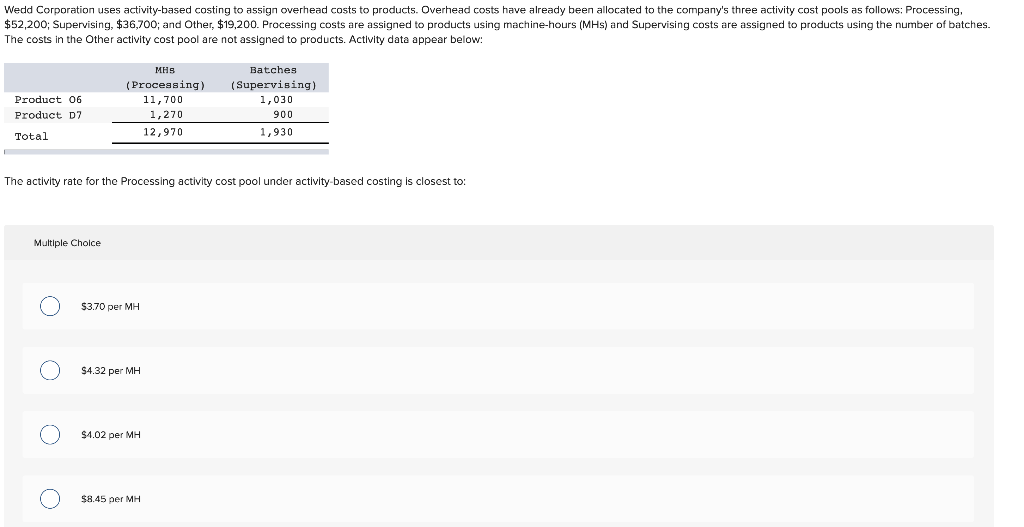

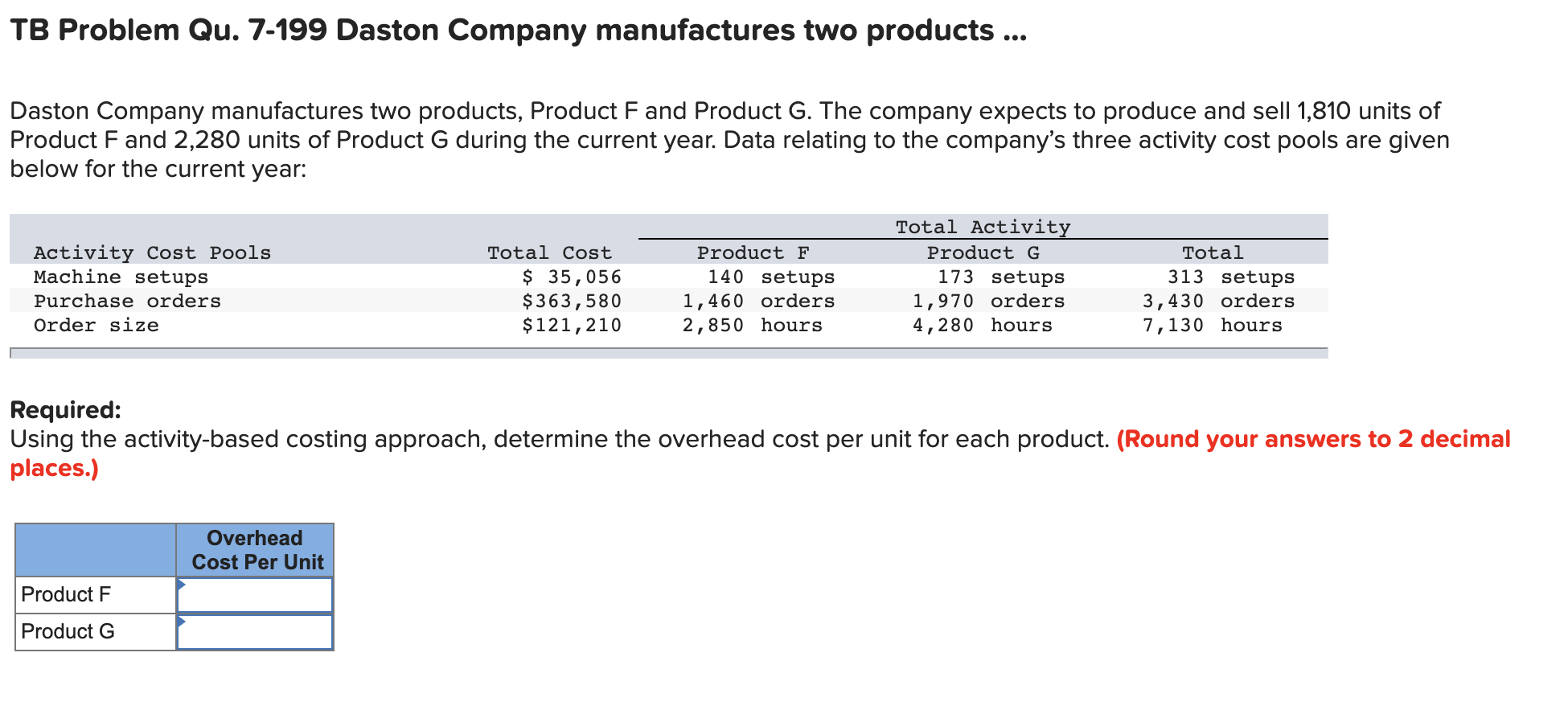

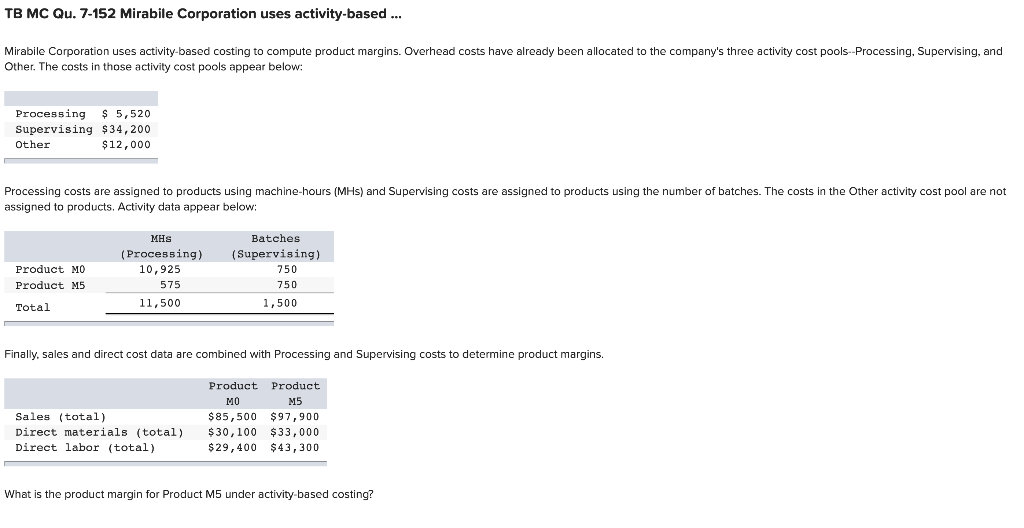

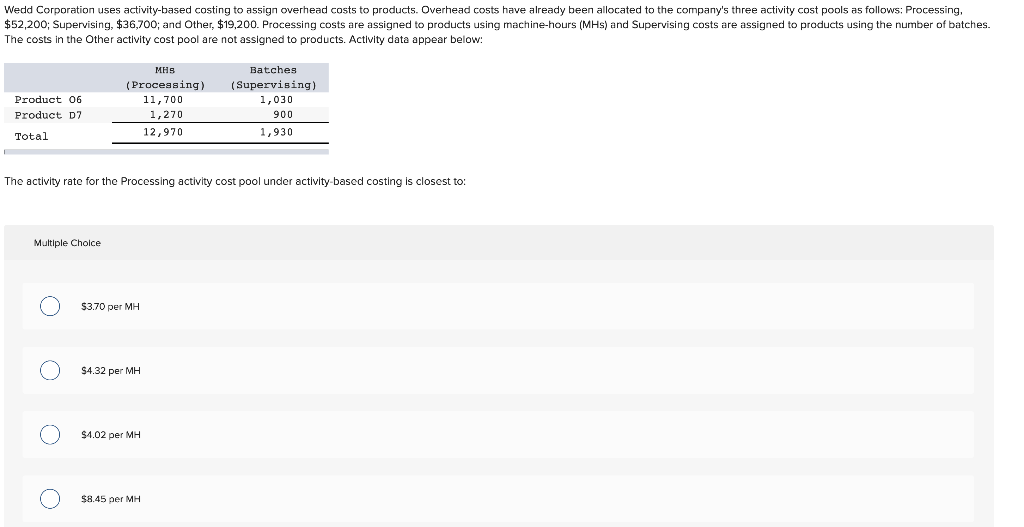

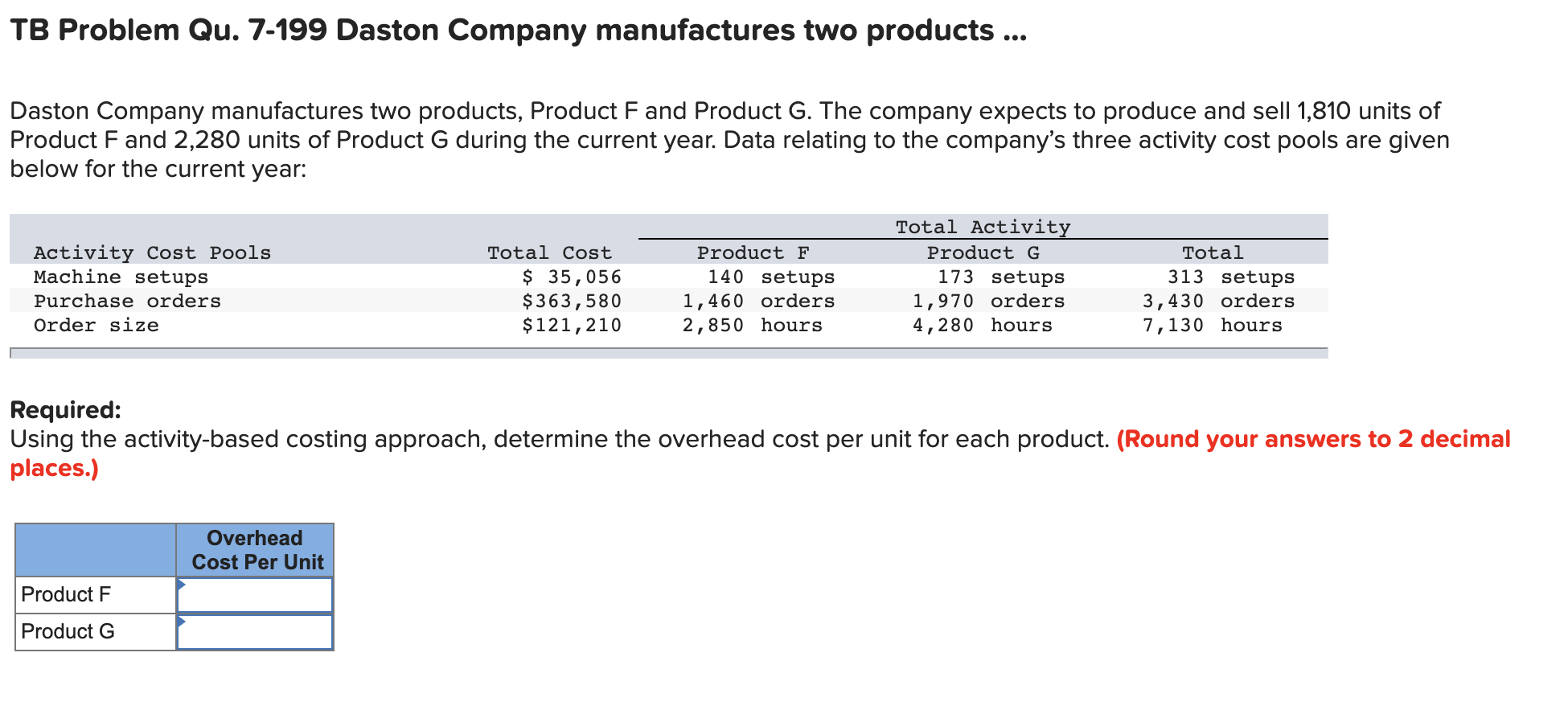

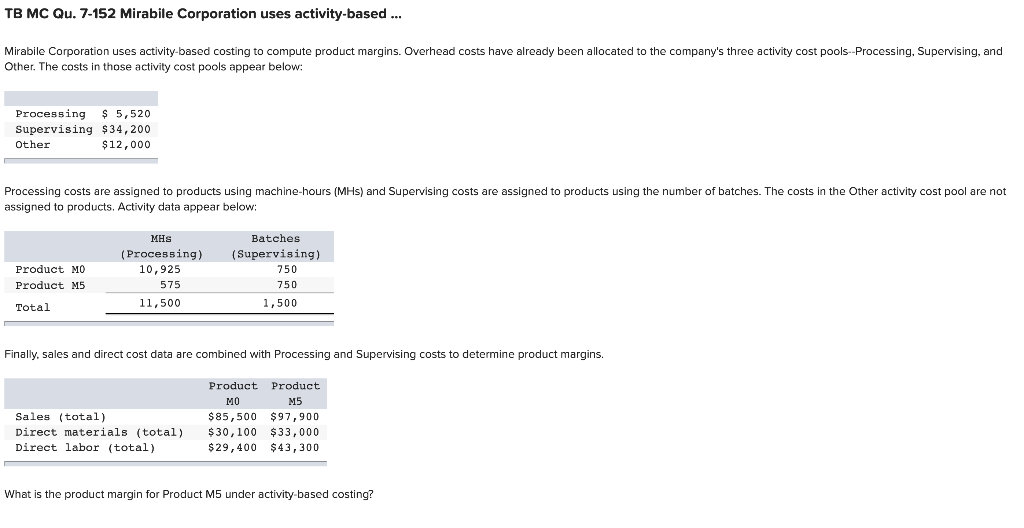

Wedd Corporation uses activity-based costing to assign overhead costs to products. Overhead costs have already been allocated to the company's three activity cost pools as follows: Processing, $52,200; Supervising, $36,700; and Other, $19,200. Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below: Product 06 Product D7 MHS (Processing) 11,700 1,270 12,970 Batches (Supervising) 1,030 900 1,930 Total The activity rate for the Processing activity cost pool under activity based costing is closest to: Multiple Choice $3.70 per MH O $4.32 per MH $1.02 per MH $8.45 per MH TB Problem Qu. 7-199 Daston Company manufactures two products ... Daston Company manufactures two products, Product F and Product G. The company expects to produce and sell 1,810 units of Product F and 2,280 units of Product G during the current year. Data relating to the company's three activity cost pools are given below for the current year: Activity Cost Pools Machine setups Purchase orders Order size Total Cost $ 35,056 $363,580 $121,210 Product F 140 setups 1,460 orders 2,850 hours Total Activity Product G 173 setups 1,970 orders 4,280 hours Total 313 setups 3,430 orders 7,130 hours Required: Using the activity-based costing approach, determine the overhead cost per unit for each product. (Round your answers to 2 decimal places.) Overhead Cost Per Unit Product F Product G TB MC Qu. 7-152 Mirabile Corporation uses activity-based ... Mirabile Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools--Processing, Supervising, and Other. The costs in those activity cost pools appear below: Processing $ 5,520 Supervising $34,200 Other $12,000 Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the other activity cost pool are not assigned to products. Activity data appear below: Product MO Product M5 MHS (Processing) 10,925 575 11,500 Batches (Supervising) 750 750 1,500 Total Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins. Sales (total) Direct materials (total) Direct labor (total) Product Product MO M5 $85,500 $97,900 $30,100 $33,000 $ 29,400 $43,300 What is the product margin for Product M5 under activity-based costing