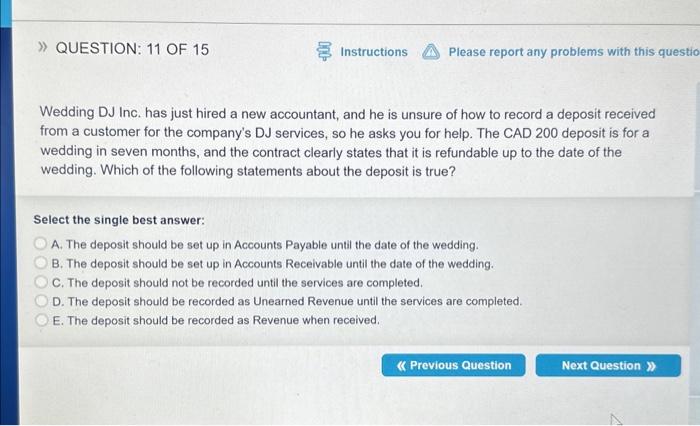

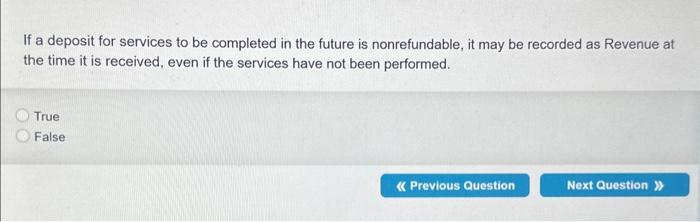

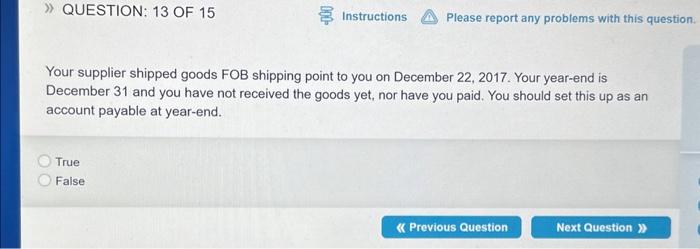

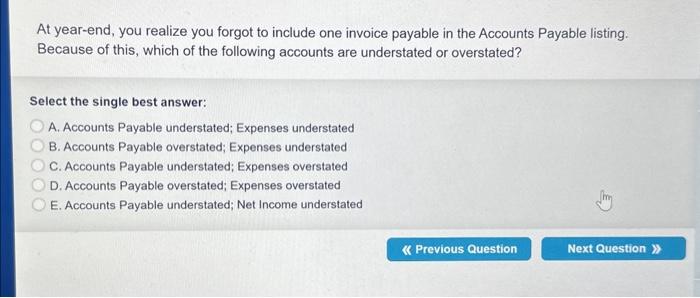

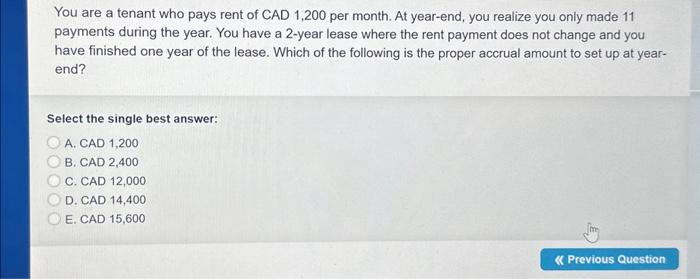

Wedding DJ Inc. has just hired a new accountant, and he is unsure of how to record a deposit received from a customer for the company's DJ services, so he asks you for help. The CAD 200 deposit is for a wedding in seven months, and the contract clearly states that it is refundable up to the date of the wedding. Which of the following statements about the deposit is true? Select the single best answer: A. The deposit should be set up in Accounts Payable until the date of the wedding. B. The deposit should be set up in Accounts Receivable until the date of the wedding. C. The deposit should not be recorded until the services are completed. D. The deposit should be recorded as Unearned Revenue until the services are completed. E. The deposit should be recorded as Revenue when received. If a deposit for services to be completed in the future is nonrefundable, it may be recorded as Revenue at the time it is received, even if the services have not been performed. True False QUESTION: 13 OF 15 Instructions Please report any problems with this question. Your supplier shipped goods FOB shipping point to you on December 22, 2017. Your year-end is December 31 and you have not received the goods yet, nor have you paid. You should set this up as an account payable at year-end. True False At year-end, you realize you forgot to include one invoice payable in the Accounts Payable listing. Because of this, which of the following accounts are understated or overstated? Select the single best answer: A. Accounts Payable understated; Expenses understated B. Accounts Payable overstated; Expenses understated C. Accounts Payable understated; Expenses overstated D. Accounts Payable overstated; Expenses overstated E. Accounts Payable understated; Net Income understated You are a tenant who pays rent of CAD 1,200 per month. At year-end, you realize you only made 11 payments during the year. You have a 2-year lease where the rent payment does not change and you have finished one year of the lease. Which of the following is the proper accrual amount to set up at yearend? Select the single best answer: A. CAD 1,200 B. CAD 2,400 C. CAD 12,000 D. CAD 14,400 E. CAD 15,600