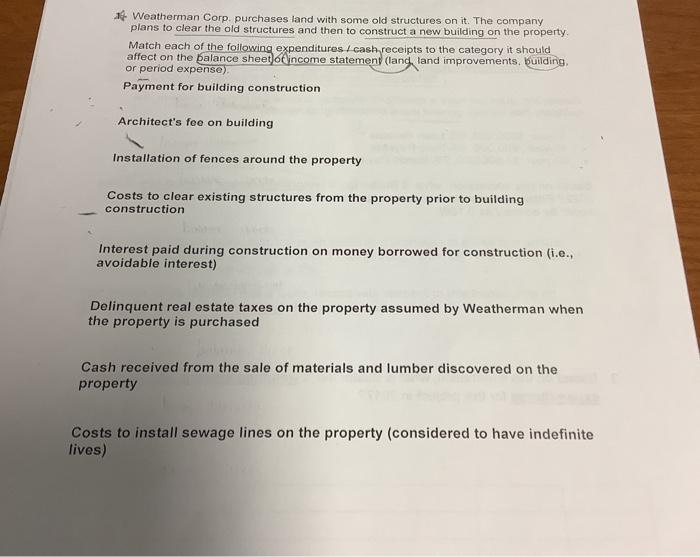

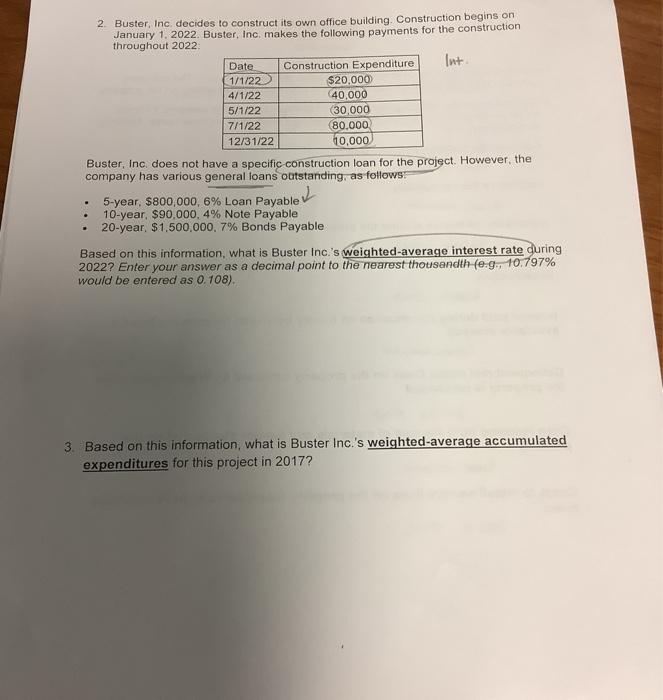

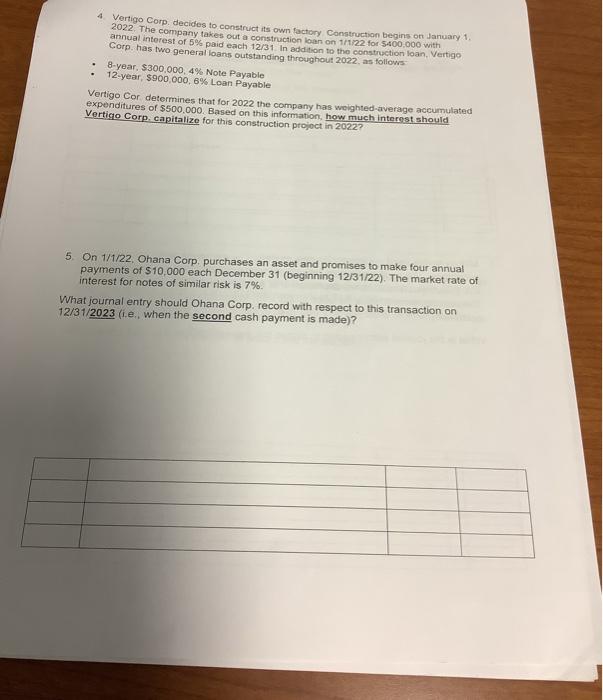

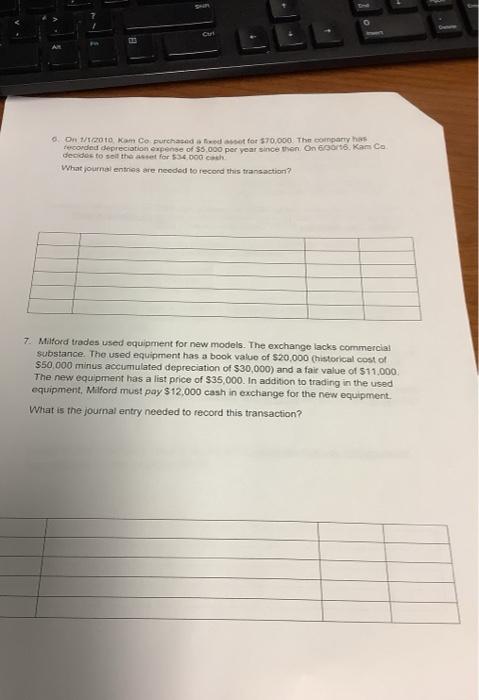

Weatherman Corp purchases land with some old structures on it. The company plans to clear the old structures and then to construct a new building on the property. Match each of the following expenditures / cash receipts to the category it should affect on the balance sheet of income statement (land, land improvements, building, or period expense) Payment for building construction Architect's fee on building Installation of fences around the property Costs to clear existing structures from the property prior to building construction Interest paid during construction on money borrowed for construction (.e., avoidable interest) Delinquent real estate taxes on the property assumed by Weatherman when the property is purchased Cash received from the sale of materials and lumber discovered on the property Costs to install sewage lines on the property (considered to have indefinite lives) Int. 2. Buster, Inc. decides to construct its own office building. Construction begins on January 1, 2022. Buster, Inc, makes the following payments for the construction throughout 2022 Date Construction Expenditure 1/1/22 $20.000 4/1/22 40,000 5/1/22 (30,000 7/1/22 80,000 12/31/22 10,000 Buster, Inc does not have a specific construction loan for the project. However, the company has various general loans outstanding, as follows 5-year. $800,000,6% Loan Payable 10-year. $90.000.4% Note Payable 20-year, $1,500,000.7% Bonds Payable Based on this information, what is Buster Inc.'s weighted average interest rate during 2022? Enter your answer as a decimal point to the nearest thousandth (e.g., 10.797% would be entered as 0.108). . 3. Based on this information, what is Buster Inc.'s weighted average accumulated expenditures for this project in 2017? 4 Vertigo Corp decides to construct its own factory Construction begins on January 1 2022 The company takes out a construction loan on 171122 for $400,000 with annual interest of 5% paid each 12/31 In addition to the construction loan, Vertigo Corp. has two general loans outstanding throughout 2022, as follows 8-year. $300.000, 4% Note Payable 12-year $900.000,6% Loan Payable Vertigo Cor determines that for 2022 the company has weighted average accumulated expenditures of $500.000. Based on this information, how much interest should Vertigo Corp capitalize for this construction project in 2022? 5. On 1/1/22. Ohana Corp purchases an asset and promises to make four annual payments of S10,000 each December 31 (beginning 12/31/22). The market rate of interest for notes of similar risk is 7%. What journal entry should Ohana Corp. record with respect to this transaction on 12/31/2023 (i.e., when the second cash payment is made)? Com On Oto Kom Co purchased foot for $70,000. The company has tecorded depreciation expense of $5.000 per year sinceton on 6.90/6. Kanco decides to sell the asset for 534.000 ch What journal entries are needed to record this transaction? 7. Milford trades used equipment for new models. The exchange lacks commercial substance. The used equipment has a book value of $20.000 (historical cost of $50,000 minus accumulated depreciation of $30,000) and a fair value of $11.000 The new equipment has a list price of $35.000. In addition to trading in the used equipment, Milford must pay $12,000 cash in exchange for the new equipment. What is the journal entry needed to record this transaction? 8. Johnny trades a used laptop for a new model. The exchange tacks commercial substance. The used laptop has a book value of $1.000 (historical cost of $2.500 minus accumulated depreciation of $1,500) and a fait value of $1.200 The model has a list price of $2,500. In addition to trading in the used laptop. Johnny must pay $800 cash in exchange for the new model What is the journal entry needed to record this transaction? 9. Barry trades newer used equipment for an older version of the same equipment. The exchange lacks commercial substance. The newer equipment that Barry trades away has a book value of $90,000 (historical cost of $140,000 minus accumulated depreciation of $50,000) and a fair value of $100,000. In addition to receiving the older equipment, Barry receives $20,000 in the exchange What is the journal entry needed to record this transaction? Weatherman Corp purchases land with some old structures on it. The company plans to clear the old structures and then to construct a new building on the property. Match each of the following expenditures / cash receipts to the category it should affect on the balance sheet of income statement (land, land improvements, building, or period expense) Payment for building construction Architect's fee on building Installation of fences around the property Costs to clear existing structures from the property prior to building construction Interest paid during construction on money borrowed for construction (.e., avoidable interest) Delinquent real estate taxes on the property assumed by Weatherman when the property is purchased Cash received from the sale of materials and lumber discovered on the property Costs to install sewage lines on the property (considered to have indefinite lives) Int. 2. Buster, Inc. decides to construct its own office building. Construction begins on January 1, 2022. Buster, Inc, makes the following payments for the construction throughout 2022 Date Construction Expenditure 1/1/22 $20.000 4/1/22 40,000 5/1/22 (30,000 7/1/22 80,000 12/31/22 10,000 Buster, Inc does not have a specific construction loan for the project. However, the company has various general loans outstanding, as follows 5-year. $800,000,6% Loan Payable 10-year. $90.000.4% Note Payable 20-year, $1,500,000.7% Bonds Payable Based on this information, what is Buster Inc.'s weighted average interest rate during 2022? Enter your answer as a decimal point to the nearest thousandth (e.g., 10.797% would be entered as 0.108). . 3. Based on this information, what is Buster Inc.'s weighted average accumulated expenditures for this project in 2017? 4 Vertigo Corp decides to construct its own factory Construction begins on January 1 2022 The company takes out a construction loan on 171122 for $400,000 with annual interest of 5% paid each 12/31 In addition to the construction loan, Vertigo Corp. has two general loans outstanding throughout 2022, as follows 8-year. $300.000, 4% Note Payable 12-year $900.000,6% Loan Payable Vertigo Cor determines that for 2022 the company has weighted average accumulated expenditures of $500.000. Based on this information, how much interest should Vertigo Corp capitalize for this construction project in 2022? 5. On 1/1/22. Ohana Corp purchases an asset and promises to make four annual payments of S10,000 each December 31 (beginning 12/31/22). The market rate of interest for notes of similar risk is 7%. What journal entry should Ohana Corp. record with respect to this transaction on 12/31/2023 (i.e., when the second cash payment is made)? Com On Oto Kom Co purchased foot for $70,000. The company has tecorded depreciation expense of $5.000 per year sinceton on 6.90/6. Kanco decides to sell the asset for 534.000 ch What journal entries are needed to record this transaction? 7. Milford trades used equipment for new models. The exchange lacks commercial substance. The used equipment has a book value of $20.000 (historical cost of $50,000 minus accumulated depreciation of $30,000) and a fair value of $11.000 The new equipment has a list price of $35.000. In addition to trading in the used equipment, Milford must pay $12,000 cash in exchange for the new equipment. What is the journal entry needed to record this transaction? 8. Johnny trades a used laptop for a new model. The exchange tacks commercial substance. The used laptop has a book value of $1.000 (historical cost of $2.500 minus accumulated depreciation of $1,500) and a fait value of $1.200 The model has a list price of $2,500. In addition to trading in the used laptop. Johnny must pay $800 cash in exchange for the new model What is the journal entry needed to record this transaction? 9. Barry trades newer used equipment for an older version of the same equipment. The exchange lacks commercial substance. The newer equipment that Barry trades away has a book value of $90,000 (historical cost of $140,000 minus accumulated depreciation of $50,000) and a fair value of $100,000. In addition to receiving the older equipment, Barry receives $20,000 in the exchange What is the journal entry needed to record this transaction