Question

wealthy client contacts you to discuss purchasing a potential investment property. He has already prepared a cash flow model and has provided it to you

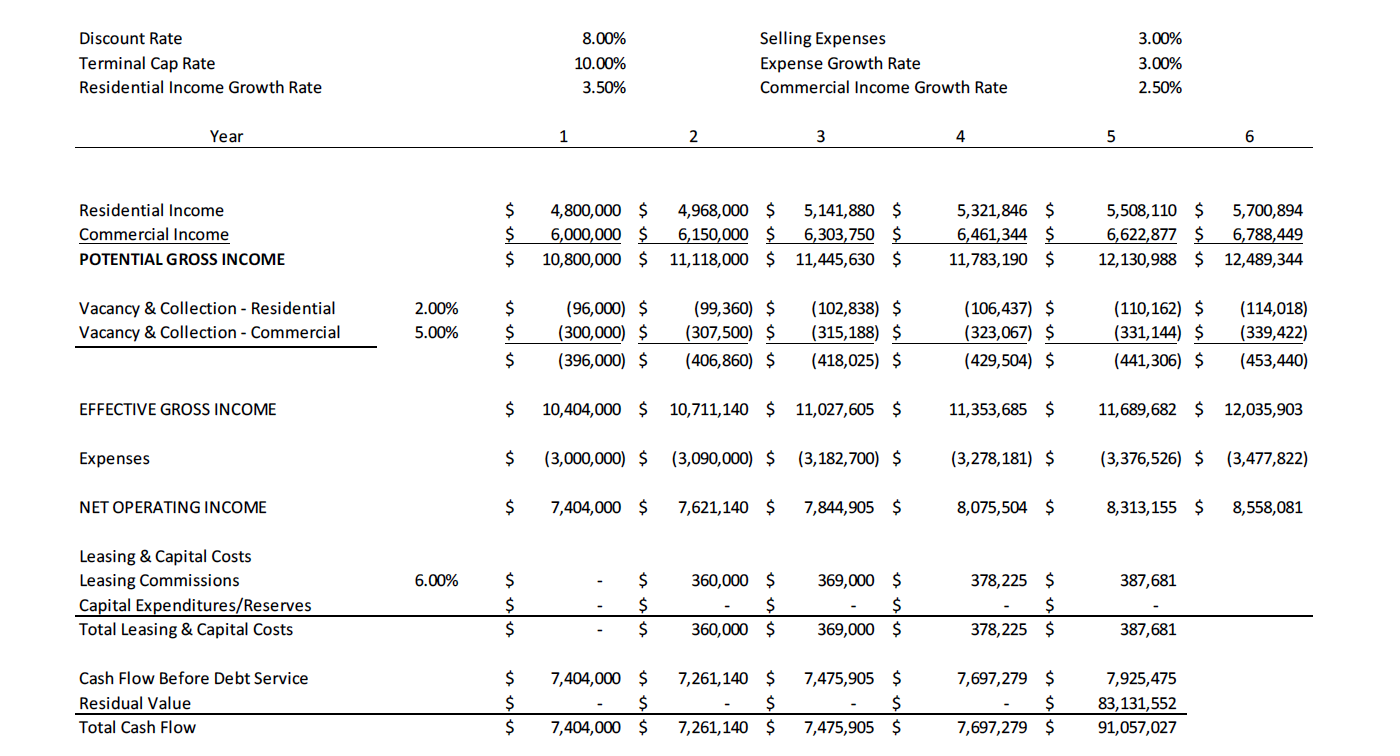

wealthy client contacts you to discuss purchasing a potential investment property. He has already prepared a cash flow model and has provided it to you for review. The property is stabilized, mixed use building with residential and commercial tenants. The project is located in a very stable area with a solid list of tenants. Though the project was built within the last 5 years, there are some signs of deferred maintenance and a need for $100,000 in capital expenditures right away. Commercial leasing commissions are 6.00% and begin in Year 2. Leasing commissions are calculated based on the prior years rent. Your client intends on purchasing the property for $70,000,000 all cash and will sell it in Year 5. His Discount Rate is 8.00%. He believes the project will generate a NPV of $15,412,074 and an IRR of 13.60%.

part1:

After reviewing the model, what concerns (if any) do you have?

part2: 2. After making any necessary changes to the model, explain if your client should invest or not.

part3: 3. Your client increases his bid to $90,000,000. Should he invest? Why or why not?

please solve part by part

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started