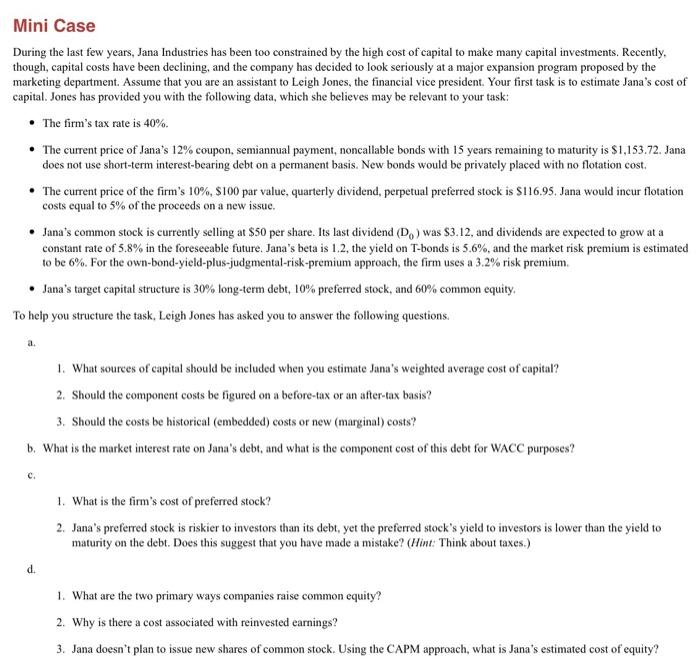

Week 4 Mini Case Complete the Chapter 9 Mini-case on page 411 in your textbook. After reading the case, you will complete questions A through D only. In addition to your textbook, please provide at least two scholarly sources to support your answers. Business School Assignment Instructions The requirements below must be met for your paper to be accepted and graded: Write between 750 - 1,250 words (approximately 3 - 5 pages) using Microsoft Word in APA style. Use font size 12 and 1" margins. Include cover page and reference page. At least 80% of your paper must be original content/writing. No more than 20% of your content/information may come from references. Use at least three references from outside the course material; one reference must be from EBSCOhost. Text book, lectures, and other materials in the course may be used, but are not counted toward the three reference requirement. Cite all reference material (data, dates, graphs, quotes, paraphrased words, values, etc.) in the paper and list on a reference page in APA style. References must come from sources such as scholarly journals found in EBSCOhost or on Google Scholar, government websites and publications, reputable news media (e.g. CNN, The Wall Street Journal, The New York Times) websites and publications, etc. Sources such as Wikis, Yahoo Answers, eHow, blogs, etc. are not acceptable for academic writing. Mini Case During the last few years, Jana Industries has been too constrained by the high cost of capital to make many capital investments. Recently. though, capital costs have been declining, and the company has decided to look seriously at a major expansion program proposed by the marketing department. Assume that you are an assistant to Leigh Jones, the financial vice president. Your first task is to estimate Jana's cost of capital. Jones has provided you with the following data, which she believes may be relevant to your task: . The firm's tax rate is 40%. The current price of Jana's 12% coupon, semiannual payment, noncallable bonds with 15 years remaining to maturity is $1,153.72. Jana does not use short-term interest-bearing debt on a permanent basis. New bonds would be privately placed with no flotation cost. The current price of the firm's 10%, $100 par value, quarterly dividend, perpetual preferred stock is $116.95. Jana would incur flotation costs equal to 5% of the proceeds on a new issue. Jana's common stock is currently selling at $50 per share. Its last dividend (D) was $3.12, and dividends are expected to grow at a constant rate of 5.8% in the foreseeable future. Jana's beta is 1.2, the yield on T-bonds is 5.6%, and the market risk premium is estimated to be 6%. For the own-bond-yield-plus-judgmental-risk-premium approach, the firm uses a 3.2% risk premium Jana's target capital structure is 30% long-term debt, 10% preferred stock, and 60% common equity. To help you structure the task, Leigh Jones has asked you to answer the following questions 1. What sources of capital should be included when you estimate Jana's weighted average cost of capital? 2. Should the component costs be figured on a before-tax or an after-tax basis? 3. Should the costs be historical (embedded) costs or new (marginal) costs? b. What is the market interest rate on Jana's debt, and what is the component cost of this debt for WACC purposes? C. 1. What is the firm's cost of preferred stock? 2. Jana's preferred stock is riskier to investors than its debt, yet the preferred stock's yield to investors is lower than the yield to maturity on the debt. Does this suggest that you have made a mistake? (Wint. Think about taxes.) d. 1. What are the two primary ways companies raise common equity? 2. Why is there a cost associated with reinvested earnings? 3. Jana doesn't plan to issue new shares of common stock. Using the CAPM approach, what is Jana's estimated cost of equity