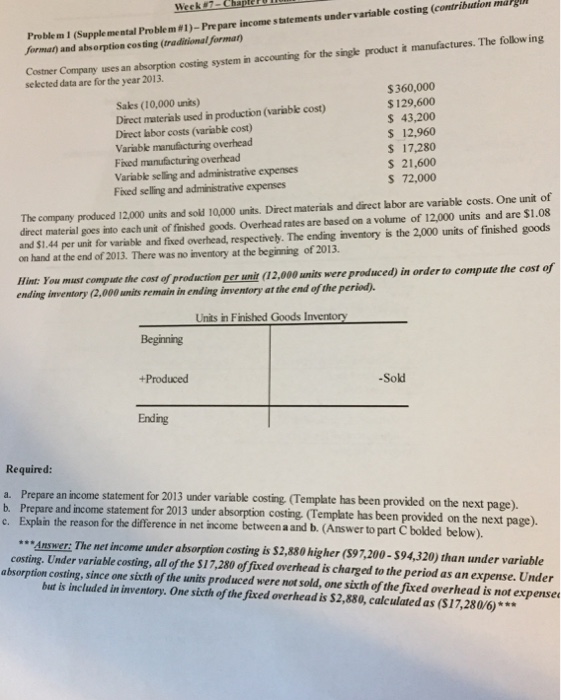

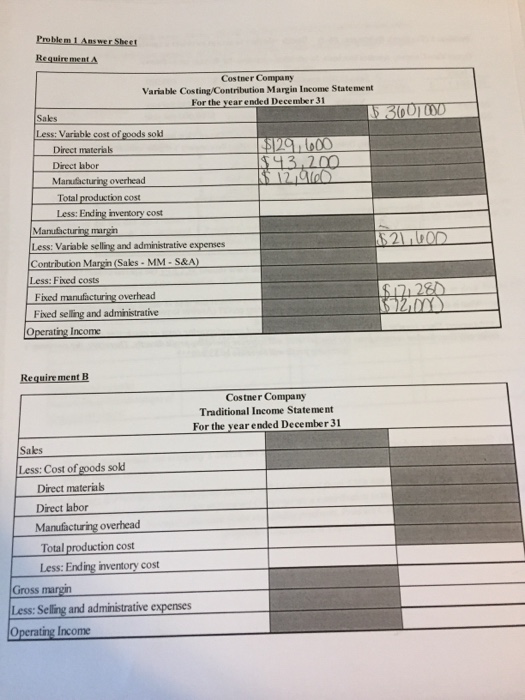

Week 7-ChapterU Proble m 1 (Supplemental Problem # i )-Prepare income statements under variable costing (contribution margi Jorman) and absorption cos ting (traditional format Costner selected data are for the year 2013 Company uses an absorption costing system in accounting for the single product i manufactures. The follow ing Saks (10,000 units) Direct materias used in production (variable cost) Direct labor costs (variable cost) Variable manufacturing overhead Fixed manufacturing overhead Variable selling and administrative expenses Fixed selling and administrative expenses $360,000 $129,600 S 43,200 S 12,960 s 17.280 S 21,600 s 72,000 The company produced 12,000 units and sold 10,000 units. Direct materias and direct labor are variable costs. One unit of direct material goes into each unit of finished goods. Overhead rates are based on a volume of 12,000 units and are S1.08 and $1.44 per unit for variable and fixed overhead, respectively. The ending inventory is the 2,000 units of finished goods on hand at the end of 2013. There was no inventory at the beginning of 2013. Hint: You must compute the cost of production per unit (12,000 units were produced) in order to compute the cost of ending inventory (2,000 units remain in ending inventory at the end of the period). Units in Finished Goods Inventory Beginning +Producecd -Sold Ending Required: a. Prepare an income statement for 2013 under variable costing (Template has been provided on the next page). b. Prepare and income statement for 2013 under absorption costing (Templte has been provided on the next page). c. Explain the reason for the difference in net income between a and b. (Answer to part C bolded below). Answer: The net income under absorption costing is $2,880 higher (597,200-394,320) than under variable costing. Under variable costing, all of the $17,280 of fixed overhead is charged to the period as an expense. Under absorption costing, since one sicth of the units produced were not sold, one sicth of the fixed overhead is not expense but is included in inventory. One sixth of the fixed overhead is $2,880, caleulated as (S17,280/6)*