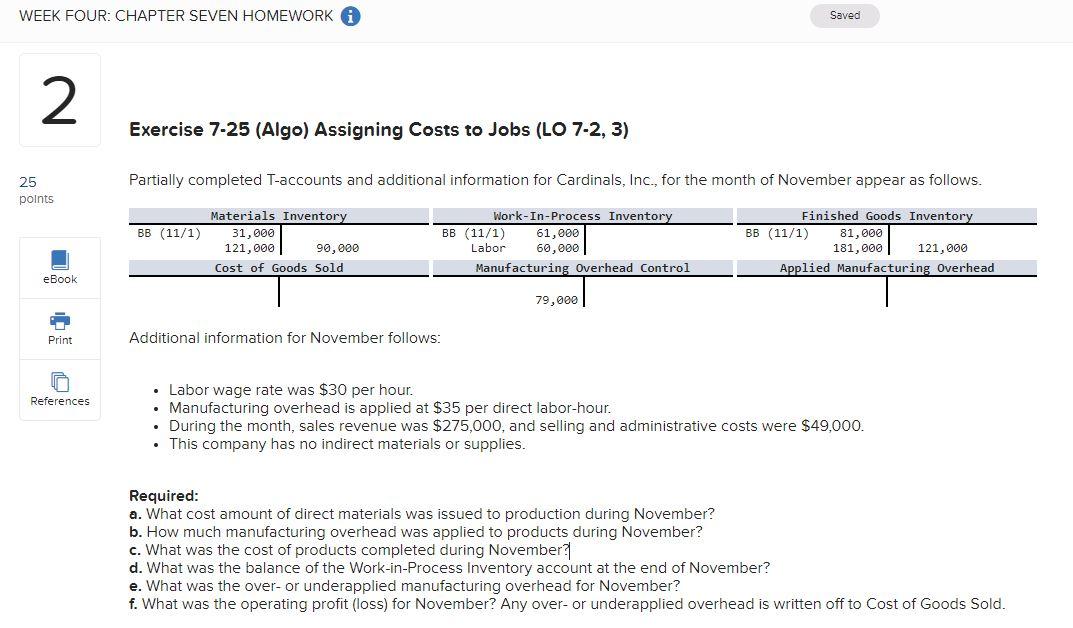

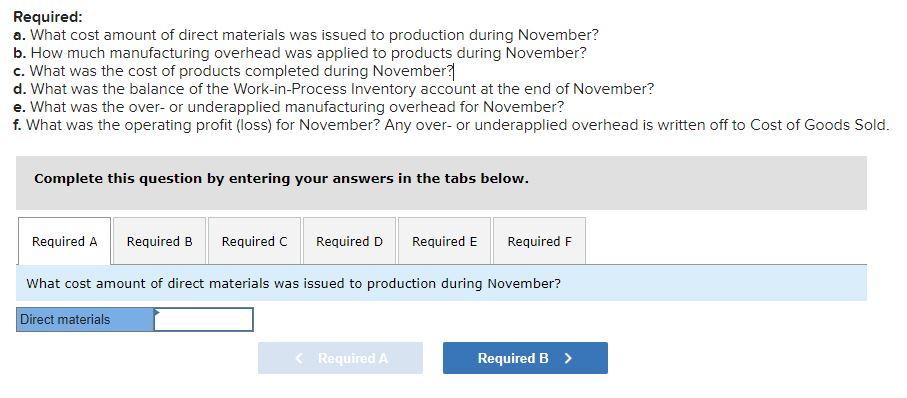

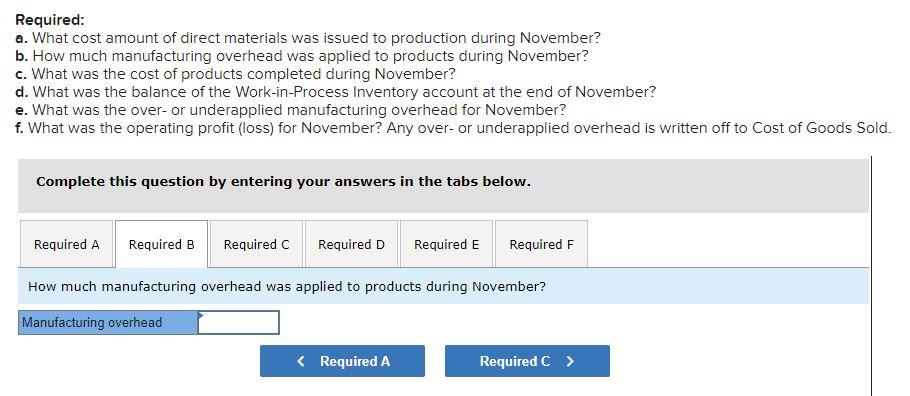

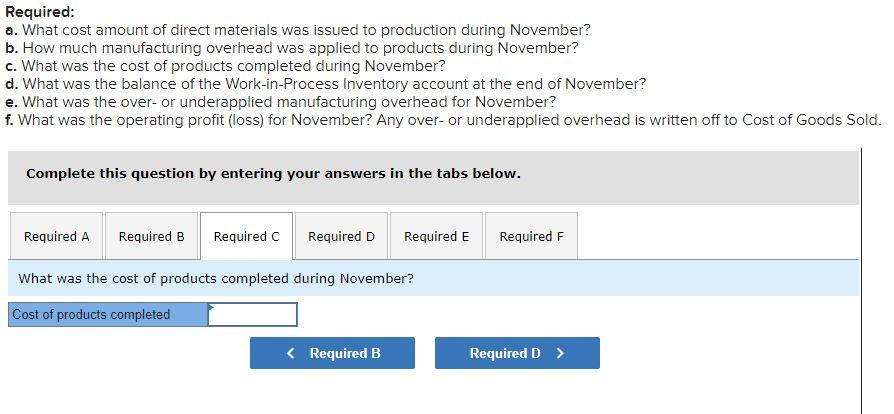

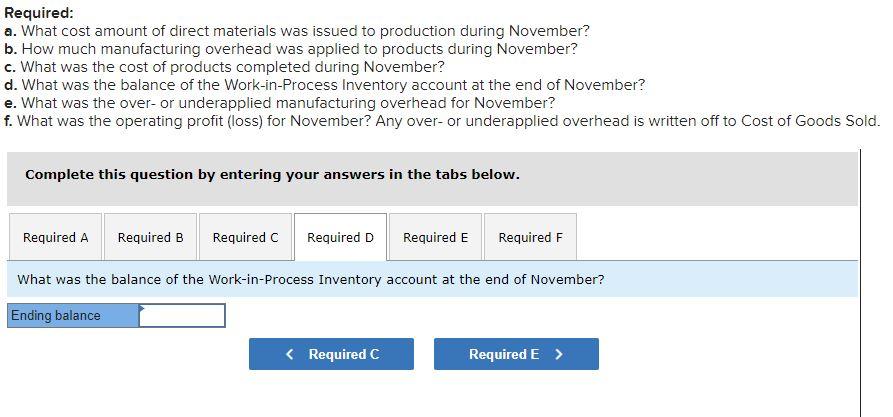

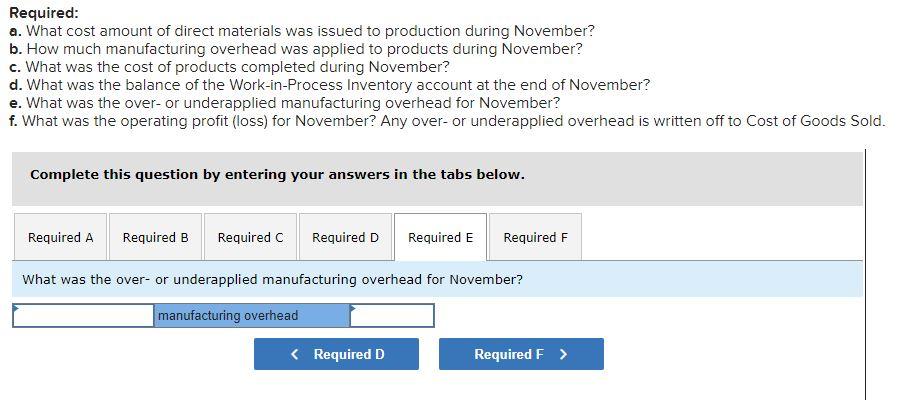

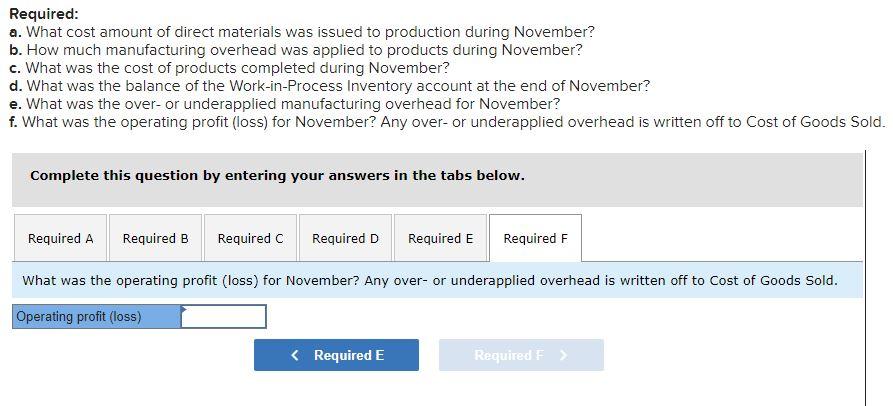

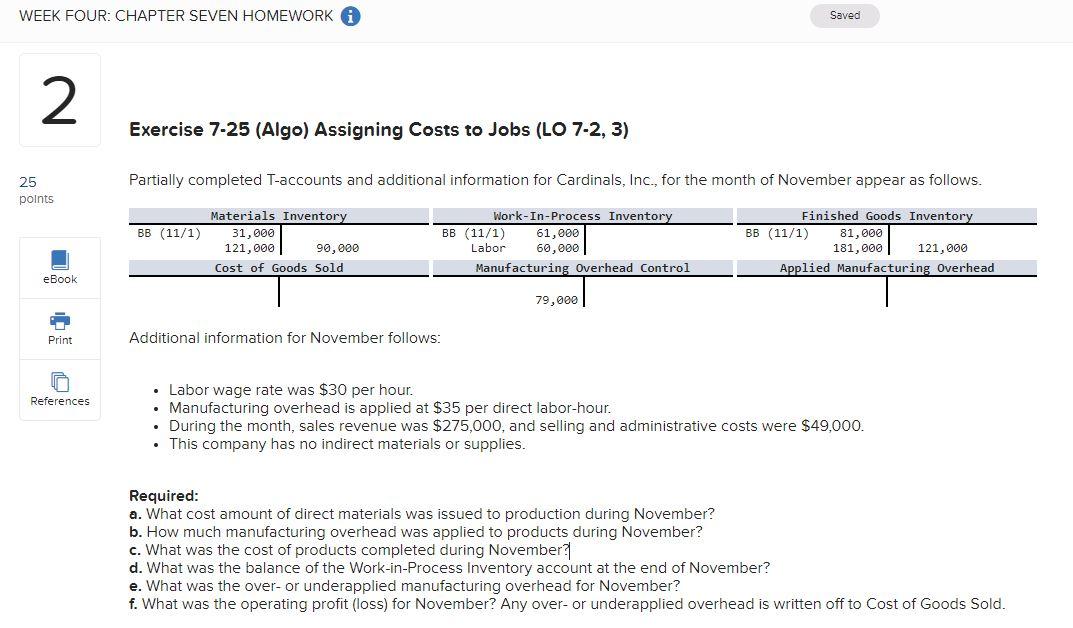

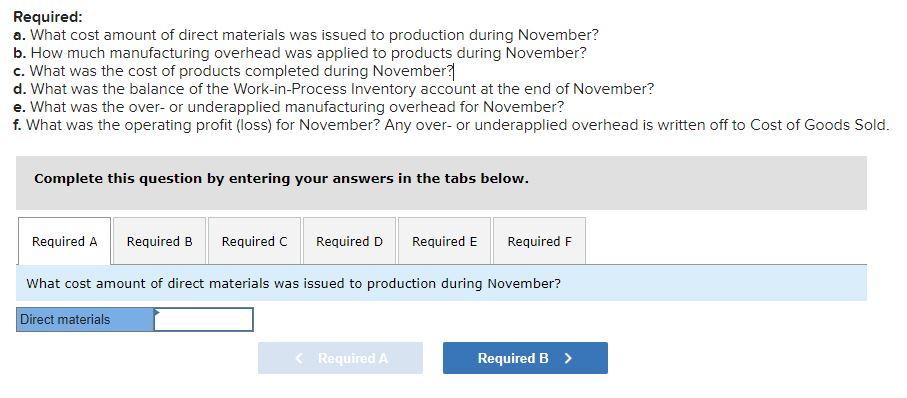

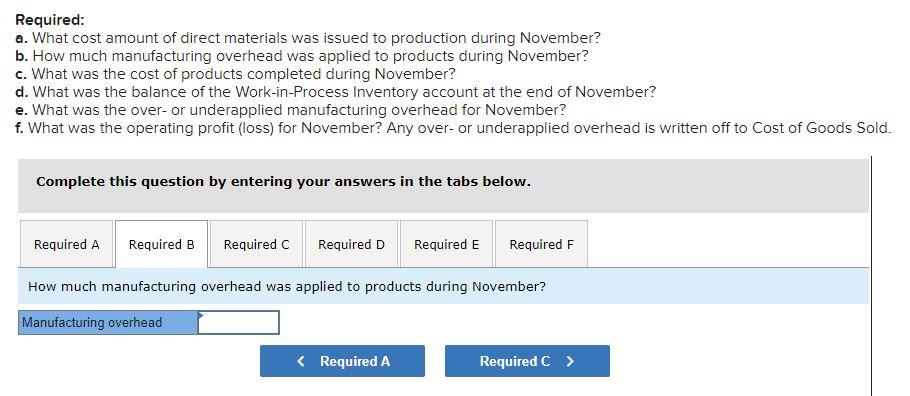

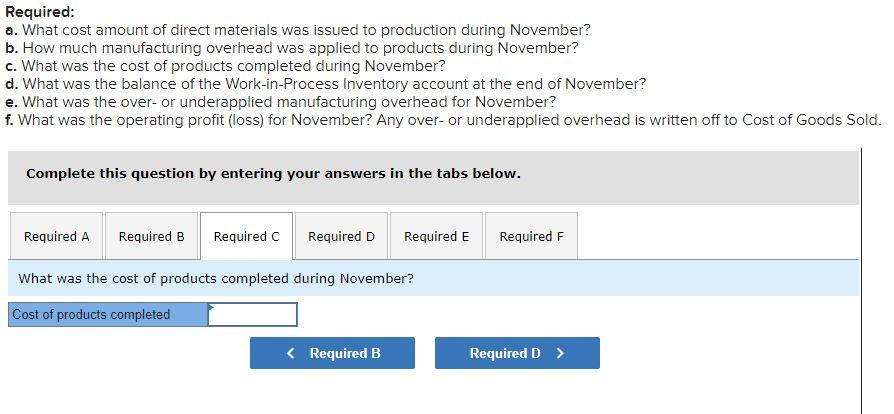

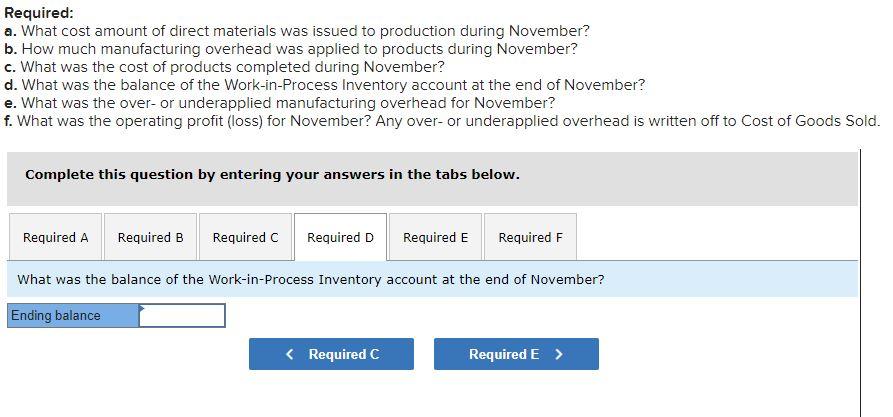

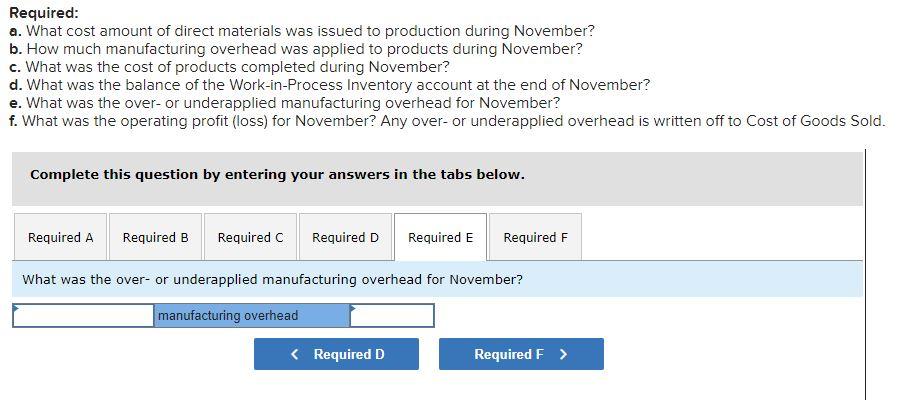

WEEK FOUR: CHAPTER SEVEN HOMEWORK Saved 2 Exercise 7-25 (Algo) Assigning Costs to Jobs (LO 7-2, 3) Partially completed T-accounts and additional information for Cardinals, Inc., for the month of November appear as follows. 25 points BB (11/1) Materials Inventory 31,800 121,000 90,000 Cost of Goods Sold Work-In-Process Inventory BB (11/1) 61,000 Labor 60,000 Manufacturing Overhead Control Finished Goods Inventory BB (11/1) 81,000 181,000 121,000 Applied Manufacturing Overhead eBook 79,000 Print Additional information for November follows: References Labor wage rate was $30 per hour. Manufacturing overhead is applied at $35 per direct labor-hour. . During the month, sales revenue was $275,000, and selling and administrative costs were $49,000. This company has no indirect materials or supplies. Required: a. What cost amount of direct materials was issued to production during November? b. How much manufacturing overhead was applied to products during November? c. What was the cost of products completed during November? d. What was the balance of the Work-in-Process Inventory account at the end of November? e. What was the over- or underapplied manufacturing overhead for November? f. What was the operating profit (loss) for November? Any over- or underapplied overhead is written off to Cost of Goods Sold. Required: a. What cost amount of direct materials was issued to production during November? b. How much manufacturing overhead was applied to products during November? c. What was the cost of products completed during November? d. What was the balance of the Work-in-Process Inventory account at the end of November? e. What was the over- or underapplied manufacturing overhead for November? f. What was the operating profit (loss) for November? Any over- or underapplied overhead is written off to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Required F What cost amount of direct materials was issued to production during November? Direct materials Required A Required > Required: a. What cost amount of direct materials was issued to production during November? b. How much manufacturing overhead was applied to products during November? c. What was the cost of products completed during November? d. What was the balance of the Work-in-Process Inventory account at the end of November? e. What was the over- or underapplied manufacturing overhead for November? f. What was the operating profit (loss) for November? Any over- or underapplied overhead is written off to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Required F How much manufacturing overhead was applied to products during November? Manufacturing overhead Required: a. What cost amount of direct materials was issued to production during November? b. How much manufacturing overhead was applied to products during November? c. What was the cost of products completed during November? d. What was the balance of the Work-in-Process Inventory account at the end of November? e. What was the over- or underapplied manufacturing overhead for November? f. What was the operating profit (loss) for November? Any over- or underapplied overhead is written off to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Required F What was the cost of products completed during November? Cost of products completed Required: a. What cost amount of direct materials was issued to production during November? b. How much manufacturing overhead was applied to products during November? c. What was the cost of products completed during November? d. What was the balance of the Work-in-Process Inventory account at the end of November? e. What was the over- or underapplied manufacturing overhead for November? f. What was the operating profit (loss) for November? Any over- or underapplied overhead is written off to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Required F What was the balance of the Work-in-Process Inventory account at the end of November? Ending balance Required: a. What cost amount of direct materials was issued to production during November? b. How much manufacturing overhead was applied to products during November? c. What was the cost of products completed during November? d. What was the balance of the Work-in-Process Inventory account at the end of November? e. What was the over- or underapplied manufacturing overhead for November? f. What was the operating profit (loss) for November? Any over- or underapplied overhead is written off to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Required F What was the over- or underapplied manufacturing overhead for November? manufacturing overhead Required: a. What cost amount of direct materials was issued to production during November? b. How much manufacturing overhead was applied to products during November? c. What was the cost of products completed during November? d. What was the balance of the Work-in-Process Inventory account at the end of November? e. What was the over- or underapplied manufacturing overhead for November? f. What was the operating profit (loss) for November? Any over- or underapplied overhead is written off to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Required F What was the operating profit (loss) for November? Any over- or underapplied overhead is written off to Cost of Goods Sold. Operating profit (loss)

![For Heintz/parrys College Accounting, Chapters 1-15, 22nd Edition, [instant Access]](https://dsd5zvtm8ll6.cloudfront.net/si.question.images/book_images/2022/04/6257c8d15b633_2096257c8d10b1d2.jpg)