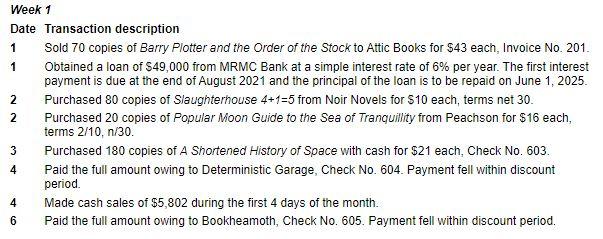

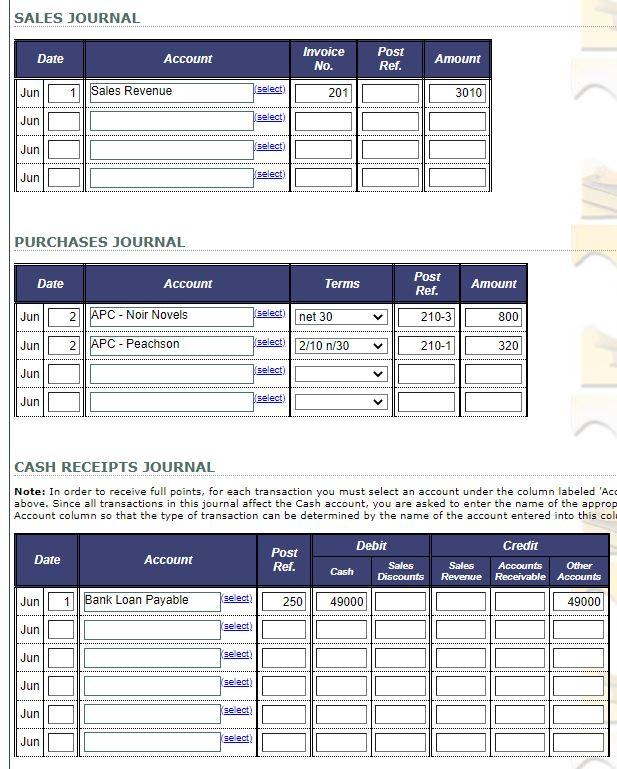

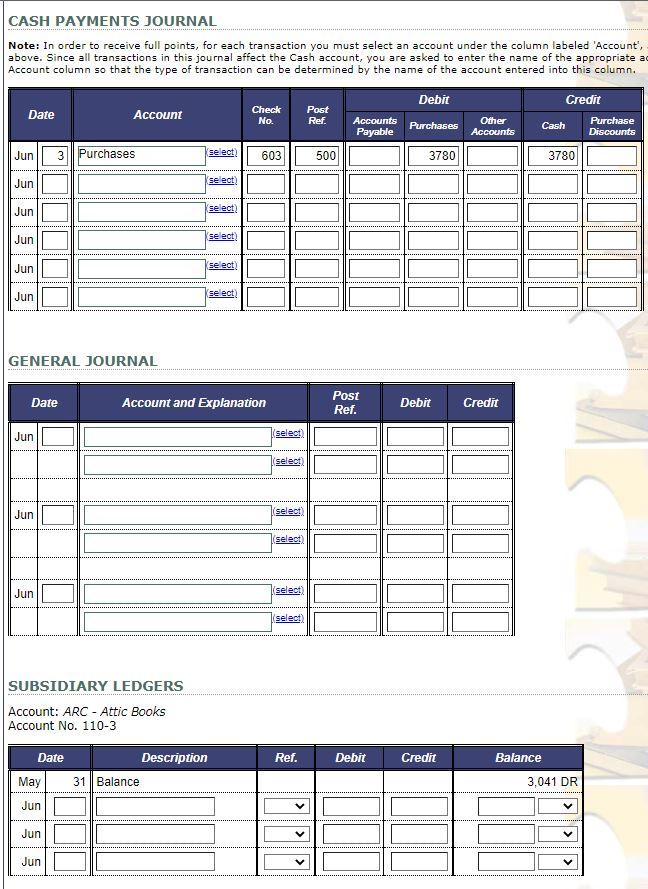

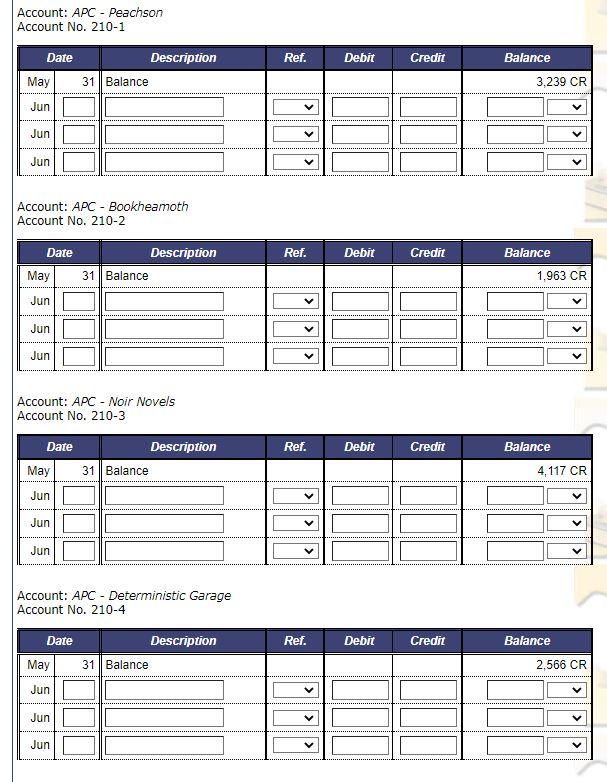

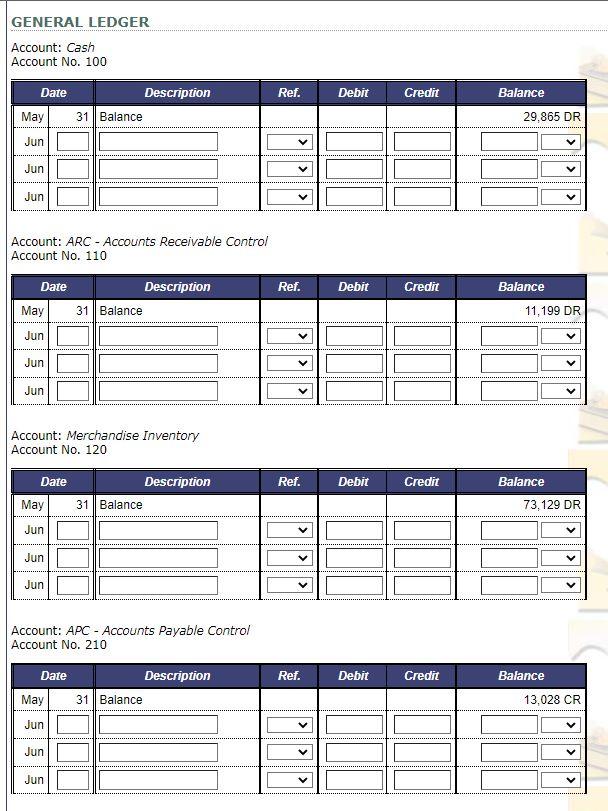

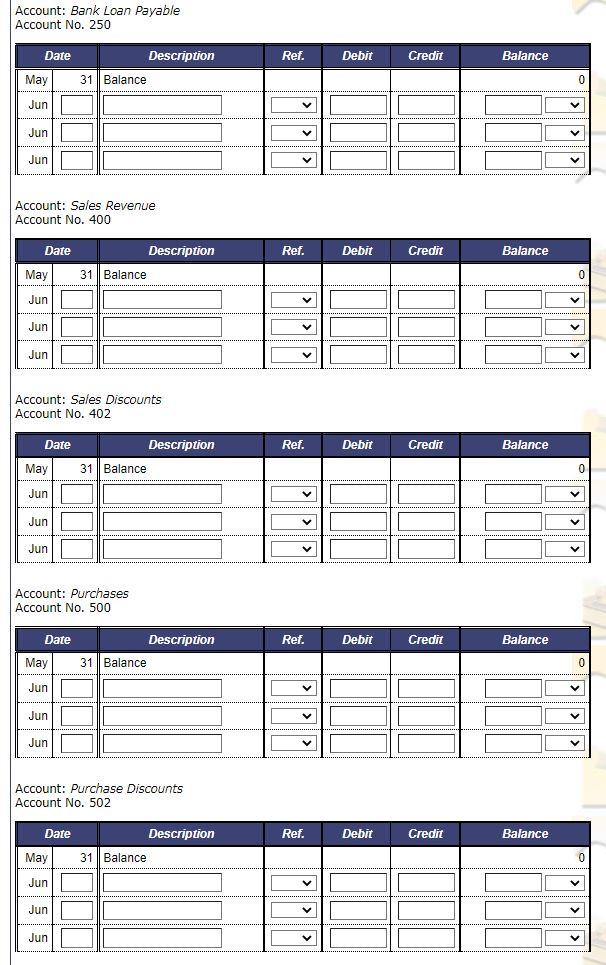

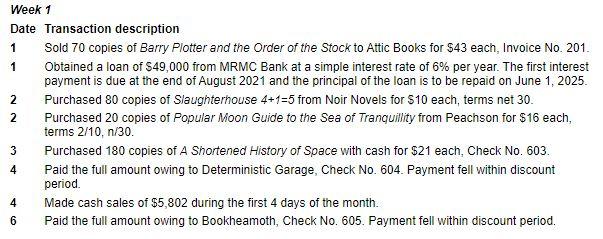

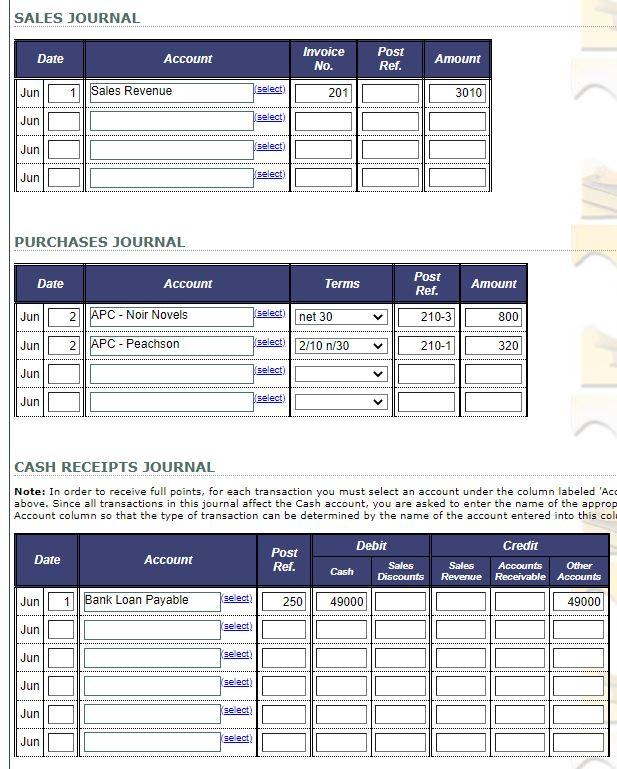

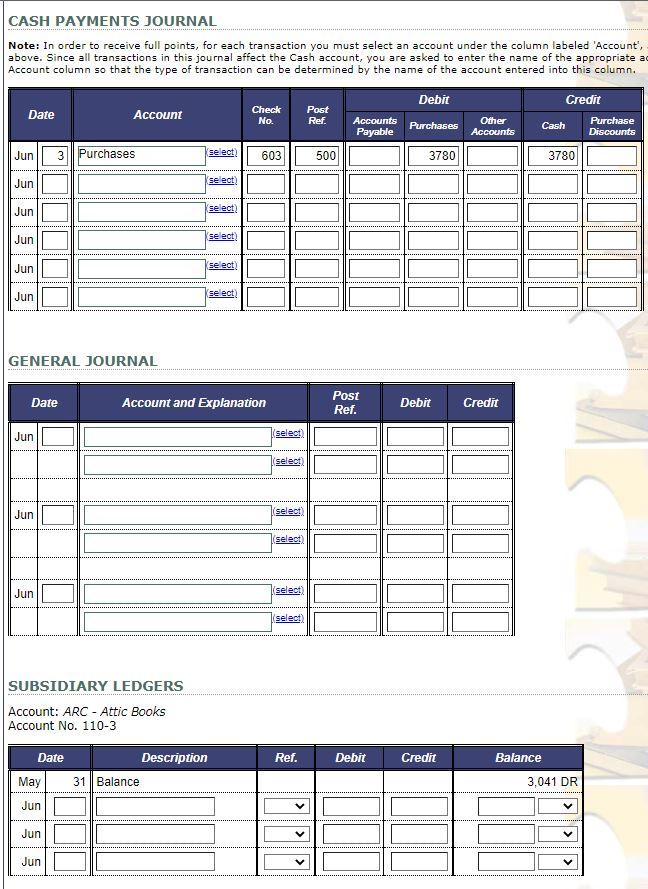

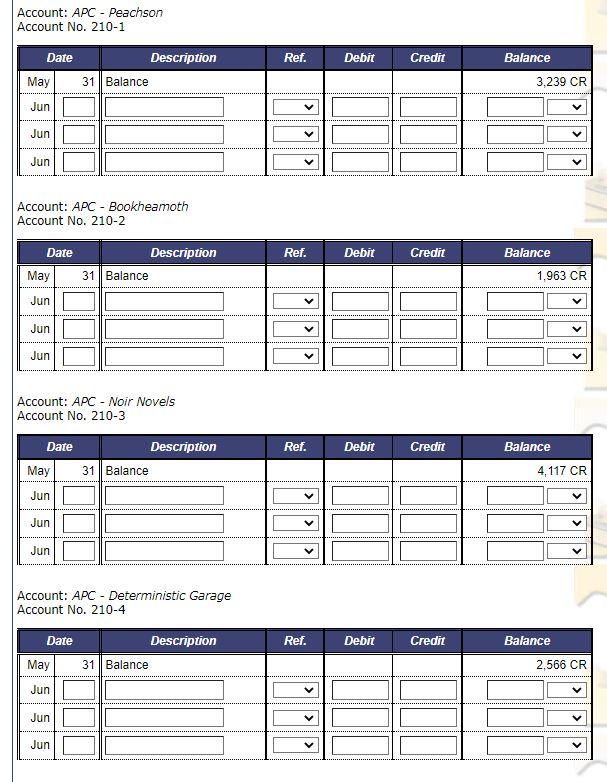

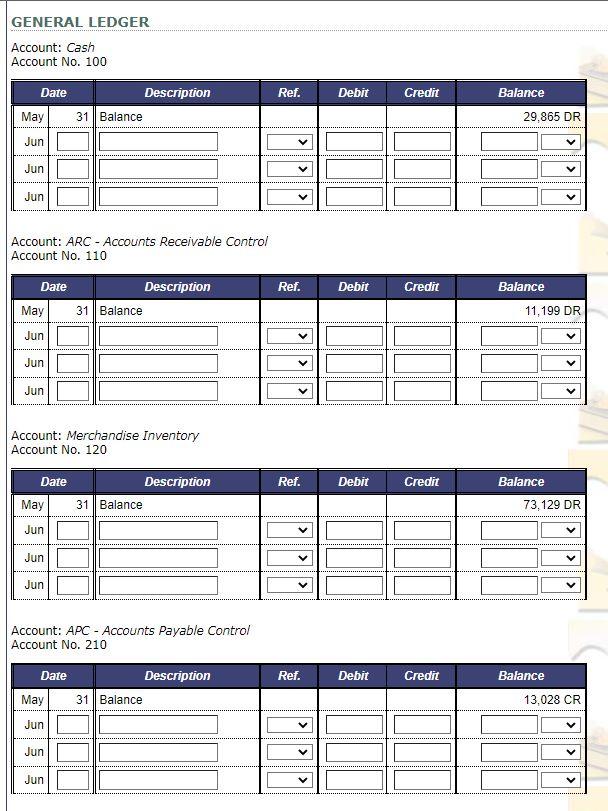

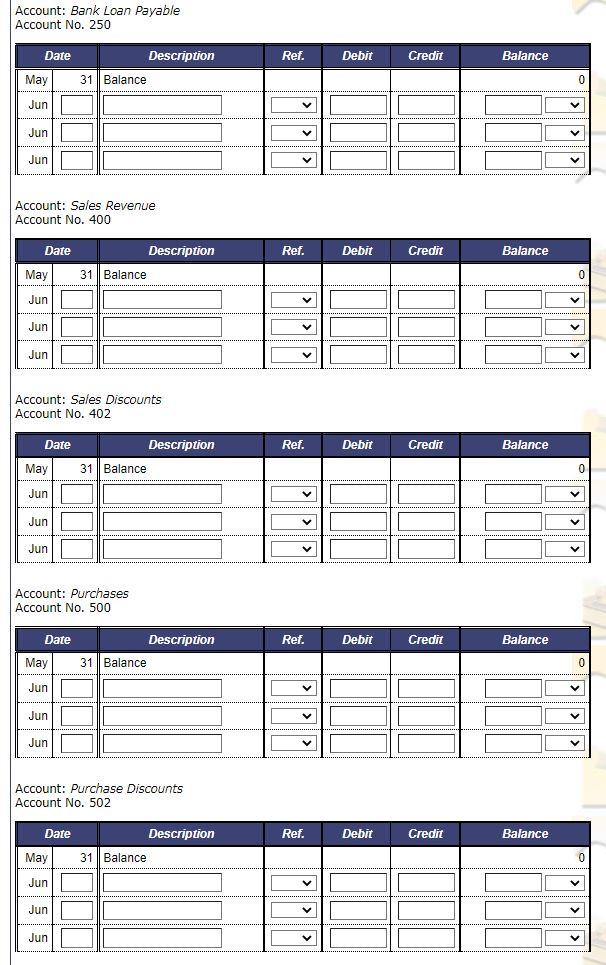

Week 1 Date Transaction description 1 Sold 70 copies of Barry Potter and the Order of the Stock to Attic Books for $43 each Invoice No. 201. 1 Obtained a loan of $49,000 from MRMC Bank at a simple interest rate of 6% per year. The first interest payment is due at the end of August 2021 and the principal of the loan is to be repaid on June 1, 2025. 2 Purchased 80 copies of Slaughterhouse 4+1=5 from Noir Novels for $10 each, terms net 30. 2 Purchased 20 copies of Popular Moon Guide to the Sea of Tranquillity from Peachson for $16 each, terms 2/10, n/30. 3 Purchased 180 copies of A Shortened History of Space with cash for $21 each, Check No. 603. Paid the full amount owing to Deterministic Garage, Check No. 604. Payment fell within discount period. Made cash sales of $5,802 during the first 4 days of the month. Paid the full amount owing to Bookheamoth, Check No. 605. Payment fell within discount period. 4 4 6 SALES JOURNAL Date Account Invoice No. Post Ref. Amount Jun 1 Sales Revenue Select 201 3010 Jun select Jun select Jun select) PURCHASES JOURNAL Date Account Terms Post Ref. Amount Jun 2 || APC - Noir Novels (select net 30 > 210-3 800 Jun 2 || APC - Peachson select 2/10 n/30 210-1 320 Jun select) Jun select) CASH RECEIPTS JOURNAL Note: In order to receive full points, for each transaction you must select an account under the column labeled 'Ace above. Since all transactions in this journal affect the Cash account, you are asked to enter the name of the approp Account column so that the type of transaction can be determined by the name of the account entered into this col Date Account Post Ref. Debit Sales Cash Discounts 49000 Sales Revenue Credit Accounts Other Receivable Accounts Jun 1 | Bank Loan Payable se est 250 49000 Jun Select) Jun select) Jun select) Jun select) Jun select) CASH PAYMENTS JOURNAL Note: In order to receive full points, for each transaction you must select an account under the column labeled 'Account', above. Since all transactions in this journal affect the Cash account, you are asked to enter the name of the appropriate a Account column so that the type of transaction can be determined by the name of the account entered into this column. Debit Date Account Check No. Post Ref. Credit Cash Purchase Discounts Accounts Payable Purchases Other Accounts Jun 3 || Purchases select 603 500 3780 3780 Jun select) Jun select) Jun select) Jun select) Jun Select) GENERAL JOURNAL Date Account and Explanation Post Ref. Debit Credit Jun select) . select) Jun select) select) Jun select) (select) SUBSIDIARY LEDGERS Account: ARC - Attic Books Account No. 110-3 Date Ref. Debit Credit Balance Description 31 Balance May 3,041 DR Jun Jun Jun Account: APC - Peachson Account No. 210-1 Ref. Debit Credit Balance Date May Description 31 Balance 3,239 CR Jun Jun Jun Account: APC - Bookheamoth Account No. 210-2 Date Description Ref. Debit Credit Balance May 31 Balance 1,963 CR Jun > Jun Jun > > - Account: APC - Noir Novels Account No. 210-3 Date Ref. Debit Credit Balance Description 31 Balance May 4,117 CR Jun Jun > Jun Account: APC - Deterministic Garage Account No. 210-4 Date Description Ref. Debit Credit Balance May 31 Balance 2,566 CR Jun Jun Jun 210-3 800 Jun 2 || APC - Peachson select 2/10 n/30 210-1 320 Jun select) Jun select) CASH RECEIPTS JOURNAL Note: In order to receive full points, for each transaction you must select an account under the column labeled 'Ace above. Since all transactions in this journal affect the Cash account, you are asked to enter the name of the approp Account column so that the type of transaction can be determined by the name of the account entered into this col Date Account Post Ref. Debit Sales Cash Discounts 49000 Sales Revenue Credit Accounts Other Receivable Accounts Jun 1 | Bank Loan Payable se est 250 49000 Jun Select) Jun select) Jun select) Jun select) Jun select) CASH PAYMENTS JOURNAL Note: In order to receive full points, for each transaction you must select an account under the column labeled 'Account', above. Since all transactions in this journal affect the Cash account, you are asked to enter the name of the appropriate a Account column so that the type of transaction can be determined by the name of the account entered into this column. Debit Date Account Check No. Post Ref. Credit Cash Purchase Discounts Accounts Payable Purchases Other Accounts Jun 3 || Purchases select 603 500 3780 3780 Jun select) Jun select) Jun select) Jun select) Jun Select) GENERAL JOURNAL Date Account and Explanation Post Ref. Debit Credit Jun select) . select) Jun select) select) Jun select) (select) SUBSIDIARY LEDGERS Account: ARC - Attic Books Account No. 110-3 Date Ref. Debit Credit Balance Description 31 Balance May 3,041 DR Jun Jun Jun Account: APC - Peachson Account No. 210-1 Ref. Debit Credit Balance Date May Description 31 Balance 3,239 CR Jun Jun Jun Account: APC - Bookheamoth Account No. 210-2 Date Description Ref. Debit Credit Balance May 31 Balance 1,963 CR Jun > Jun Jun > > - Account: APC - Noir Novels Account No. 210-3 Date Ref. Debit Credit Balance Description 31 Balance May 4,117 CR Jun Jun > Jun Account: APC - Deterministic Garage Account No. 210-4 Date Description Ref. Debit Credit Balance May 31 Balance 2,566 CR Jun Jun Jun