Answered step by step

Verified Expert Solution

Question

1 Approved Answer

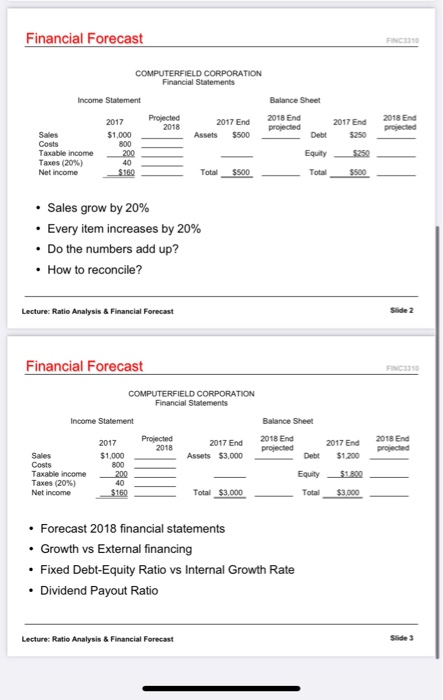

We walked through the two cases (slide 2 versus slide 3) and demonstrated that at the same 20% growth (and the same assumption that Debt-Equity

We walked through the two cases (slide 2 versus slide 3) and demonstrated that at the same 20% growth (and the same assumption that Debt-Equity Ratios stay constant year to year) into the next year for both cases, slide 2 does not need EFN (rather, slide 2 could afford to pay out some dividend in the next year), but slide 3 does need EFN.

Please explain what fundamentally gives rise to the difference? Try to relate your explanation to the Sustainable Growth Rate (as well as the SGR formula given in the textbook), ROE and other concepts if needed. Show algebra if it helps.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started