Answered step by step

Verified Expert Solution

Question

1 Approved Answer

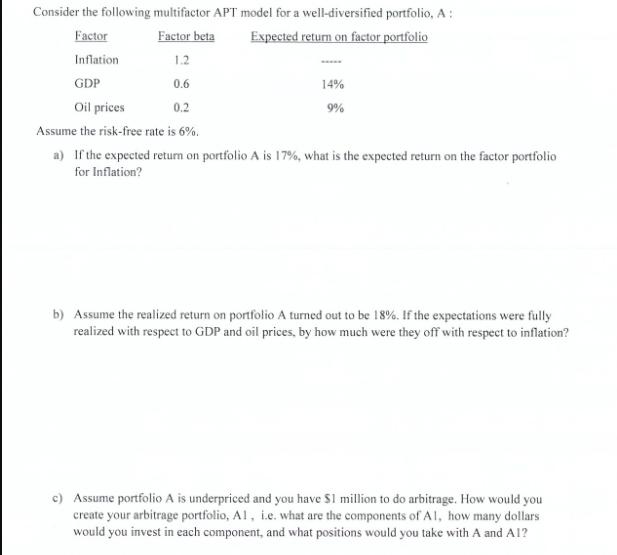

Consider the following multifactor APT model for a well-diversified portfolio, A: Factor Factor beta Inflation 1.2 GDP 0.6 Oil prices 0.2 Expected return on

Consider the following multifactor APT model for a well-diversified portfolio, A: Factor Factor beta Inflation 1.2 GDP 0.6 Oil prices 0.2 Expected return on factor portfolio 14% 9% Assume the risk-free rate is 6%. a) If the expected return on portfolio A is 17%, what is the expected return on the factor portfolio for Inflation? b) Assume the realized return on portfolio A turned out to be 18%. If the expectations were fully realized with respect to GDP and oil prices, by how much were they off with respect to inflation? c) Assume portfolio A is underpriced and you have $1 million to do arbitrage. How would you create your arbitrage portfolio, A1, i.e. what are the components of A1, how many dollars would you invest in each component, and what positions would you take with A and A1?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Multifactor APT Model Analysis Portfolio A a Expected Return on Inflation Factor Portfolio We cannot directly calculate the expected return on the Inf...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started