Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wees Tutorial Questions Question ! What is the ellicient liontier! Question 2 You manage a risk portfolio with expected rate of return of 18% and

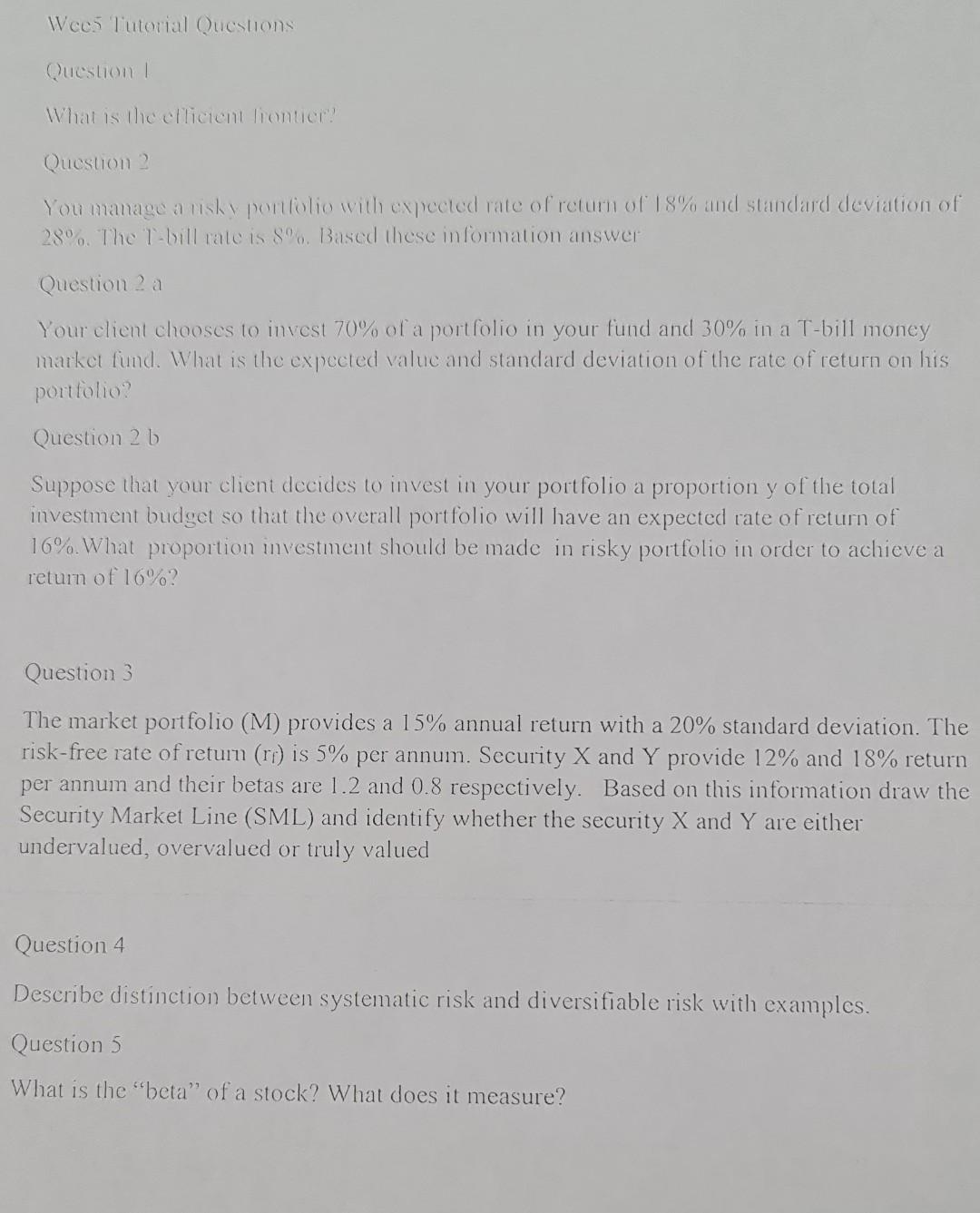

Wees Tutorial Questions Question ! What is the ellicient liontier! Question 2 You manage a risk portfolio with expected rate of return of 18% and standard deviation of 28. The T-bill rate is S. Based these information answer Question 2 a Your client chooses to invest 70% of a portfolio in your fund and 30% in a T-bill money market fund. What is the expected value and standard deviation of the rate of return on his portfolio Question 2b Suppose that your client decides to invest in your portfolio a proportion y of the total investment budget so that the overall portfolio will have an expected rate of return of 16%. What proportion investment should be made in risky portfolio in order to achieve a return of 16%? Question 3 The market portfolio (M) provides a 15% annual return with a 20% standard deviation. The risk-free rate of return (ri) is 5% per annum. Security X and Y provide 12% and 18% return per annum and their betas are 1.2 and 0.8 respectively. Based on this information draw the Security Market Line (SML) and identify whether the security X and Y are either undervalued, overvalued or truly valued Question 4 Describe distinction between systematic risk and diversifiable risk with examples. Question 5 What is the "beta" of a stock? What does it measure

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started