Question

Week 3 Determine Adjusted Book Income: You are provided with the unadjusted trial balance (Microsoft Excel) and your managers meeting notes and questions (Microsoft Word)

Week 3 Determine Adjusted Book Income:

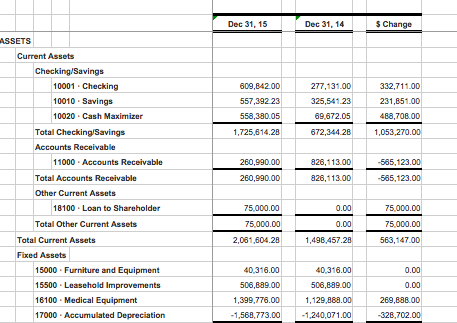

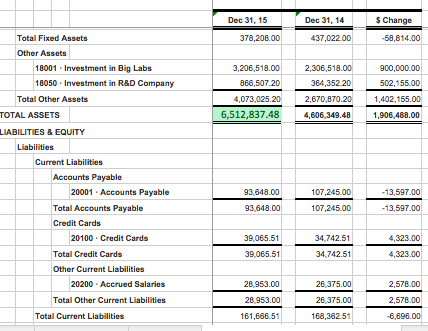

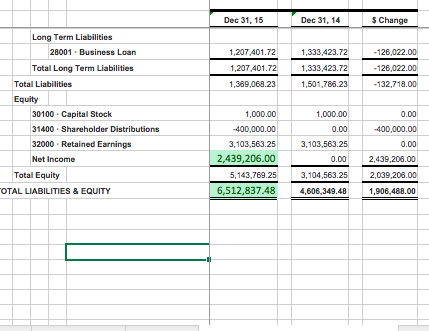

You are provided with the unadjusted trial balance (Microsoft Excel) and your managers meeting notes and questions (Microsoft Word) for your new tax client Phoenix Medical.

Following the notes, modify the unadjusted trial balance to generate a trial balance workpaper (in Microsoft Excel) that includes:

Adjusting Journal Entries

Adjusted Book Income

Tax Journal Entries

Taxable Income

Answers to your managers questions (Microsoft Word or Excel).

The client depends on you, the CPA, to provide journal entries for activity in fixed assets. While discussing fixed assets, the client divulges that he got a great deal to upgrade his laser dermatology equipment. Ultimately, you find out that $569,888 of new equipment was purchased and placed in service on 6/18/2015.

Furthermore, and much after the fact, you discover that old medical equipment was sold to an unrelated party for $75,000 cash. The original cost of the equipment was $300,000 and it was fully depreciated (no Sec. 179). The cash was deposited in one of the shareholders personal accounts.

Provide a journal entry to calculate the gain on sale and adjust the fixed asset and accumulated depreciation accounts.

What is the nature of this gain?

Could the Dr. have structured this sale in a different way to avoid taxable income? How?

The client depends on his accountant to provide a journal entry for the annual depreciation expense. They have adopted a policy of treating book depreciation equal to tax depreciation. Depreciation expense for the year will include:

Depreciation on assets placed in service prior to 2015 is: $86,769

Maximize Sec. 179 expense on assets placed in service in 2015.

Take Sec. 168(k) 50% Bonus on new equipment if applicable.

Week 3 Determine Taxable Income:

Determine taxable income. Show all adjustments in the Microsoft Excel spreadsheet. Footnote references are provided to assist you.

The Dr. has filed his prior tax returns on the cash basis.

What questions will you ask to be sure he can continue to file on the cash basis?

You find that in 2015, the Dr. qualifies, and choose to file on the cash basis. His books are kept on the accrual basis. Determine the adjustments needed.

No federal taxes were paid in 2014, and no estimated taxes were paid in 2015.

Within the state tax expense, you find $4,389 is late payment penalties.

While analyzing the financial information, you find that hidden in Accounts Payable is $28,953 of accrued salaries. You also find that the salaries were paid in the first week of February.

Does this have an impact on taxable income?

Determine the accrual to cash adjustments for accounts receivable and accounts payable.

A charitable contribution carryforward of $40,000 is available.

Included in insurance expense is $12,523 of officers life insurance. You determine the company is the beneficiary, and each officer is a greater than 20% shareholder.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started