Answered step by step

Verified Expert Solution

Question

1 Approved Answer

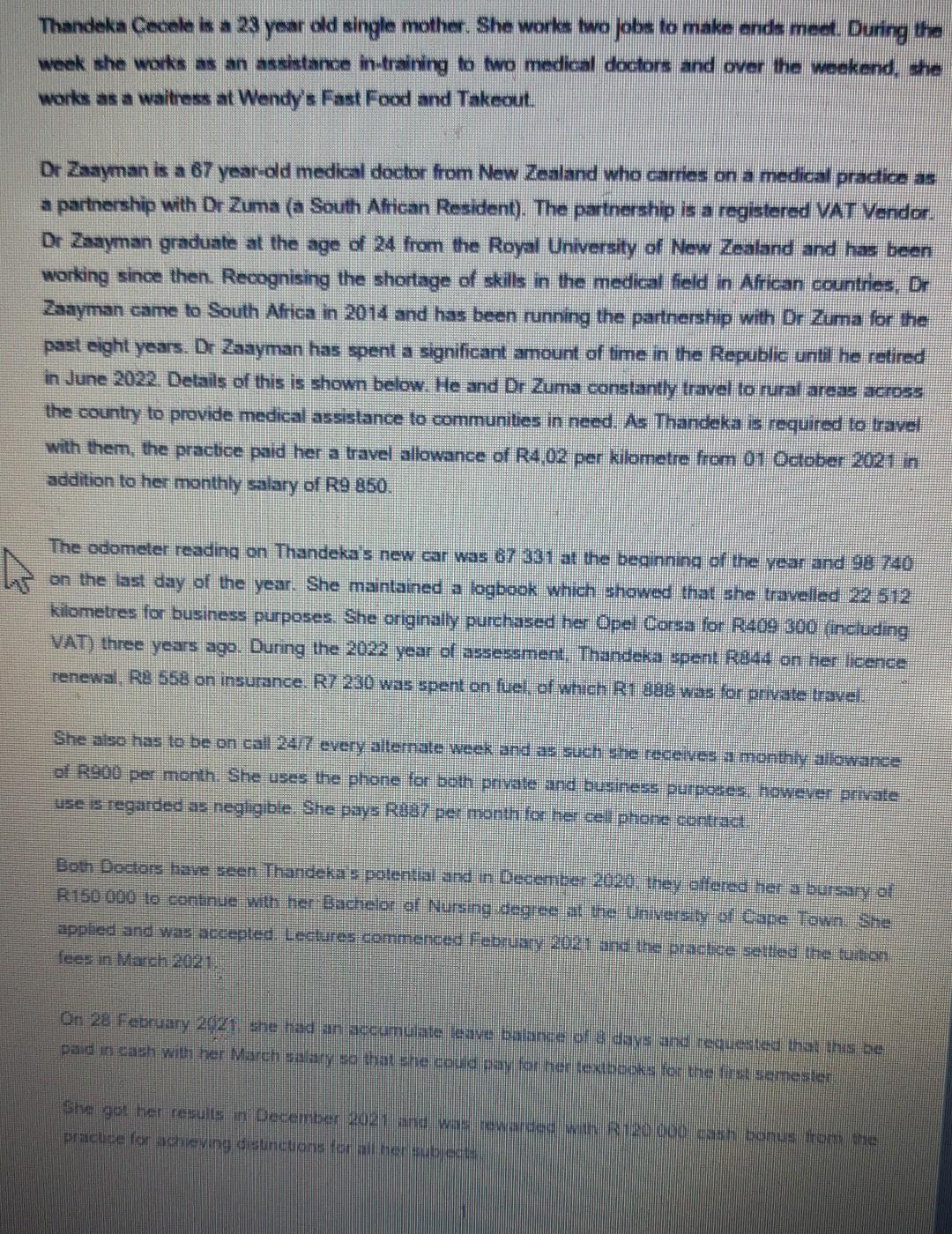

week she works as an assistance in-training to two medical doctors and over the waekend, she works as a waitiess at Wendy's Fast Food and

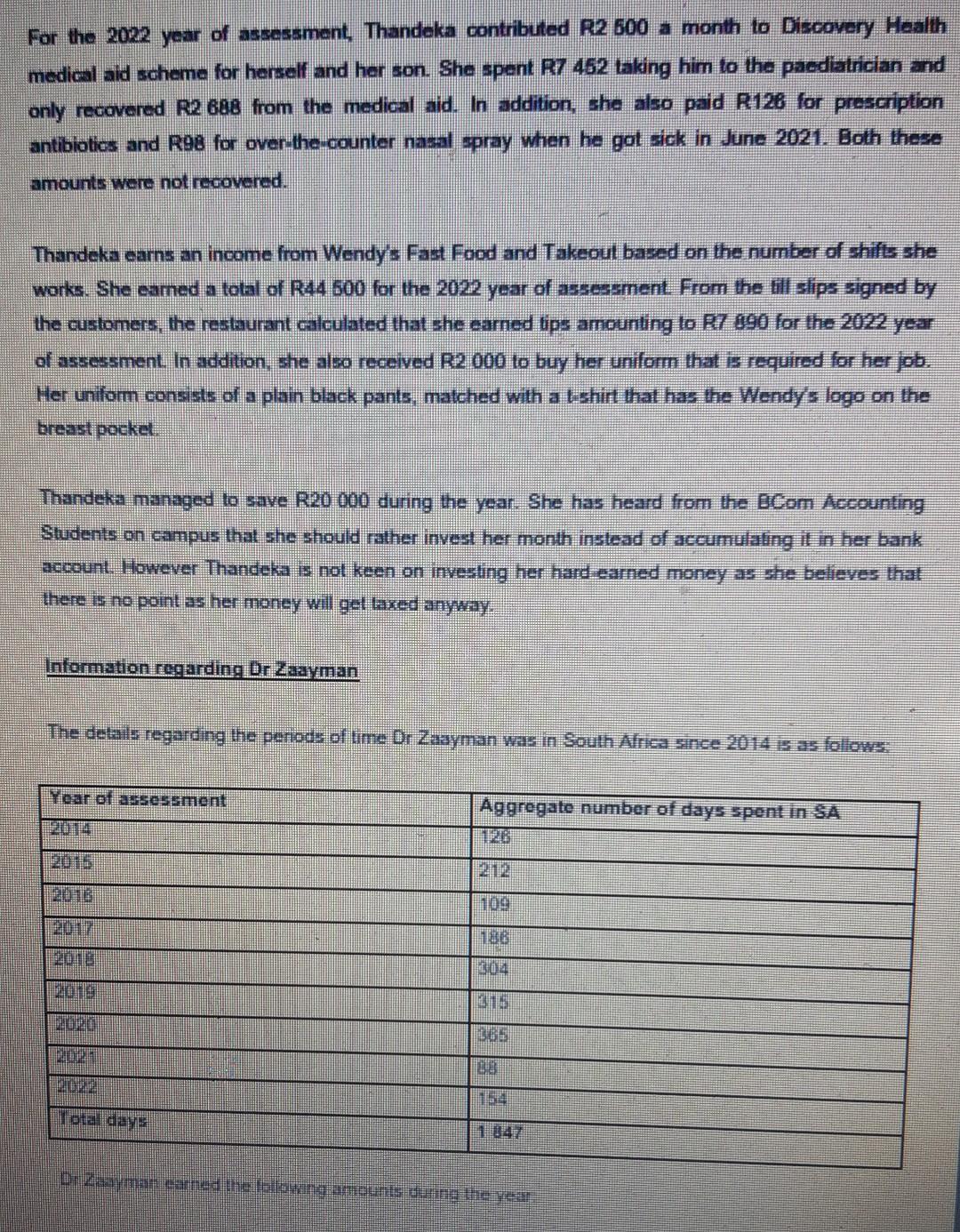

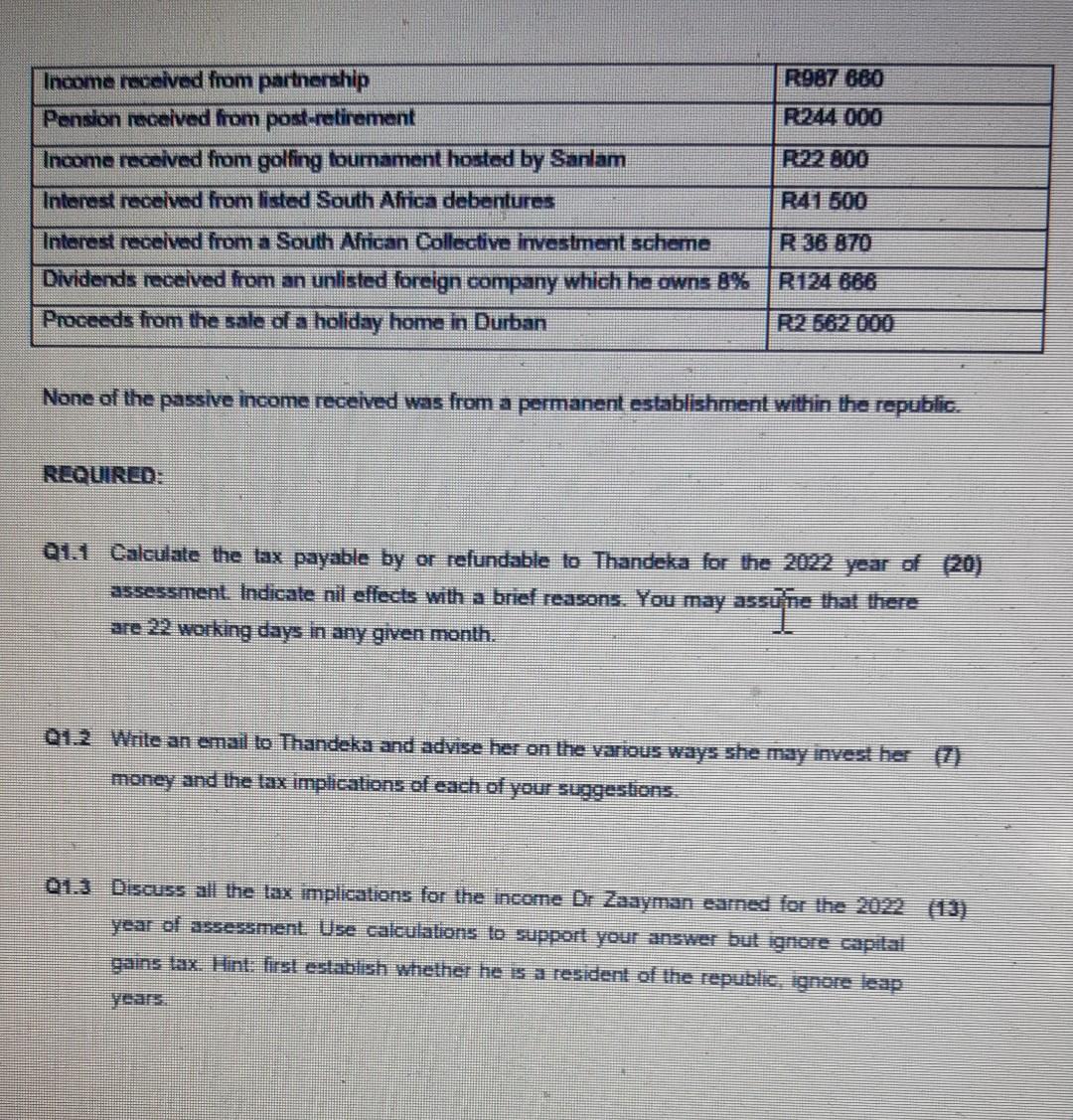

week she works as an assistance in-training to two medical doctors and over the waekend, she works as a waitiess at Wendy's Fast Food and Takeout. Dr Zaayman is a 67 yean-old medical doctor from New Zealand who oarres on a medical practice as a parthership with Dr Zuma (a South African Resident). The partnership is a registered VAT Vendor. Dr Zaayman graduate at the age of 24 from the Royal University of New Zoaland and has been working since then. Recognising the shortage of skills in the medical field in African counines, Br Zaayman eame to South Africa in 2014 and has been running the parinership with Dr Zuma for the past eight years. Dr Zaayman has spent a significant amount of time in the Republic unti he retired in June 2022. Details of this is shown below. He and Dr Zuma constanty travel to rural areas across the country to provide medical assistance to communities in need. As. Thandeka is required to travel with them, the practice paid her a travel allowance of R4,02 per kilometre from 01 Oetober 2021 in addition to her monthly salary of R9850. The odometer reading on Thandeka's new ear was 67321 at the beqinning of the vear and 98,740 on the last day of the year. She maintained a logbook which showed that she travelled 22512 kilometres for business purposes. She originaly purchased her Opel Corsa for R409 300 including VAT) three years ago. During the 2022 year of assessment. Thandeka spent Re44 on her licence renewal, R2 556 on insurance. Ry 230 was spent on fuel, of when R1 302 was for private travel. She also has to be on call 247 every allernate week and as such she receves a monthly allowance of R900 per month. She uses the phone for both privte and business purposes however private use is regarded as negigble. She pays Rush per month for her ecl phone contract: Both Doctors tave seen Thandeka s potential and in Decenter 2020, hey offered her a bursary of R150 000 to contrue with her Bacheor of Nursing degree at the Whiversty of Cape lown she applied and was accested. Lectures commenced Febyay 2021 and the pratice selled the thiton fees in March 2021. On 28 February 2021 the had an accumulate leave balance of a days and requested that thus be For the 2022 year of assessment, Thandeka contributed R2 600 a month to Discovery Healih medical aid scheme for herself and her son. She spent P7 452 taking him to the paedialician and only recovered R2 688 from the medical aid. In addition, she also paid R126 for prescription antibiotios and R98 for over-the-counter nasal spray when he got sick in June 2021. Both these amounts were not recovered. Thandeka earns an income from Wendy's Fast Food and Takeoul based on the number of shilts she works. She earned a total of R44 600 for the 2022 year of assessment. From the till slips signed by the customers, the restaurant calculated that she earned tips amounting to 87 890 for the 2022 year of assessment. In addition, she also received R2 000 to buy her uniform that is required for her job. Her uniform consists of a plain black pants, matched with a tshirt that has the Wendy's logo on the breast pocket. Thandeka managed to save R20 000 during the year. She has heard from the BCom Accounting Swdents on campus that she should rather invest her month instead of accumulaling it in her bank account. However Thandeka is not keen on investing her hand earned money as she believes that there is no point as her money will get laxed anyway. None of the passive income received was from a permanent establishment within the republic. RePulRed: Q1.1 Calculate the tax payable by or refundable to Thandeka for the 2022 year of (20) assessment. Indicate nil effects with a brief reasons. You may asstine that thereare 22 working days in any given month. Q1.2. Write an email to Thandeka and advise her on the various ways she may invest her (7) money and the tax implications of each of your suggestions. Q1.3. Discuss all the tax implications for the income Di Zaayman eamed for the 20122 (13) year of assessment. Use calculations to support your answer but ignore capitat gains ax. Hint: first estabilsh whether he is a resident of the republic, ignore leap years. week she works as an assistance in-training to two medical doctors and over the waekend, she works as a waitiess at Wendy's Fast Food and Takeout. Dr Zaayman is a 67 yean-old medical doctor from New Zealand who oarres on a medical practice as a parthership with Dr Zuma (a South African Resident). The partnership is a registered VAT Vendor. Dr Zaayman graduate at the age of 24 from the Royal University of New Zoaland and has been working since then. Recognising the shortage of skills in the medical field in African counines, Br Zaayman eame to South Africa in 2014 and has been running the parinership with Dr Zuma for the past eight years. Dr Zaayman has spent a significant amount of time in the Republic unti he retired in June 2022. Details of this is shown below. He and Dr Zuma constanty travel to rural areas across the country to provide medical assistance to communities in need. As. Thandeka is required to travel with them, the practice paid her a travel allowance of R4,02 per kilometre from 01 Oetober 2021 in addition to her monthly salary of R9850. The odometer reading on Thandeka's new ear was 67321 at the beqinning of the vear and 98,740 on the last day of the year. She maintained a logbook which showed that she travelled 22512 kilometres for business purposes. She originaly purchased her Opel Corsa for R409 300 including VAT) three years ago. During the 2022 year of assessment. Thandeka spent Re44 on her licence renewal, R2 556 on insurance. Ry 230 was spent on fuel, of when R1 302 was for private travel. She also has to be on call 247 every allernate week and as such she receves a monthly allowance of R900 per month. She uses the phone for both privte and business purposes however private use is regarded as negigble. She pays Rush per month for her ecl phone contract: Both Doctors tave seen Thandeka s potential and in Decenter 2020, hey offered her a bursary of R150 000 to contrue with her Bacheor of Nursing degree at the Whiversty of Cape lown she applied and was accested. Lectures commenced Febyay 2021 and the pratice selled the thiton fees in March 2021. On 28 February 2021 the had an accumulate leave balance of a days and requested that thus be For the 2022 year of assessment, Thandeka contributed R2 600 a month to Discovery Healih medical aid scheme for herself and her son. She spent P7 452 taking him to the paedialician and only recovered R2 688 from the medical aid. In addition, she also paid R126 for prescription antibiotios and R98 for over-the-counter nasal spray when he got sick in June 2021. Both these amounts were not recovered. Thandeka earns an income from Wendy's Fast Food and Takeoul based on the number of shilts she works. She earned a total of R44 600 for the 2022 year of assessment. From the till slips signed by the customers, the restaurant calculated that she earned tips amounting to 87 890 for the 2022 year of assessment. In addition, she also received R2 000 to buy her uniform that is required for her job. Her uniform consists of a plain black pants, matched with a tshirt that has the Wendy's logo on the breast pocket. Thandeka managed to save R20 000 during the year. She has heard from the BCom Accounting Swdents on campus that she should rather invest her month instead of accumulaling it in her bank account. However Thandeka is not keen on investing her hand earned money as she believes that there is no point as her money will get laxed anyway. None of the passive income received was from a permanent establishment within the republic. RePulRed: Q1.1 Calculate the tax payable by or refundable to Thandeka for the 2022 year of (20) assessment. Indicate nil effects with a brief reasons. You may asstine that thereare 22 working days in any given month. Q1.2. Write an email to Thandeka and advise her on the various ways she may invest her (7) money and the tax implications of each of your suggestions. Q1.3. Discuss all the tax implications for the income Di Zaayman eamed for the 20122 (13) year of assessment. Use calculations to support your answer but ignore capitat gains ax. Hint: first estabilsh whether he is a resident of the republic, ignore leap years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started