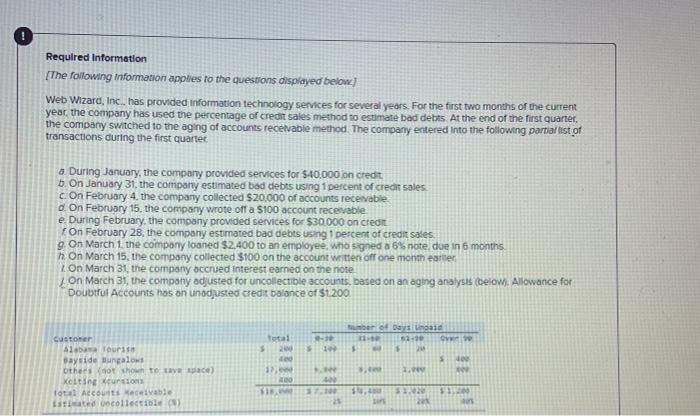

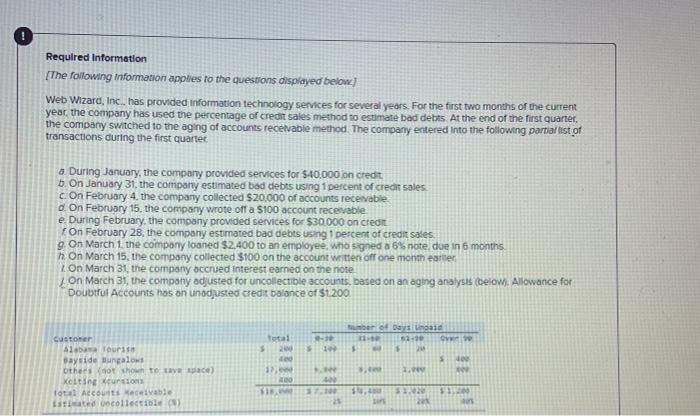

Web Wizard, has provided Information technology services for several years. For the first two months of the current yearthe company has used the percentage of credit sales method 10 estimate bad debts. At the end of the first quarter the company switched to the aging accounts receivable method. The company entered into the following partial of transactions during the quaner a During January, the company provided services for \$40,000 credit b. On January 31, the company estimated bad debts using 1 percent of credit sales. On February 4, the company collected $20,000 of accounts receivable February 15, the company wrote off a $100 account receivable. . During Februarythe company provided services for $ 30,000 on credit February 28the company estimated bad debts using 1 percent of credit sales 9. On March 1the company loaned \$2.400 to an employee, who signed a 6% notedue 6 months. On March 15, the company collected $100 on the account willen of one eatler March 31. the company accrued earned on the note. March 31. the adjusted for uncollectible accounts, based on an aging analysis below) Allowance for Doubtful Accounts has an unadjusted credit balance of 1.200.

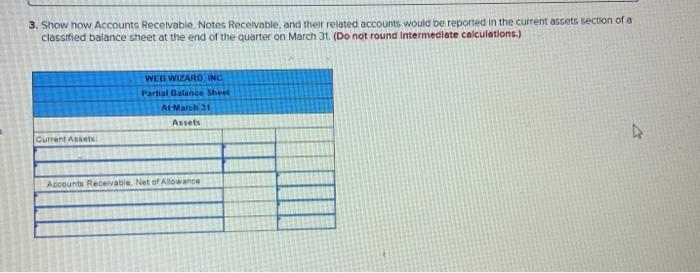

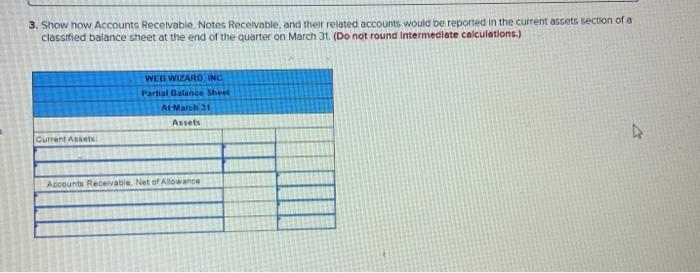

Required Information [The following information applies to the questions displayed below! Web Wizard, Inc., has provided information technology services for several years. For the first two months of the current year, the company has used the percentage of credit sales method to estimate bad debts. At the end of the first quarter. the company switched to the aging of accounts receivable method. The company entered into the following partial list of transactions during the first quartet a During January, the company provided services for $40.000 on credit b. On January 31, the company estimated bad debts using 1 percent of credit sales c On February 4. the company collected $20,000 of accounts receivable d. On February 15. the company wrote off a $100 account recevable e During February, the company provided services for $30.000 on crear On February 28, the company estimated bad debts using percent of credit sales 9 On March 1 the company loaned $2.400 to an employee, who gned a 6% note due in 6 months h On March 15, the company collected $100 on the account written off one month earner On March 31, the company accrued interest earned on the note Jon March 31, the company adjusted for uncollectible accounts, based on an aging analysis (below). Allowance for Doubtful Accounts has an unadjusted credit balance of $1.200. Total 2 -10 100 umber Days Last 11 52-10 5 2 Customer Alba Tours Bayside Bungalows Others not show to save ace) xciting custom Total Accounts Receivable Este collectible . 2. 00 si 3.100 $0. 1.29 12 3. Show how Accounts Receivable Notes Receivable, and their related accounts would be reported in the current assets section of a classified balance sheet at the end of the quarter on March 31. (Do not round Intermediate calculations.) WEE WIZARO, ING Partial Balance Sheet At Mat 31 Assets Current Assets Accounts Receivable. Net of Allowance Required Information [The following information applies to the questions displayed below! Web Wizard, Inc., has provided information technology services for several years. For the first two months of the current year, the company has used the percentage of credit sales method to estimate bad debts. At the end of the first quarter. the company switched to the aging of accounts receivable method. The company entered into the following partial list of transactions during the first quartet a During January, the company provided services for $40.000 on credit b. On January 31, the company estimated bad debts using 1 percent of credit sales c On February 4. the company collected $20,000 of accounts receivable d. On February 15. the company wrote off a $100 account recevable e During February, the company provided services for $30.000 on crear On February 28, the company estimated bad debts using percent of credit sales 9 On March 1 the company loaned $2.400 to an employee, who gned a 6% note due in 6 months h On March 15, the company collected $100 on the account written off one month earner On March 31, the company accrued interest earned on the note Jon March 31, the company adjusted for uncollectible accounts, based on an aging analysis (below). Allowance for Doubtful Accounts has an unadjusted credit balance of $1.200. Total 2 -10 100 umber Days Last 11 52-10 5 2 Customer Alba Tours Bayside Bungalows Others not show to save ace) xciting custom Total Accounts Receivable Este collectible . 2. 00 si 3.100 $0. 1.29 12 3. Show how Accounts Receivable Notes Receivable, and their related accounts would be reported in the current assets section of a classified balance sheet at the end of the quarter on March 31. (Do not round Intermediate calculations.) WEE WIZARO, ING Partial Balance Sheet At Mat 31 Assets Current Assets Accounts Receivable. Net of Allowance