Answered step by step

Verified Expert Solution

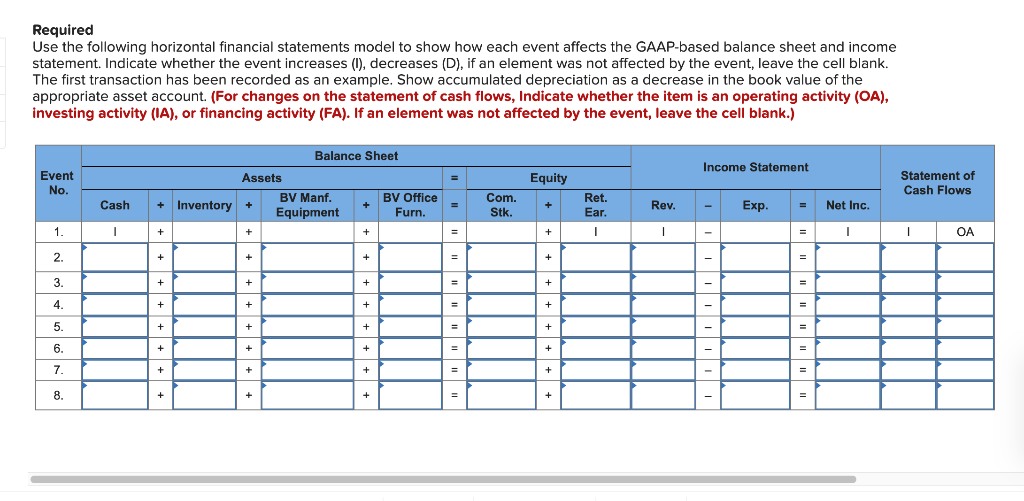

Question

1 Approved Answer

Weib Manufacturing experienced the following events during its first accounting period: 1. Recognized revenue from cash sale of products 2. Recognized cost ot goods sold

Weib Manufacturing experienced the following events during its first accounting period:

1. Recognized revenue from cash sale of products 2. Recognized cost ot goods sold from sale referenced in Event 1. 3. AcquIred cash by issuIng common stocK 4. Pala casn to purchase raw materias inat were used to make products. . Pala wages to proguction workers. 6. Paid salaries to administrative staff. 7. Recognized depreciation on manufacturing equipment. 8. recognized depreciation on offIce turniture

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started