Answered step by step

Verified Expert Solution

Question

1 Approved Answer

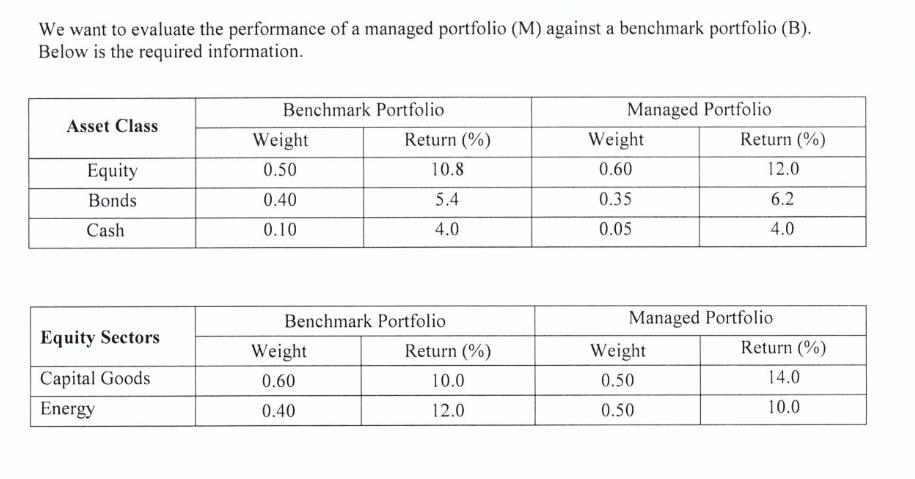

We want to evaluate the performance of a managed portfolio (M) against a benchmark portfolio (B). Below is the required information. Asset Class Equity

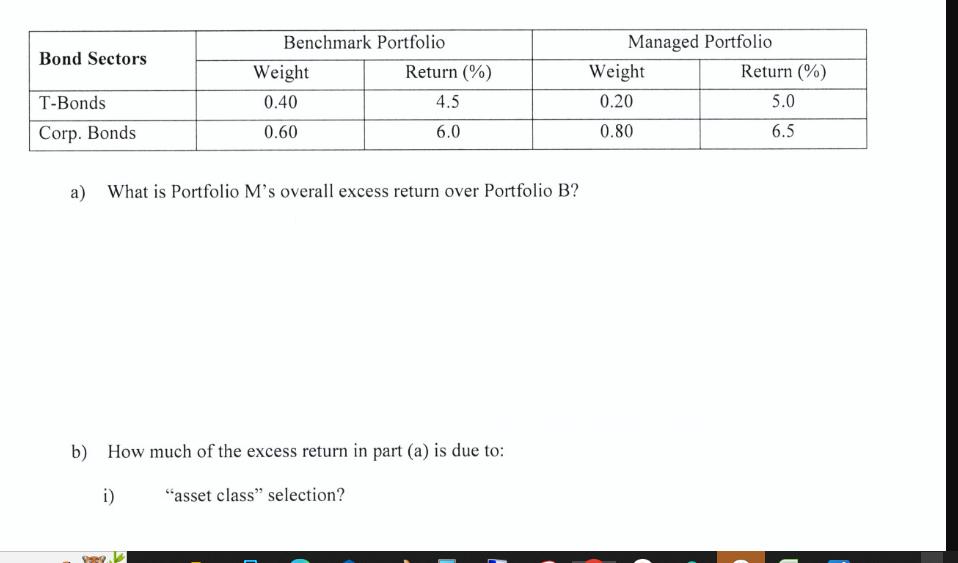

We want to evaluate the performance of a managed portfolio (M) against a benchmark portfolio (B). Below is the required information. Asset Class Equity Bonds Cash Equity Sectors Capital Goods Energy Benchmark Portfolio Weight 0.50 0.40 0.10 Return (%) 10.8 5.4 4.0 Benchmark Portfolio Weight 0.60 0.40 Return (%) 10.0 12.0 Managed Portfolio Weight 0.60 0.35 0.05 Return (%) 12.0 6.2 4.0 Managed Portfolio Weight 0.50 0.50 Return (%) 14.0 10.0 Benchmark Portfolio Managed Portfolio Bond Sectors Weight Return (%) Weight Return (%) T-Bonds 0.40 4.5 0.20 5.0 Corp. Bonds 0.60 6.0 0.80 6.5 a) What is Portfolio M's overall excess return over Portfolio B? b) How much of the excess return in part (a) is due to: i) "asset class" selection?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Evaluating Managed Portfolio M Performance vs Benchmark Portfolio B We can analyze the performance of Managed Portfolio M compared to the Benchmark Portfolio B using several metrics 1 Overall Return M ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started