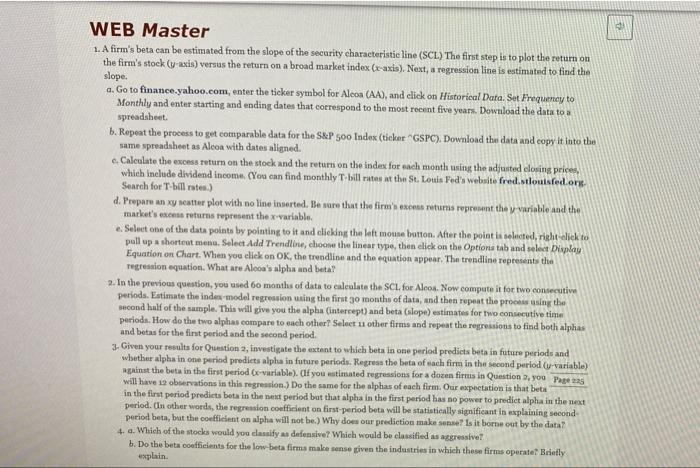

WEB Master 1. A firm's beta can be estimated from the slope of the security characteristic line (SCL) The first step is to plot the return on the firm's stock (y-axis) versus the return on a broad market index (x-axis). Next, a regression line is estimated to find the slope. a. Go to finance.yahoo.com, enter the ticker symbol for Alcon (AA), and click on Historical Data Set Frequeney to Monthly and enter starting and ending dates that correspond to the most recent five years. Download the data to a spreadsheet b. Repeat the process to get comparable data for the S&P 5oo Index (ticker "GSPC). Download the data and copy it into the same spreadsheet as Alcoa with dates aligned. e Calculate the excess return on the stock and the return on the index for each month using the adjusted closing price, which include dividend income. (You can find monthly T-bill rates at the St. Louis Ped's website fred.stlouisfed.org Search for T-bill rates.) d. Prepare an xy seatter plot with no line inserted. Be sure that the firm's exents returns represent the variable and the market's exceto returns represent the variable . Select one of the data points by pointing to it and clicking the left mouse button. After the point is selected, right-click to pull up a shortcut menu. Select Add Trendline, choose the linear type, then click on the Options tab and select Display Equation on Chart. When you click on OK, the trendline and the equation appear. The trendline represents the regression equation. What are Alcoa's alpha and beta! 2. In the previous question, you used 60 months of data to calculate the SCL. for Aloos. Now compute it for two consecutiva periods. Estimate the index model regression using the first 30 months of data, and then repeat the processing the second half of the sample. This will give you the alpha intercept) and beta (slope) estimates for two consecutive time periods. How do the two alphas compare to each other? Select 11 other firms and repeat the regressions to find both alphas and betas for the first period and the second period 3. Given your results for Question 2, investigate the extent to which beta in one period predicts beta in future periods and whether alpha in one period prediets alpha in future periods. Regress the beta of each firm in the second period (w-variable) against the buta in the first period o variable). Clf you estimated regressions for a dozen firms in Question you Page 2 will have 19 observations in this regression.) Do the same for the alphas of each firm. Our expectation is that bett in the first period predicts beta in the best period but that alpha in the first period has no power to predict alpha in the next period. In other words, the regression coefficient on first-period beta will be statistically significant in explaining second- period beta, but the coufficient on alpha will not be.) Why dous our prediction make sense to it borne out by the data? 4. 4. Which of the stocks would you classify na defensive? Which would be classified as agressive b. Do the beta coefficients for the low beta firma make sense given the industries in which these firms operate Briefly explain