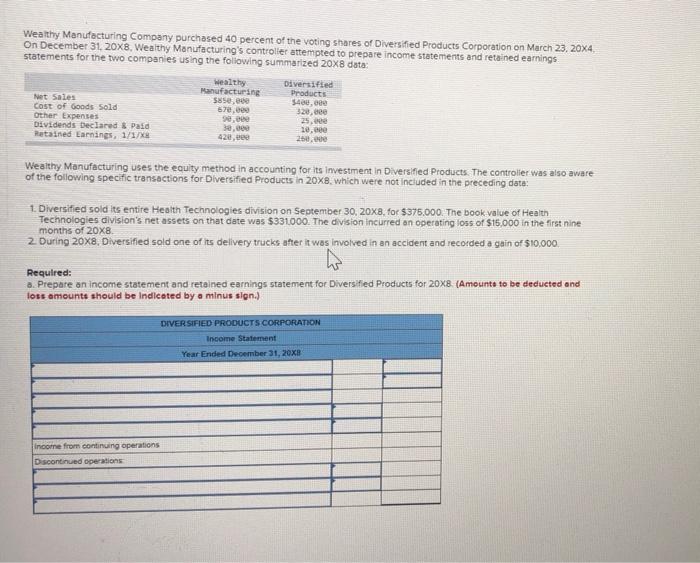

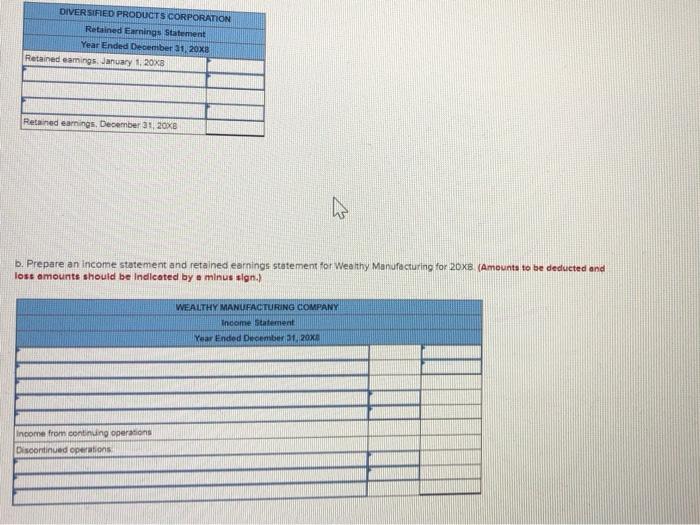

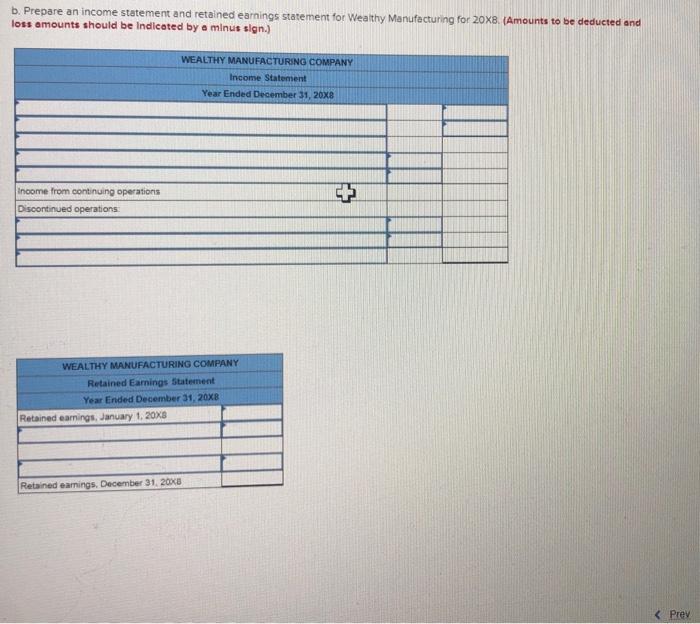

Wealthy Manufacturing Company purchased 40 percent of the voting shares of Diversified Products Corporation on March 23,20x4 On December 31, 20X8, Wealthy Manufacturing's controller attempted to prepare income statements and retained earnings statements for the two companies using the following summarized 20X8 data: Wealthy Diversified Manufacturing Products Net Sales 5850.ece $400,000 Cost of Goods Sold 670,000 320,000 Other Expenses 9, 25. Dividends Declared & Paid 8,000 10.00 Retained Earnings, 1/1/X 420, 250. Wealthy Manufacturing uses the equity method in accounting for its investment in Diversified Products. The controller was also aware of the following specific transactions for Diversified Products in 20x8, which were not included in the preceding data: 1. Diversified sold its entire Health Technologies division on September 30, 20X8, for $375,000. The book value of Health Technologies division's net assets on that date was $331000. The division incurred an operating loss of $15,000 in the first nine 2. During 20x8, Diversified sold one of its delivery trucks after it was involved in an accident and recorded a gain of $10,000 h Required: a. Prepare an income statement and retained earnings statement for Diversified Products for 20x8 (Amounts to be deducted and loss amounts should be indicated by a minus sign.) DIVERSIFIED PRODUCTS CORPORATION Income Statement Year Ended December 31, 20XB Income from continuing operations Discontinued operations DIVERSIFIED PRODUCTS CORPORATION Retained Earnings Statement Year Ended December 31, 20x8 Retained earnings. January 1, 20x8 Retained earnings. December 31, 20X8 b. Prepare an income statement and retained earnings statement for Wealthy Manufacturing for 20XB (Amounts to be deducted and loss amounts should be indicated by a minus sign. WEALTHY MANUFACTURING COMPANY Income Statement Year Ended December 21, 20XA income from continuing operations Discontinued operations b. Prepare an income statement and retained earnings statement for Wealthy Manufacturing for 20X8. (Amounts to be deducted and loss amounts should be indicated by a minus sign.) WEALTHY MANUFACTURING COMPANY Income Statement Year Ended December 31, 20XB Income from continuing operations Discontinued operations WEALTHY MANUFACTURING COMPANY Retained Earnings Statement Year Ended December 31, 20XB Retained earings, January 1, 20X8 Retained earnings, December 31, 20x8