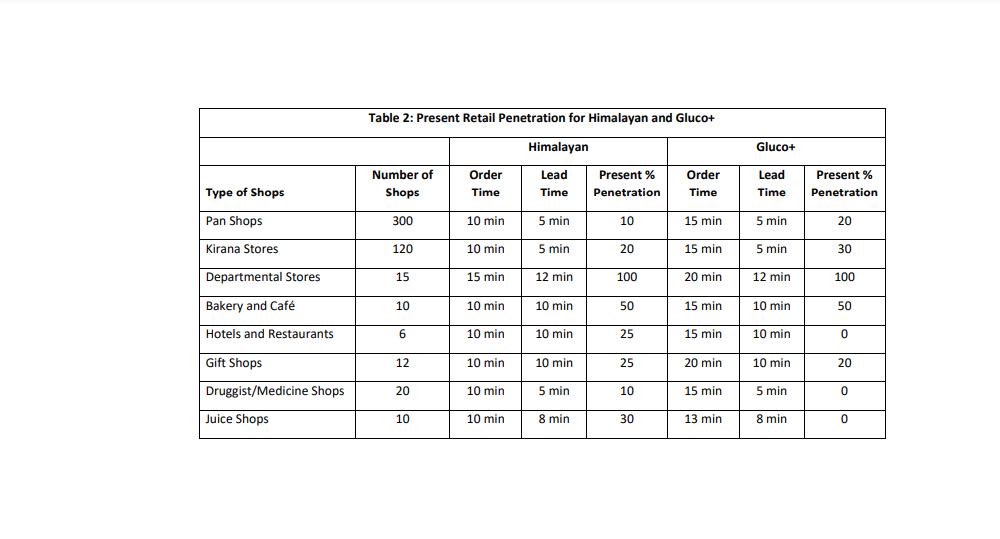

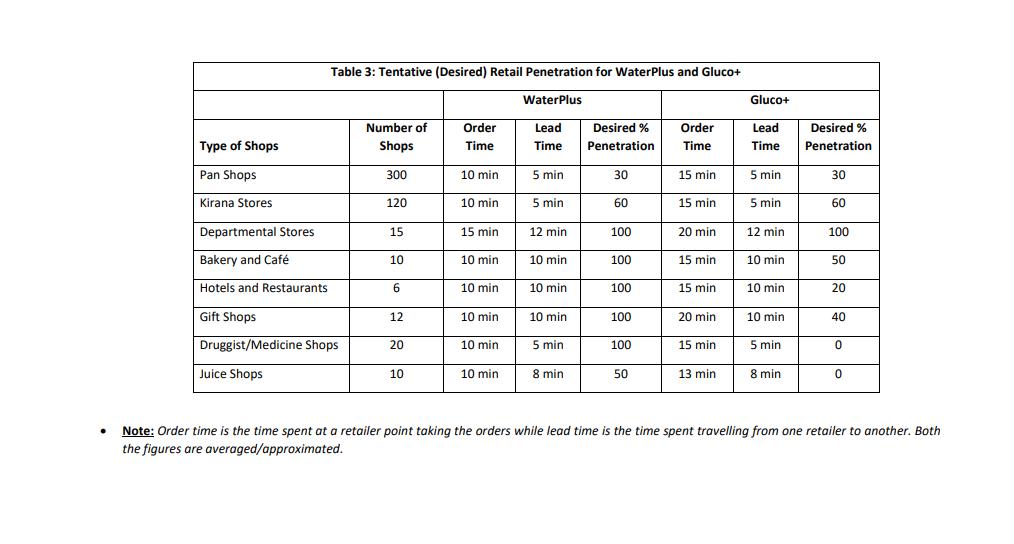

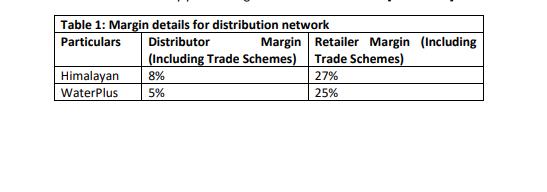

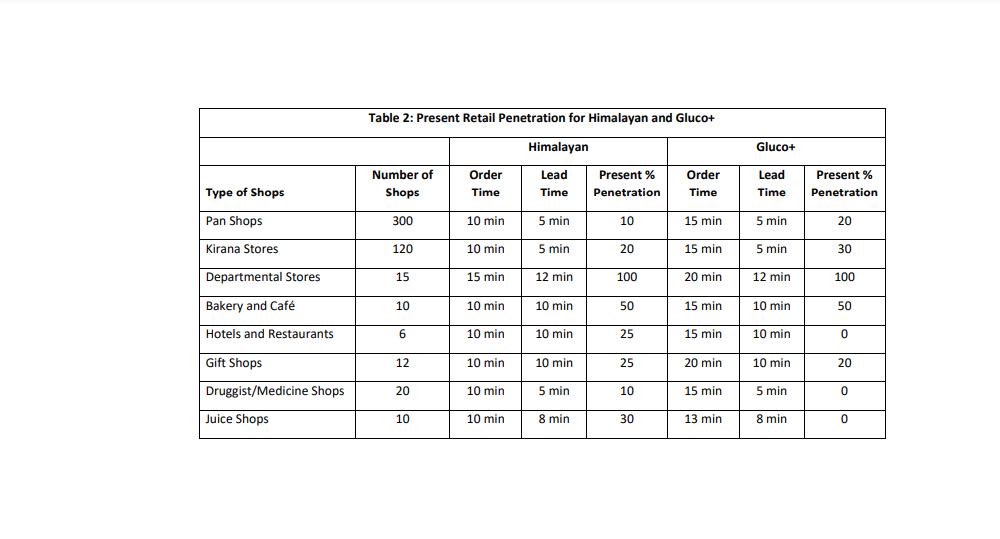

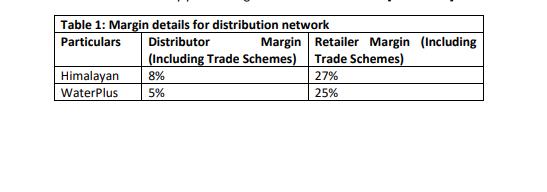

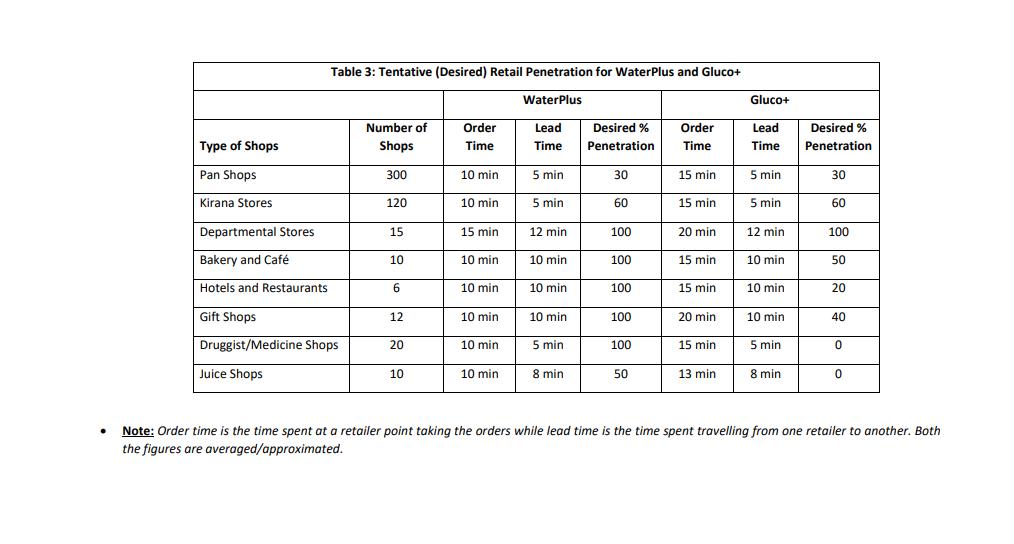

"We want to do it quickly,'' Pradeep Poddar, managing director and CEO, Mount Everest, told in an interview. "The market is still very young and we can evolve it further through marketing new offerings." The company plans to sell its bottled water brand for masses at rates lower than those offered by competitors Bisleri, PepsiCo and Coca-Cola, he said. "The challenge for us is developing a right technology." Tata Tea, which owns 31.73 per cent stake in Mount Everest, doesn't have a mass market bottled water brand in India. The company's Himalayan brand is a premium brand controlling about half of the natural mineral water segment. Coca-Cola's Kinley and PepsiCo's Aquafina together dominate about quarter of the mass bottled water market. Bisleri, owned by Ramesh Chauhan, accounts for 16 per cent of total sales. More than 50 per cent of the packaged drinking water market is dominated by 200 odd water brands that sell in regional pockets. The move to create a low-price bottled water is part of Mount Everest's strategy to develop a comprehensive water-based beverage portfolio that straddles all the price points in the domestic market. Both out-of-home and in-home consumption of packaged drinking water has grown in the country as consumers increasingly see it as an option for getting safe and clean drinking water. Growing health awareness is also boosting demand for bottled water that offer functional benefits like losing weight and nutrition. "We would focus on introducing brands that can be volume-drivers for the company," Poddar said. The firm's strategy reflects the parent Tata Group's drive to expand its brand presence in top and low end segments. As part of the plan the Tata Group is developing the world's cheapest car Nano and acquiring marquee brands including Jaguar and Land Rover, he added. Tata Tea, which acquired 30 per cent stake in Energy Brands (Glaceau), a vitamin-enriched water brand, in August 2006 for $677 million, sold the stake after nine months as Coca-Cola offered to buy it out for $1.2 billion. It bought the natural mineral water brand Himalayan in the premium segment in August 2007.Poddar believes that domestic water market could grow in line with the western world where there is a huge demand for value-added water products like functional water that offer health and wellness benefits to consumers. Mount Everest would look at twin approach of developing its own brands and acquisitions to build its portfolio to service the demand in the country as well as globally. MEMW's Himalayan operates in a premium segment at a price of Rs 40 per litre as against the average price of Rs 20 per litre of other brands in the packaged drinking water space. However, the company has realised that volumes lie in the Rs 1,6000 crore packaged (approx. figure) drinking water market that is growing at the compounded annual growth rate of 25 per cent. Out of this, the natural mineral water roughly contributes around 6%. The company is also focusing on developing the brand equity and distribution of the Himalayan brand. While the company is planning to market both the water segment aggressively, the top management is giving second look at the present distribution network for water and other beverages which include products like Tata Gluco+ and Good Earth. As of now all the entire beverage segment is being distributed through the same distribution network (i.e., same distributor distributing all the brands of beverages). The present set of distributors have shown some resistance to market Water Plus’ mainly owning to the margin (check Table 1), but detailed market survey also proved that that the present set of distributors are reluctant to take up the most popular segments of retails like Kirana shops, small hotels & restaurants, and other smaller shops. Presently, Himalayan is being sold through departmental stores, premium hotels & restaurants and other high end shops. Kamalnath, one of the present distributors says “The inventory requirement would be much higher, atleast 15 times of present stock of Himalayan which would require much bigger godown space. The market coverage/penetration for ‘water plus’ would be much higher with distribution footprints needing to be increased atleast 15 folds. Also the market coverage for ‘water plus’ needs to be much more frequent, atleast 4 times the present coverage frequency of ‘Himalayan’ which is distributed once in 15days for bigger towns and once in a month for smaller towns. All this would lead to much higher expenses for the present distributors while the margins offered is much lower than that of ‘Himalayan’”. As a trial, the company plans to set up new distribution network (new distributors) in couple of cities. The top management believes they would witness encouraging signs in form of retail penetration, initial market share and the growth in sales much higher for both the cities than the national average. The management is also of the view that the new set of distributors can market ‘Gluco+’ to improve its retail penetration and market share. Thus, both ‘Water Plus’ and ‘Gluco+’ would be used in the trial. Table 2 and 3 provides data for present retail penetration (of the existing distributors) and tentative retail penetration (for new set of distributors). The top management is also wary of the possible channel conflict situation arising in case they go for a new set of distributors. Being in dilemma, the top management has consulted the consultancy firm you work in and the project has been allocated to you being a sales and distribution domain expert in the firm. Answer the following questions in the current scenario:

"We want to do it quickly,'' Pradeep Poddar, managing director and CEO, Mount Everest, told in an interview. "The market is still very young and we can evolve it further through marketing new offerings." The company plans to sell its bottled water brand for masses at rates lower than those offered by competitors Bisleri, PepsiCo and Coca-Cola, he said. "The challenge for us is developing a right technology." Tata Tea, which owns 31.73 per cent stake in Mount Everest, doesn't have a mass market bottled water brand in India. The company's Himalayan brand is a premium brand controlling about half of the natural mineral water segment. Coca-Cola's Kinley and PepsiCo's Aquafina together dominate about quarter of the mass bottled water market. Bisleri, owned by Ramesh Chauhan, accounts for 16 per cent of total sales. More than 50 per cent of the packaged drinking water market is dominated by 200 odd water brands that sell in regional pockets. The move to create a low-price bottled water is part of Mount Everest's strategy to develop a comprehensive water-based beverage portfolio that straddles all the price points in the domestic market. Both out-of-home and in-home consumption of packaged drinking water has grown in the country as consumers increasingly see it as an option for getting safe and clean drinking water. Growing health awareness is also boosting demand for bottled water that offer functional benefits like losing weight and nutrition. "We would focus on introducing brands that can be volume-drivers for the company," Poddar said. The firm's strategy reflects the parent Tata Group's drive to expand its brand presence in top and low end segments. As part of the plan the Tata Group is developing the world's cheapest car Nano and acquiring marquee brands including Jaguar and Land Rover, he added. Tata Tea, which acquired 30 per cent stake in Energy Brands (Glaceau), a vitamin-enriched water brand, in August 2006 for $677 million, sold the stake after nine months as Coca-Cola offered to buy it out for $1.2 billion. It bought the natural mineral water brand Himalayan in the premium segment in August 2007.Poddar believes that domestic water market could grow in line with the western world where there is a huge demand for value-added water products like functional water that offer health and wellness benefits to consumers. Mount Everest would look at twin approach of developing its own brands and acquisitions to build its portfolio to service the demand in the country as well as globally. MEMW's Himalayan operates in a premium segment at a price of Rs 40 per litre as against the average price of Rs 20 per litre of other brands in the packaged drinking water space. However, the company has realised that volumes lie in the Rs 1,6000 crore packaged (approx. figure) drinking water market that is growing at the compounded annual growth rate of 25 per cent. Out of this, the natural mineral water roughly contributes around 6%. The company is also focusing on developing the brand equity and distribution of the Himalayan brand. While the company is planning to market both the water segment aggressively, the top management is giving second look at the present distribution network for water and other beverages which include products like Tata Gluco+ and Good Earth. As of now all the entire beverage segment is being distributed through the same distribution network (i.e., same distributor distributing all the brands of beverages). The present set of distributors have shown some resistance to market Water Plus’ mainly owning to the margin (check Table 1), but detailed market survey also proved that that the present set of distributors are reluctant to take up the most popular segments of retails like Kirana shops, small hotels & restaurants, and other smaller shops. Presently, Himalayan is being sold through departmental stores, premium hotels & restaurants and other high end shops. Kamalnath, one of the present distributors says “The inventory requirement would be much higher, atleast 15 times of present stock of Himalayan which would require much bigger godown space. The market coverage/penetration for ‘water plus’ would be much higher with distribution footprints needing to be increased atleast 15 folds. Also the market coverage for ‘water plus’ needs to be much more frequent, atleast 4 times the present coverage frequency of ‘Himalayan’ which is distributed once in 15days for bigger towns and once in a month for smaller towns. All this would lead to much higher expenses for the present distributors while the margins offered is much lower than that of ‘Himalayan’”. As a trial, the company plans to set up new distribution network (new distributors) in couple of cities. The top management believes they would witness encouraging signs in form of retail penetration, initial market share and the growth in sales much higher for both the cities than the national average. The management is also of the view that the new set of distributors can market ‘Gluco+’ to improve its retail penetration and market share. Thus, both ‘Water Plus’ and ‘Gluco+’ would be used in the trial. Table 2 and 3 provides data for present retail penetration (of the existing distributors) and tentative retail penetration (for new set of distributors). The top management is also wary of the possible channel conflict situation arising in case they go for a new set of distributors. Being in dilemma, the top management has consulted the consultancy firm you work in and the project has been allocated to you being a sales and distribution domain expert in the firm. Answer the following questions in the current scenario:

Q1. Calculate the number of sales people required to cover the market a. in the present set up (use Table 2) [4 marks] b. with the proposed new set up (use Table 3) [4marks]

Q2. If the present set of distributor agrees to cater to the proposed coverage, what would be the extra sales people requirement? [5marks]

Q3. In your opinion, explain whether TATA should go for new set of distributors for ‘WaterPlus’? [4 marks]

Q4. If TATA decides to stick to the present set of distributors, provide a rational to counter the arguments put forth by Kamalnath (Hint: you may compare the ROI providing valid assumptions) [5 marks]

Q5. If case TATA decides to go to the market with different (new) set of distributors, do you expect any type of conflict with the existing set of distributors? Discuss your perspectives in any one: A. Type of conflict and resolution to the conflict B. Why you envisage a no-conflict situation. [3+5 marks]