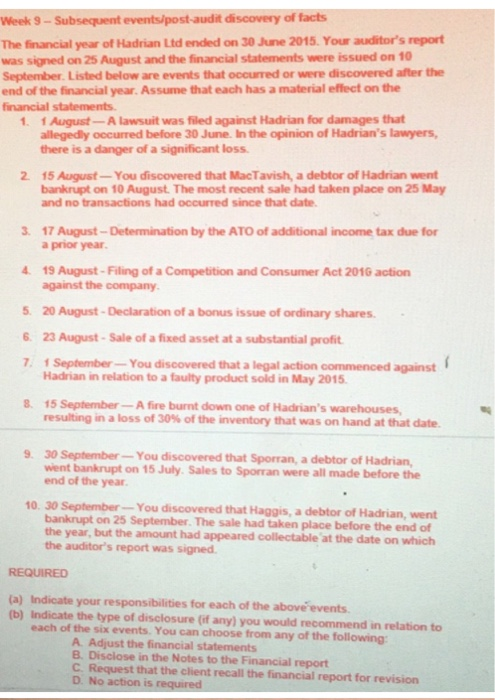

Week 9 - Subsequent events post-audit discovery of facts The financial year of Hadrian Ltd ended on 30 June 2015. Your auditor's report was signed on 25 August and the financial statements were issued on 10 September. Listed below are events that occurred or were discovered after the end of the financial year. Assume that each has a material effect on the financial statements 1 1 August-A lawsuit was filed against Hadrian for damages that allegedly occurred before 30 June. In the opinion of Hadrian's lawyers, there is a danger of a significant loss. 2 15 August - You discovered that MacTavish, a debtor of Hadrian went bankrupt on 10 August. The most recent sale had taken place on 25 May and no transactions had occurred since that date. 3. 17 August - Determination by the ATO of additional income tax due for a prior year 4. 19 August - Filing of a Competition and Consumer Act 2016 action against the company. 5. 20 August - Declaration of a bonus issue of ordinary shares. 6 23 August - Sale of a fixed asset at a substantial profit 7 1 September You discovered that a legal action commenced against Hadrian in relation to a faulty product sold in May 2015 8 15 September - A fire burnt down one of Hadrian's warehouses resulting in a loss of 30% of the inventory that was on hand at that date 9.30 September - You discovered that Sporran, a debtor of Hadrian, went bankrupt on 15 July Sales to Sporran were all made before the end of the year 10. 30 September You discovered that Haggis, a debtor of Hadrian, went bankrupt on 25 September. The sale had taken place before the end of the year, but the amount had appeared collectable at the date on which the auditor's report was signed REQUIRED (a) Indicate your responsibilities for each of the above events (b) Indicate the type of disclosure (if any) you would recommend in relation to each of the six events. You can choose from any of the following: A Adjust the financial statements B. Disclose in the Notes to the Financial report C Request that the client recall the financial report for revision D.No action is required Week 9 - Subsequent events post-audit discovery of facts The financial year of Hadrian Ltd ended on 30 June 2015. Your auditor's report was signed on 25 August and the financial statements were issued on 10 September. Listed below are events that occurred or were discovered after the end of the financial year. Assume that each has a material effect on the financial statements 1 1 August-A lawsuit was filed against Hadrian for damages that allegedly occurred before 30 June. In the opinion of Hadrian's lawyers, there is a danger of a significant loss. 2 15 August - You discovered that MacTavish, a debtor of Hadrian went bankrupt on 10 August. The most recent sale had taken place on 25 May and no transactions had occurred since that date. 3. 17 August - Determination by the ATO of additional income tax due for a prior year 4. 19 August - Filing of a Competition and Consumer Act 2016 action against the company. 5. 20 August - Declaration of a bonus issue of ordinary shares. 6 23 August - Sale of a fixed asset at a substantial profit 7 1 September You discovered that a legal action commenced against Hadrian in relation to a faulty product sold in May 2015 8 15 September - A fire burnt down one of Hadrian's warehouses resulting in a loss of 30% of the inventory that was on hand at that date 9.30 September - You discovered that Sporran, a debtor of Hadrian, went bankrupt on 15 July Sales to Sporran were all made before the end of the year 10. 30 September You discovered that Haggis, a debtor of Hadrian, went bankrupt on 25 September. The sale had taken place before the end of the year, but the amount had appeared collectable at the date on which the auditor's report was signed REQUIRED (a) Indicate your responsibilities for each of the above events (b) Indicate the type of disclosure (if any) you would recommend in relation to each of the six events. You can choose from any of the following: A Adjust the financial statements B. Disclose in the Notes to the Financial report C Request that the client recall the financial report for revision D.No action is required