Weighted average cost of capital

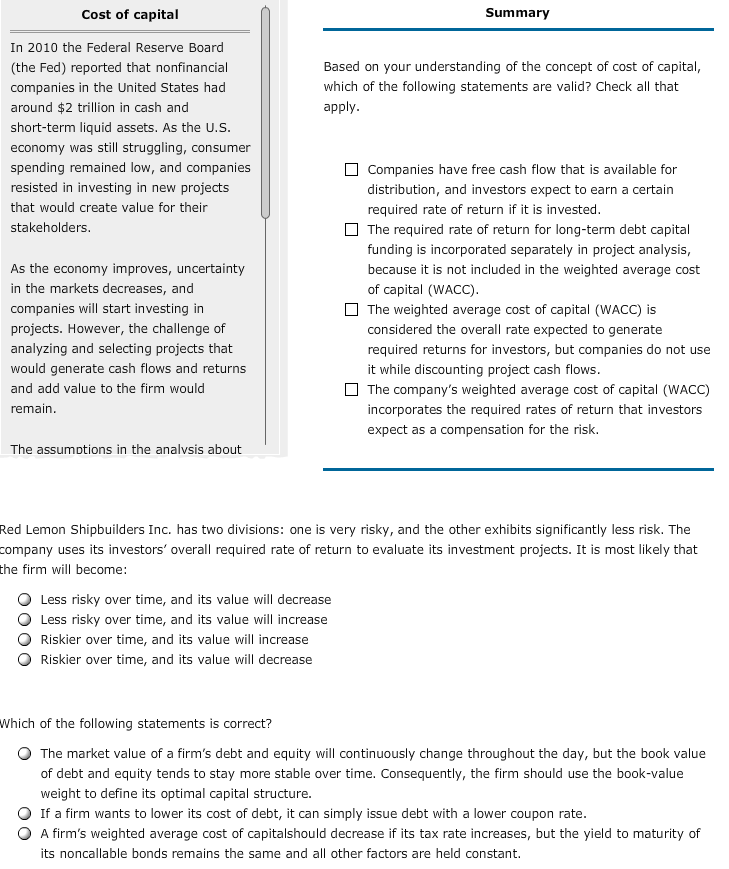

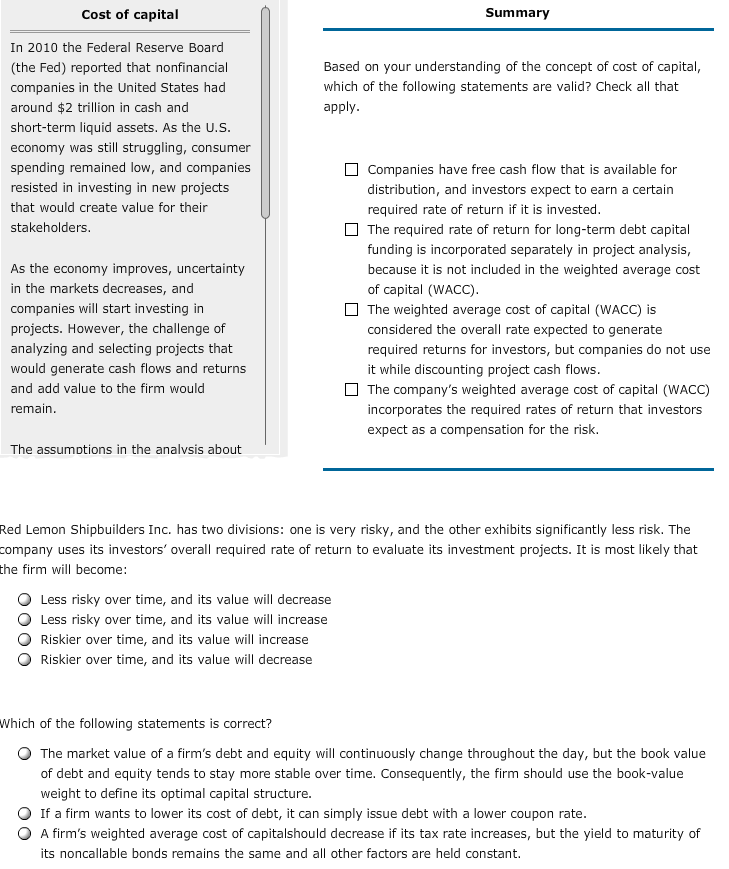

Cost of capital Summary In 2010 the Federal Reserve Board (the Fed) reported that nonfinancial companies in the United States had around $2 trillion in cash and short-term liquid assets. As the U.S economy was still struggling, consumer spending remained low, and companies resisted in investing in new projects that would create value for their stakeholders Based on your understanding of the concept of cost of capital which of the following statements are valid? Check all that apply Companies have free cash flow that is available for distribution, and investors expect to earn a certain required rate of return if it is invested The required rate of return for long-term debt capital As the economy improves, uncertainty in the markets decreases, and companies will start investing in projects. However, the challenge of analyzing and selecting projects that would generate cash flows and returns and add value to the firm would emain funding is incorporated separately in project analysis, because it is not included in the weighted average cost of capital (WACC) The weighted average cost of capital (WACC) is considered the overall rate expected to generate required returns for investors, but companies do not use it while discounting project cash flows The company's weighted average cost of capital (WACC) incorporates the required rates of return that investors expect as a compensation for the risk. The assumptions in the analvsis about Red Lemon Shipbuilders Inc. has two divisions: one is very risky, and the other exhibits significantly less risk. The company uses its investors' overall required rate of return to evaluate its investment projects. It is most likely that the firm will become: O Less risky over time, and its value will decrease O Less risky over time, and its value will increase Riskier over time, and its value will increase Riskier over time, and its value will decrease Which of the following statements is correct? O The market value of a firm's debt and equity will continuously change throughout the day, but the book value of debt and equity tends to stay more stable over time. Consequently, the firm should use the book-value weight to define its optimal capital structure. O If a firm wants to lower its cost of debt, it can simply issue debt with a lower coupon rate O A firm's weighted average cost of capitalshould decrease if its tax rate increases, but the yield to maturity of its noncallable bonds remains the same and all other factors are held constant