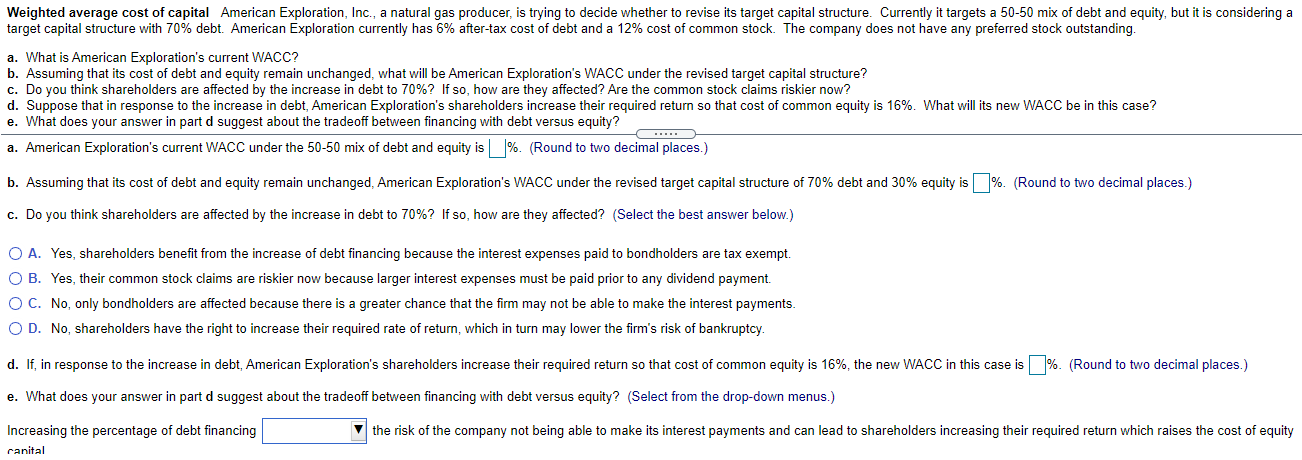

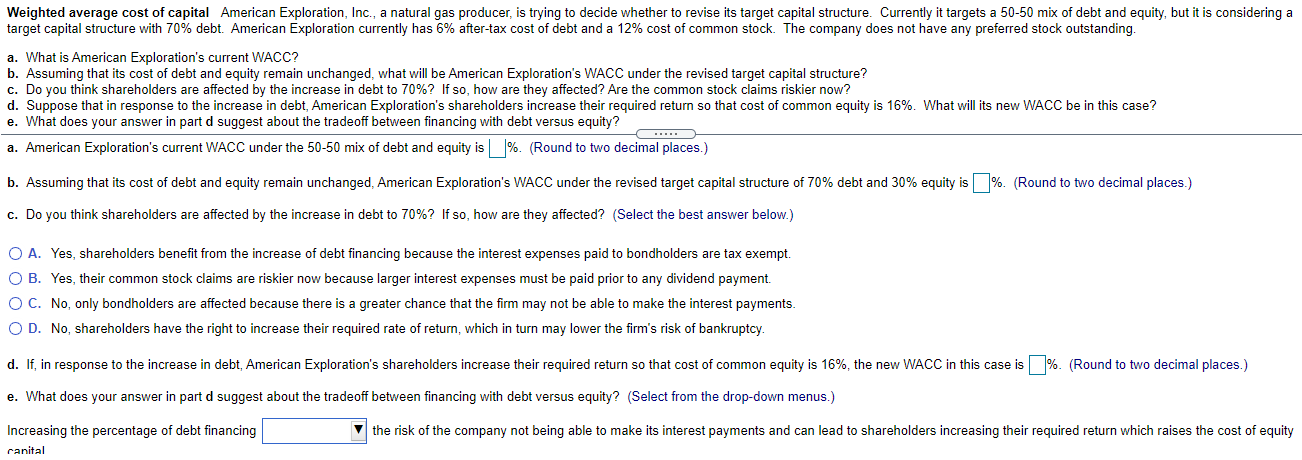

Weighted average cost of capital American Exploration, Inc., a natural gas producer, is trying to decide whether to revise its target capital structure. Currently it targets a 50-50 mix of debt and equity, but it is considering a target capital structure with 70% debt. American Exploration currently has 6% after-tax cost of debt and a 12% cost of common stock. The company does not have any preferred stock outstanding. a. What is American Exploration's current WACC? b. Assuming that its cost of debt and equity remain unchanged, what will be American Exploration's WACC under the revised target capital structure? c. Do you think shareholders are affected by the increase in debt to 70%? If so, how are they affected? Are the common stock claims riskier now? d. Suppose that in response to the increase in debt, American Exploration's shareholders increase their required return so that cost of common equity is 16%. What will its new WACC be in this case? e. What does your answer in part d suggest about the tradeoff between financing with debt versus equity? a. American Exploration's current WACC under the 50-50 mix of debt and equity is_l%. (Round to two decimal places.) b. Assuming that its cost of debt and equity remain unchanged, American Exploration's WACC under the revised target capital structure of 70% debt and 30% equity is%. (Round to two decimal places.) c. Do you think shareholders are affected by the increase in debt to 70%? If so, how are they affected? (Select the best answer below.) O A. Yes, shareholders benefit from the increase of debt financing because the interest expenses paid to bondholders are tax exempt. O B. Yes, their common stock claims are riskier now because larger interest expenses must be paid prior to any dividend payment. OC. No, only bondholders are affected because there is a greater chance that the firm may not be able to make the interest payments. OD. No, shareholders have the right to increase their required rate of return, which in turn may lower the firm's risk of bankruptcy. d. If, in response to the increase in debt, American Exploration's shareholders increase their required return so that cost of common equity is 16%, the new WACC in this case is%. (Round to two decimal places.) e. What does your answer in part d suggest about the tradeoff between financing with debt versus equity? (Select from the drop-down menus.) Increasing the percentage of debt financing canital the risk of the company not being able to make its interest payments and can lead to shareholders increasing their required return which raises the cost of equity