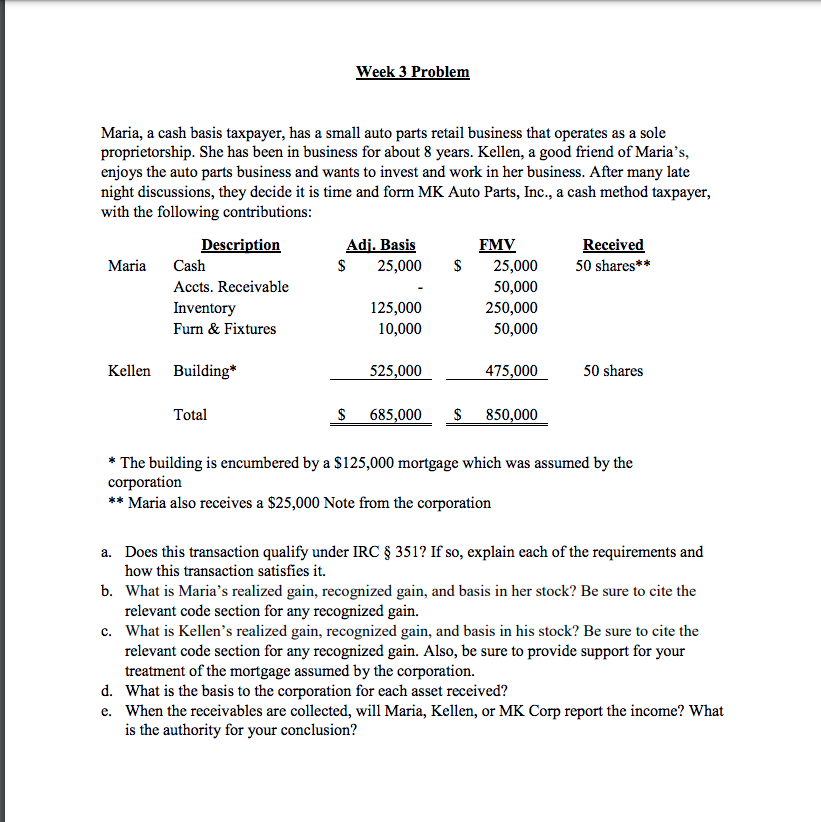

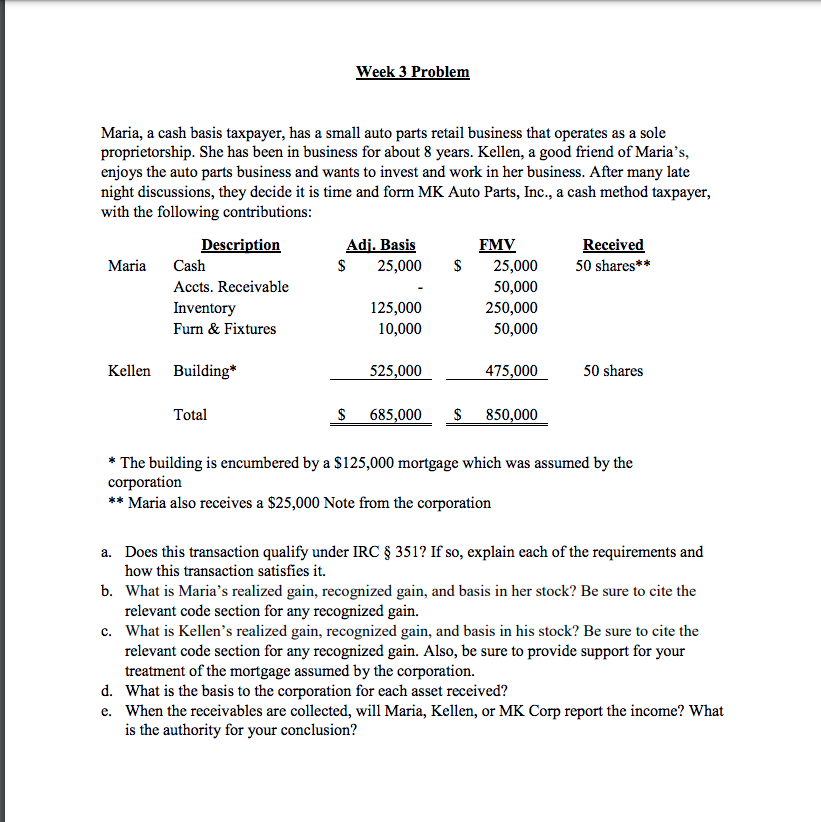

Week 3 Problem Maria, a cash basis taxpayer, has a small auto parts retail business that operates as a sole proprietorship. She has been in business for about 8 years. Kellen, a good friend of Maria's, enjoys the auto parts business and wants to invest and work in her business. After many late night discussions, they decide it is time and form MK Auto Parts, Inc., a cash method taxpayer, with the following contributions: Description Adi. Basis FMV Received Maria Cash $ 25,000 $ 25,000 50 shares** Accts. Receivable 50,000 Inventory 125,000 250,000 Furn & Fixtures 10,000 50,000 Kellen Building* 525,000 475,000 50 shares Total $ 685,000 $ 850,000 * The building is encumbered by a $125,000 mortgage which was assumed by the corporation ** Maria also receives a $25,000 Note from the corporation a. Does this transaction qualify under IRC $ 351? If so, explain each of the requirements and how this transaction satisfies it. b. What is Maria's realized gain, recognized gain, and basis in her stock? Be sure to cite the relevant code section for any recognized gain. c. What is Kellen's realized gain, recognized gain, and basis in his stock? Be sure to cite the relevant code section for any recognized gain. Also, be sure to provide support for your treatment of the mortgage assumed by the corporation. d. What is the basis to the corporation for each asset received? e. When the receivables are collected, will Maria, Kellen, or MK Corp report the income? What is the authority for your conclusion? Week 3 Problem Maria, a cash basis taxpayer, has a small auto parts retail business that operates as a sole proprietorship. She has been in business for about 8 years. Kellen, a good friend of Maria's, enjoys the auto parts business and wants to invest and work in her business. After many late night discussions, they decide it is time and form MK Auto Parts, Inc., a cash method taxpayer, with the following contributions: Description Adi. Basis FMV Received Maria Cash $ 25,000 $ 25,000 50 shares** Accts. Receivable 50,000 Inventory 125,000 250,000 Furn & Fixtures 10,000 50,000 Kellen Building* 525,000 475,000 50 shares Total $ 685,000 $ 850,000 * The building is encumbered by a $125,000 mortgage which was assumed by the corporation ** Maria also receives a $25,000 Note from the corporation a. Does this transaction qualify under IRC $ 351? If so, explain each of the requirements and how this transaction satisfies it. b. What is Maria's realized gain, recognized gain, and basis in her stock? Be sure to cite the relevant code section for any recognized gain. c. What is Kellen's realized gain, recognized gain, and basis in his stock? Be sure to cite the relevant code section for any recognized gain. Also, be sure to provide support for your treatment of the mortgage assumed by the corporation. d. What is the basis to the corporation for each asset received? e. When the receivables are collected, will Maria, Kellen, or MK Corp report the income? What is the authority for your conclusion