Answered step by step

Verified Expert Solution

Question

1 Approved Answer

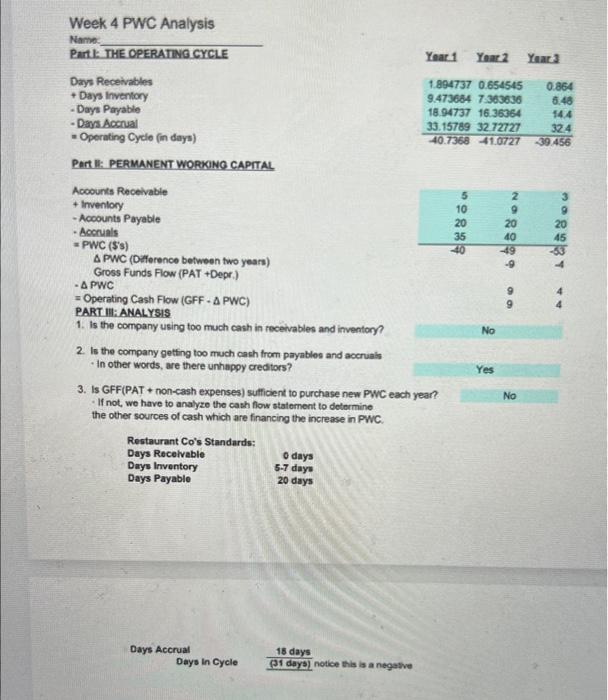

Week 4 PWC Analysis Name Part I: THE OPERATING CYCLE Days Receivables + Days Inventory -Days Payable Year 1 Year 2 Year 3 1.894737

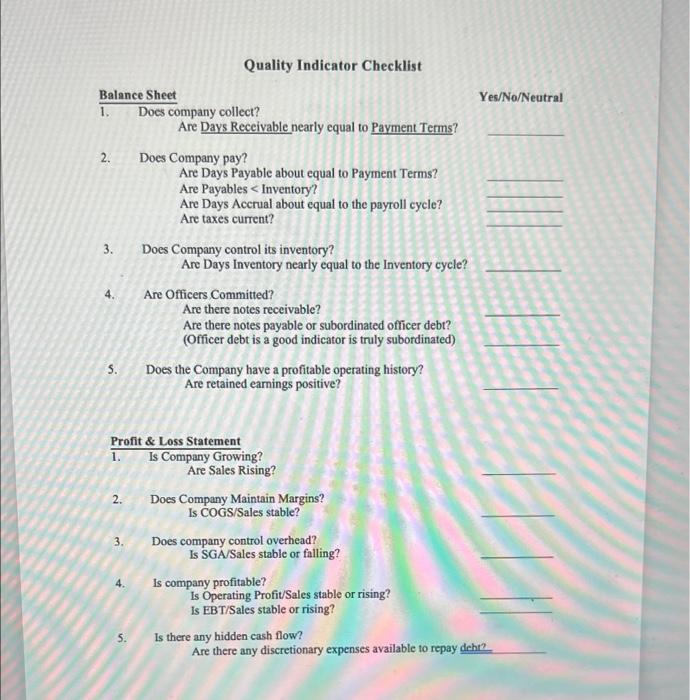

Week 4 PWC Analysis Name Part I: THE OPERATING CYCLE Days Receivables + Days Inventory -Days Payable Year 1 Year 2 Year 3 1.894737 0.654545 0.864 9.473684 7.363636 6.48 18.94737 16.36364 14.4 33.15789 32.72727 32.4 -Days Accrual " Operating Cycle (in days) Part I: PERMANENT WORKING CAPITAL Accounts Receivable +Inventory -Accounts Payable -Accruals =PWC ($'s) APWC (Difference between two years) Gross Funds Flow (PAT +Depr.) -A PWC Operating Cash Flow (GFF-A PWC) PART I: ANALYSIS 40.7368 41.0727 39.456 2 3 10 9 9 20 20 20 35 40 45 40 49 -63 -9 9 9 No 44 1. Is the company using too much cash in receivables and inventory? 2. Is the company getting too much cash from payables and accruals In other words, are there unhappy creditors? 3. Is GFF(PAT + non-cash expenses) sufficient to purchase new PWC each year? If not, we have to analyze the cash flow statement to determine the other sources of cash which are financing the increase in PWC. Restaurant Co's Standards: Days Receivable 0 days Days Inventory Days Payable 5-7 days 20 days Days Accrual Days In Cycle 18 days (31 days) notice this is a negative Yes No

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started