, is the yield-to-maturity on a j-year strip. Assume that all cash flows are riskless and we can borrow and lend at the stated rates. You buy 50, 000 30-year strips and partially finance these by issuing 5, 000 2-year strips (i.e., you are borrowing money by promising to pay $500,000 = 5,000x$100 in two years). (a) How much of Lemon County's money are you investing (i.e., what is the net investment)? (b) Suppose that one second after you make the above investments, the Federal Reserve Board announces that it is taking steps to raise interest rates. Assume that the yields on all of the strips immediately increase by one percentage point (i.e.. y = 4%, y = 5%, y = 7.1%, and y = 7.0%). By how much (in dollars and in percentage terms) does the value of the county's net investment change due to the unexpected announcement? 19 Problem 3. A one-year zero-coupon bond with face value of $100 has a price of $97.50. A two-year coupon bond with annual coupon payments, a face of $1,000, a coupon rate of 6% and a yield to maturity of 4%. (a) What is the price of the two-year coupon bond?

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a For a four year annuity paying 100 per year with a price of 33457 we can calculate the yi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started