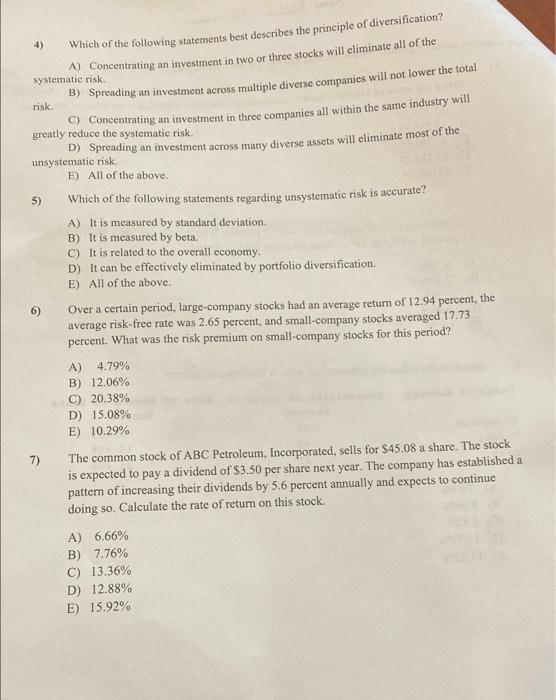

Website profil Credo will continuallore Walipo se companies will relow. Companies all within the same industry will pall DI Sydents will climest of the 30 E ALE Widering make Aby Hy het tely D) Italiendly porto di FAll at the air Oprawy stockholm entre o 12:04 percent, the 25 per und wall.company tockavered 17.73 What the mall.com for this period AJAN 2030 DO 15.085 E 10 ) The common ABC Incorpored self share. The stock expected to a 50 persent year. The company has established putem ofering er divided by percepts to continue doing. Cele there often this ook A) 6 B) C 136 DJ 1284 15% 4) Which of the following statements best describes the principle of diversification? Concentrating an investment in two or three stocks will eliminate all of the systematic risk B) Spreading an investment across multiple diverse companies will not lower the total risk. C) Concentrating an investment in three companies all within the same industry will greatly reduce the systematic risk. D) Spreading an investment across many diverse assets will eliminate most of the unsystematic risk E) All of the above 5) Which of the following statements regarding unsystematic risk is accurate? A) It is measured by standard deviation B) It is measured by beta. It is related to the overall economy. D) It can be effectively eliminated by portfolio diversification. E) All of the above. Over a certain period, large-company stocks had an average return of 12.94 percent, the average risk-free rate was 2.65 percent, and small-company stocks averaged 17.73 percent. What was the risk premium on small-company stocks for this period? A) 4.79% B) 12.06% C) 20,38% D 15.08% E) 10.29% 7) The common stock of ABC Petroleum, Incorporated, sells for $45.08 a share. The stock is expected to pay a dividend of $3.50 per share next year. The company has established a pattern of increasing their dividends by 5.6 percent annually and expects to continue doing so. Calculate the rate of return on this stock. a A) 6.66% B) 7.76% C) 13.36% D) 12.88% E) 15.92% Website profil Credo will continuallore Walipo se companies will relow. Companies all within the same industry will pall DI Sydents will climest of the 30 E ALE Widering make Aby Hy het tely D) Italiendly porto di FAll at the air Oprawy stockholm entre o 12:04 percent, the 25 per und wall.company tockavered 17.73 What the mall.com for this period AJAN 2030 DO 15.085 E 10 ) The common ABC Incorpored self share. The stock expected to a 50 persent year. The company has established putem ofering er divided by percepts to continue doing. Cele there often this ook A) 6 B) C 136 DJ 1284 15% 4) Which of the following statements best describes the principle of diversification? Concentrating an investment in two or three stocks will eliminate all of the systematic risk B) Spreading an investment across multiple diverse companies will not lower the total risk. C) Concentrating an investment in three companies all within the same industry will greatly reduce the systematic risk. D) Spreading an investment across many diverse assets will eliminate most of the unsystematic risk E) All of the above 5) Which of the following statements regarding unsystematic risk is accurate? A) It is measured by standard deviation B) It is measured by beta. It is related to the overall economy. D) It can be effectively eliminated by portfolio diversification. E) All of the above. Over a certain period, large-company stocks had an average return of 12.94 percent, the average risk-free rate was 2.65 percent, and small-company stocks averaged 17.73 percent. What was the risk premium on small-company stocks for this period? A) 4.79% B) 12.06% C) 20,38% D 15.08% E) 10.29% 7) The common stock of ABC Petroleum, Incorporated, sells for $45.08 a share. The stock is expected to pay a dividend of $3.50 per share next year. The company has established a pattern of increasing their dividends by 5.6 percent annually and expects to continue doing so. Calculate the rate of return on this stock. a A) 6.66% B) 7.76% C) 13.36% D) 12.88% E) 15.92%