Answered step by step

Verified Expert Solution

Question

1 Approved Answer

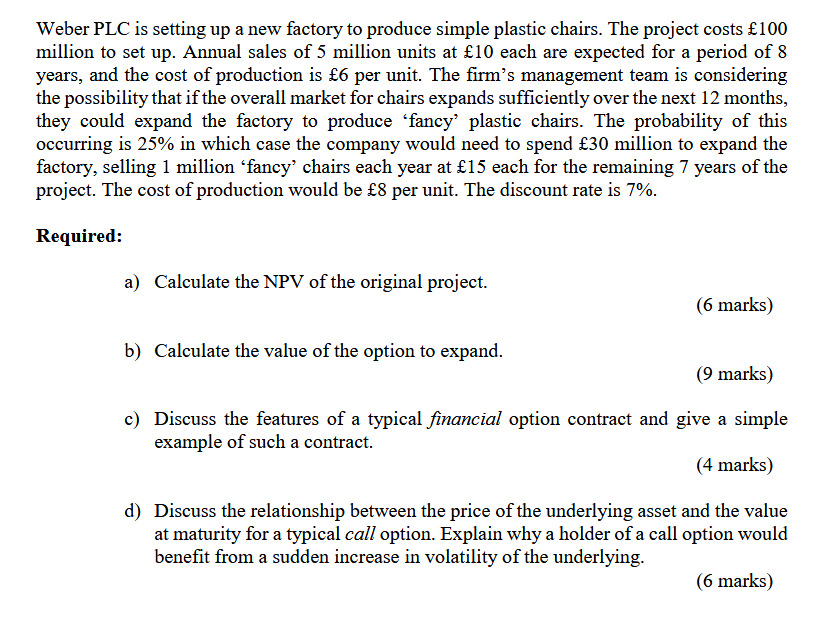

Weber PLC is setting up a new factory to produce simple plastic chairs. The project costs 1 0 0 million to set up . Annual

Weber PLC is setting up a new factory to produce simple plastic chairs. The project costs

million to set up Annual sales of million units at each are expected for a period of

years, and the cost of production is per unit. The firm's management team is considering

the possibility that if the overall market for chairs expands sufficiently over the next months,

they could expand the factory to produce 'fancy' plastic chairs. The probability of this

occurring is in which case the company would need to spend million to expand the

factory, selling million 'fancy' chairs each year at each for the remaining years of the

project. The cost of production would be per unit. The discount rate is

Required:

a Calculate the NPV of the original project.

marks

b Calculate the value of the option to expand.

marks

c Discuss the features of a typical financial option contract and give a simple

example of such a contract.

marks

d Discuss the relationship between the price of the underlying asset and the value

at maturity for a typical call option. Explain why a holder of a call option would

benefit from a sudden increase in volatility of the underlying.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started