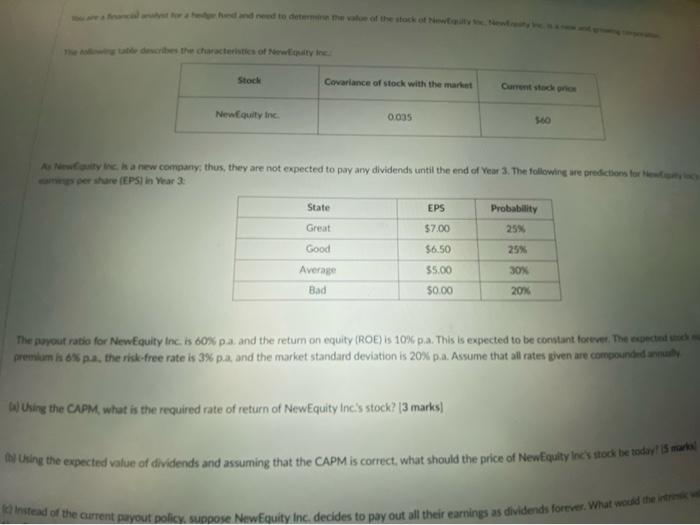

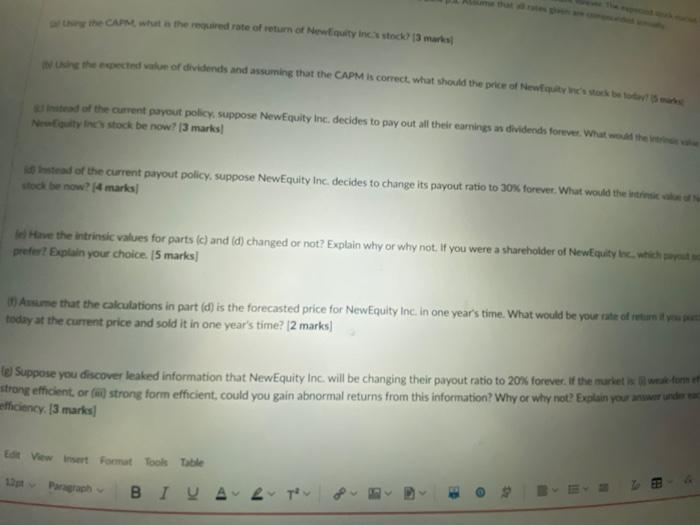

wedd need to deve of the stockow The describes the characteristics of New Stock Covariance of stock with the market Current stock NewEquity Inc 0035 560 Asyincha new company, thus, they are not expected to pay any dividends until the end of Year 3. The following we predictions for per star (EPS) in Year 3: State EPS Probability Great $7.00 25% Good $6.50 25% Average 55.00 30% Bad $0.00 20% The payout ratio for NewEquity Inc. is 60% pa, and the return on equity (ROE) is 10% pa. This is expected to be constant forever. The expected and premium 6% pa. the risk-free rate is 3% pa, and the market standard deviation is 20% pa. Assume that all rates given are compounded Using the CAPM, what is the required rate of return of NewEquity Inc.'s stock? [3 marks) Ching the expected value of dividends and assuming that the CAPM is correct, what should the price of Newgaty lock sock bendeyt 15 ml Instead of the current payout policy. Suppose NewEquity Inc. decides to pay out all their earnings as dividends forever. What would then the car what the required rate of return of New quity in stock 13 marka In the expected value of dividends and assuming that the CAPM is correct. what should the police of water and to be true instead of the current payout policy suppose NewEquity Inc. decides to pay out all their earnings a dividends forever. What would the New in stock be now? [3 marks instead of the current payout policy, suppose NewEquity Inc. decides to change its payout ratio to 30% forever. What would the infos od be now? [4 marks I Have the intrinsic values for parts (c) and (d) changed or not? Explain why or why not. If you were a shareholder of NewEquity which prefer? Explain your choice. 15 marks in Anume that the calculations in part (d) is the forecasted price for NewEquity Inc. In one year's time. What would be your rate of study today at the current price and sold it in one year's time? [2 marks] le suppose you discover leaked information that NewEquity Inc. will be changing their payout ratio to 20% forever. If the market is lll wek terme strong efficient, or (a) strong form efficient, could you gain abnormal returns from this information? Why or why not? Explain you answer under var efficiency. [3 marks Edit View mart Fort Tools Table 1Paragraph ca BI ALT