Answered step by step

Verified Expert Solution

Question

1 Approved Answer

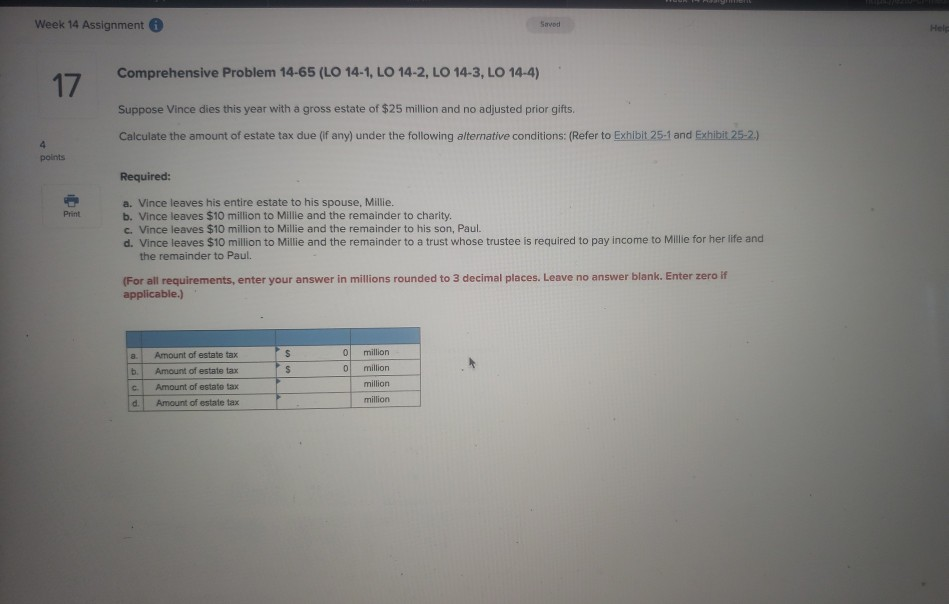

Week 14 Assignment Savod Comprehensive Problem 14-65 (LO 14-1, LO 14-2, LO 14-3, LO 14-4) 17 Suppose Vince dies this year with a gross estate

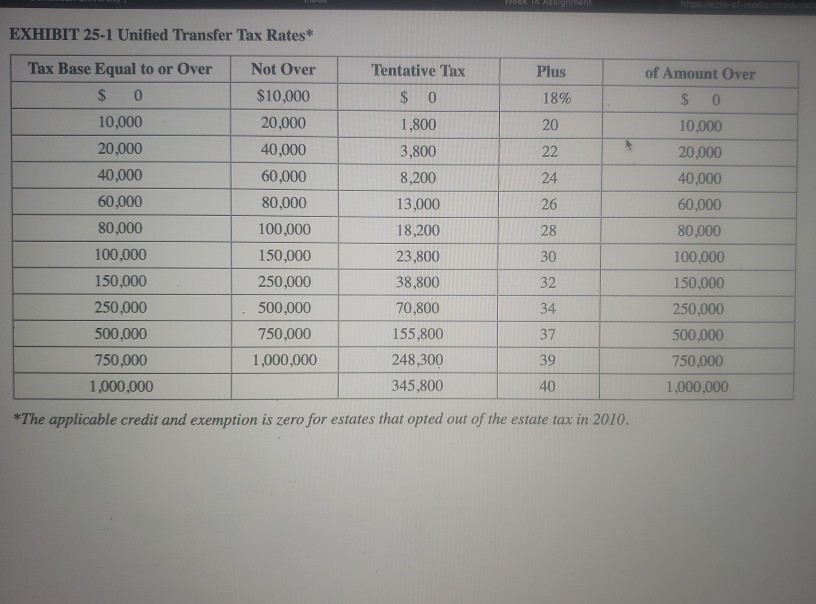

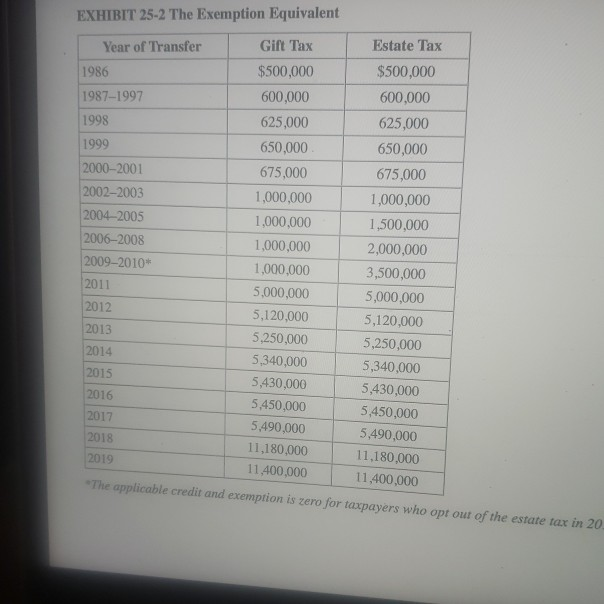

Week 14 Assignment Savod Comprehensive Problem 14-65 (LO 14-1, LO 14-2, LO 14-3, LO 14-4) 17 Suppose Vince dies this year with a gross estate of $25 million and no adjusted prior gifts Calculate the amount of estate tax due (if any) under the following alternative conditions: (Refer to Exhibit 25-1 and Exhibit 25-2.) points Required: a. Vince leaves his entire estate to his spouse, Millie. b. Vince leaves $10 million to Millie and the remainder to charity. c. Vince leaves $10 million to Millie and the remainder to his son, Paul d. Vince leaves $10 million to Millie and the remainder to a trust whose trustee is required to pay income to Mille for her life and the remainder to Paul. (For all requirements, enter your answer in millions rounded to 3 decimal places. Leave no answer blank. Enter zero if applicable.) a. million 0 0 million Amount of estate tax Amount of estate tax Amount of estate tax Amount of state tax million c. d. million EXHIBIT 25-1 Unified Transfer Tax Rates* Plus 18% 20 22 Tax Base Equal to or Over $ 0 10,000 20,000 40,000 60,000 80,000 100,000 150,000 250,000 500,000 750,000 1,000,000 Not Over $10,000 20,000 40,000 60,000 80,000 100,000 150,000 250,000 500,000 750,000 1,000,000 Tentative Tax $ 0. 1,800 3,800 8,200 13,000 18,200 23,800 38,800 70,800 155,800 248,300 345,800 of Amount Over $ 0 10,000 20,000 40,000 60,000 80,000 100,000 150,000 250,000 500,000 750,000 1,000,000 39 40 *The applicable credit and exemption is zero for estates that opted out of the estate tax in 2010. EXHIBIT 25-2 The Exemption Equivalent Gift Tax $500,000 Estate Tax $500,000 600,000 625,000 600,000 625,000 650,000 Year of Transfer 1986 1987-1997 1998 1999 2000-2001 20022003 2004-2005 2006-2008 2009-2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 675,000 1,000,000 1,000,000 1,000,000 1,000,000 5,000,000 5,120,000 5,250,000 5,340,000 5,430,000 5,450,000 5.490,000 11,180,000 11,400,000 650,000 675,000 1,000,000 1,500,000 2,000,000 3,500,000 5,000,000 5,120,000 5,250,000 5,340,000 5,430,000 5,450,000 5,490,000 11.180,000 11,400,000 The applicable credit and exemption is zero for taxpayers who opt out of the estate tax in 20

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started