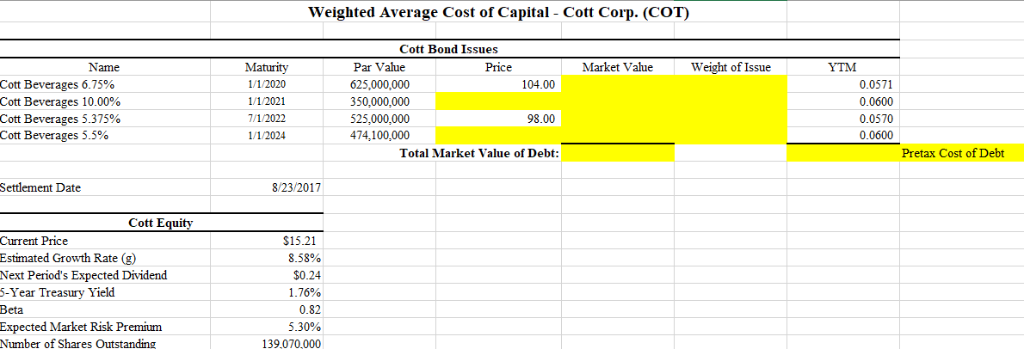

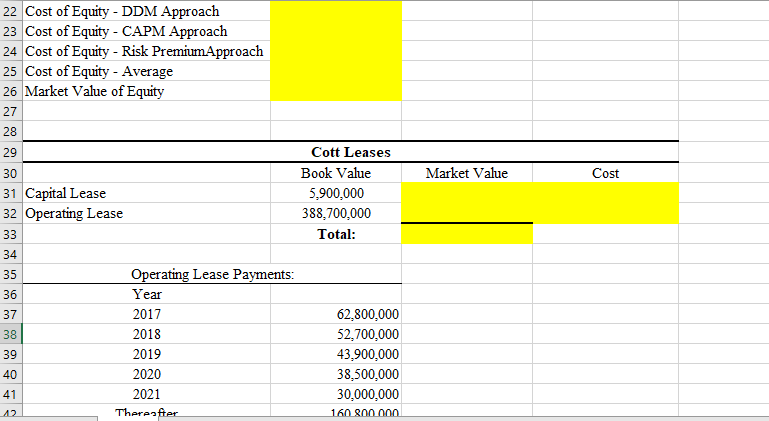

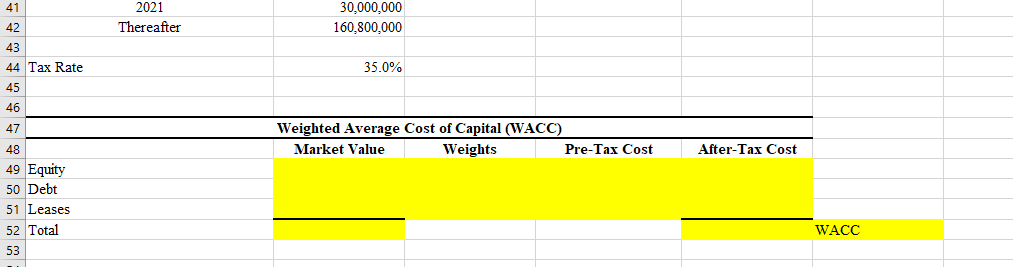

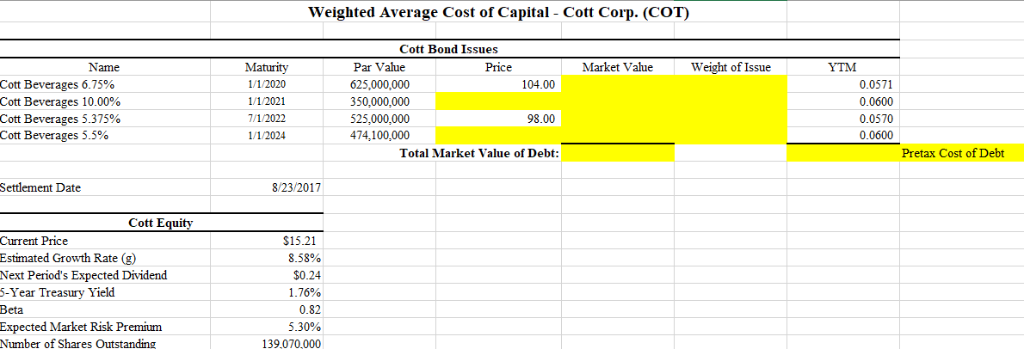

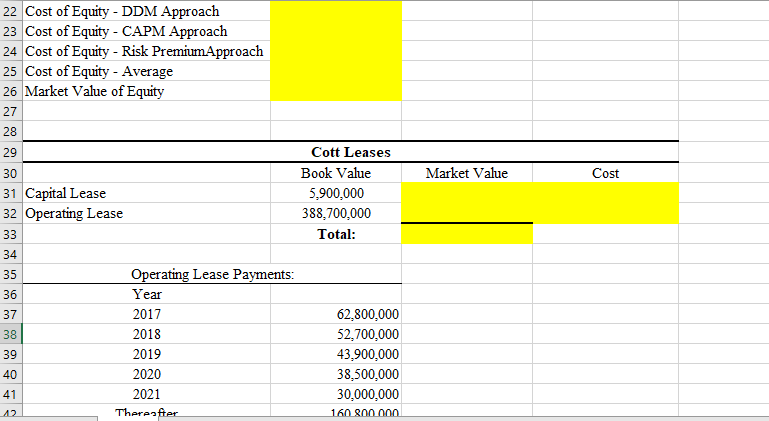

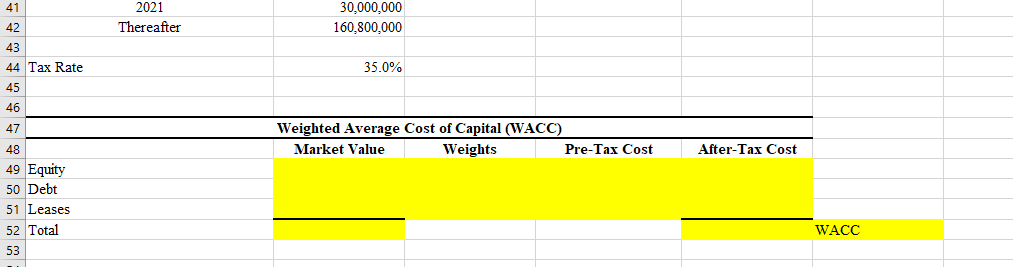

Weighted Average Cost of Capital- Cott Corp. (COT) Cott Bond Issues Maturity 1/1/2020 1/1/2021 7/1/2022 1/1/2024 Par Value 625,000,000 350,000,000 525,000,000 474,100,000 Name Price Market Value Weight of Issue YTM Cott Beverages 6.75% Cott Beverages 10.00% Cott Beverages 5.375% Cott Beverages 5.5% 0.0571 0.0600 0.0570 0.0600 104.00 98.00 Total Market Value of Debt Pretax Cost of Debt Settlement Date 8/23/2017 Cott E Current Price Estimated Growth Rate (g) Next Period's Expected Dividend 5-Year Treasury Yield Beta Expected Market Risk Premium Number of Shares Outstanding $15.21 8.58% $0.24 1. 76% 0.82 5.30% 139,070,000 22 Cost of Equity - DDM Approach 23 Cost of Equity - CAPM Approach 24 Cost of Equity - Ri 25 Cost of Equity - Average 26 Market Value of E 27 sk PremiumApproach Cott Leases 29 30 31 Capital Lease 32 Operating Lease Book Value 5,900,000 388,700,000 Total: Market Value Cost 34 35 36 37 38 39 40 perating Lease Payments: Year 2017 2018 2019 2020 2021 Thereaft 62,800,000 52,700,000 43,900,000 38,500,000 30,000,000 41 42 43 44 Tax Rate 2021 Thereafter 30,000,000 160,800,000 35.0% 46 47 48 49 Equity 50 Debt 51 Leases 52 Total 53 Weighted Average Cost of Capital (WACC) Market Value Weights Pre-Tax Cost After-Tax Cost WACC Weighted Average Cost of Capital- Cott Corp. (COT) Cott Bond Issues Maturity 1/1/2020 1/1/2021 7/1/2022 1/1/2024 Par Value 625,000,000 350,000,000 525,000,000 474,100,000 Name Price Market Value Weight of Issue YTM Cott Beverages 6.75% Cott Beverages 10.00% Cott Beverages 5.375% Cott Beverages 5.5% 0.0571 0.0600 0.0570 0.0600 104.00 98.00 Total Market Value of Debt Pretax Cost of Debt Settlement Date 8/23/2017 Cott E Current Price Estimated Growth Rate (g) Next Period's Expected Dividend 5-Year Treasury Yield Beta Expected Market Risk Premium Number of Shares Outstanding $15.21 8.58% $0.24 1. 76% 0.82 5.30% 139,070,000 22 Cost of Equity - DDM Approach 23 Cost of Equity - CAPM Approach 24 Cost of Equity - Ri 25 Cost of Equity - Average 26 Market Value of E 27 sk PremiumApproach Cott Leases 29 30 31 Capital Lease 32 Operating Lease Book Value 5,900,000 388,700,000 Total: Market Value Cost 34 35 36 37 38 39 40 perating Lease Payments: Year 2017 2018 2019 2020 2021 Thereaft 62,800,000 52,700,000 43,900,000 38,500,000 30,000,000 41 42 43 44 Tax Rate 2021 Thereafter 30,000,000 160,800,000 35.0% 46 47 48 49 Equity 50 Debt 51 Leases 52 Total 53 Weighted Average Cost of Capital (WACC) Market Value Weights Pre-Tax Cost After-Tax Cost WACC