Answered step by step

Verified Expert Solution

Question

1 Approved Answer

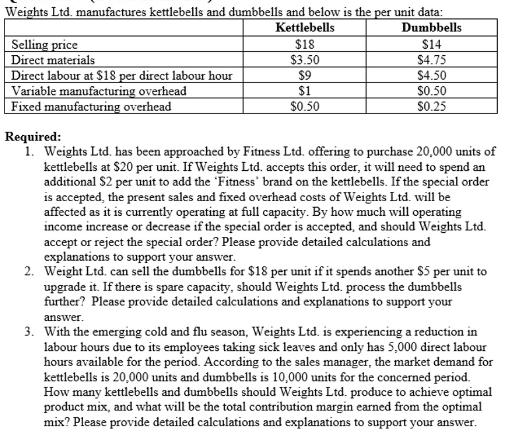

Weights Ltd. manufactures kettlebells and dumbbells and below is the per unit data: Kettlebells Dumbbells $18 $3.50 $9 $1 $0.50 Selling price Direct materials

Weights Ltd. manufactures kettlebells and dumbbells and below is the per unit data: Kettlebells Dumbbells $18 $3.50 $9 $1 $0.50 Selling price Direct materials Direct labour at $18 per direct labour hour Variable manufacturing overhead Fixed manufacturing overhead $14 $4.75 $4.50 $0.50 $0.25 Required: 1. Weights Ltd. has been approached by Fitness Ltd. offering to purchase 20,000 units of kettlebells at $20 per unit. If Weights Ltd. accepts this order, it will need to spend an additional $2 per unit to add the 'Fitness' brand on the kettlebells. If the special order is accepted, the present sales and fixed overhead costs of Weights Ltd. will be affected as it is currently operating at full capacity. By how much will operating income increase or decrease if the special order is accepted, and should Weights Ltd. accept or reject the special order? Please provide detailed calculations and explanations to support your answer. 2. Weight Ltd. can sell the dumbbells for $18 per unit if it spends another $5 per unit to upgrade it. If there is spare capacity, should Weights Ltd. process the dumbbells further? Please provide detailed calculations and explanations to support your answer. 3. With the emerging cold and flu season, Weights Ltd. is experiencing a reduction in labour hours due to its employees taking sick leaves and only has 5,000 direct labour hours available for the period. According to the sales manager, the market demand for kettlebells is 20,000 units and dumbbells is 10,000 units for the concerned period. How many kettlebells and dumbbells should Weights Ltd. produce to achieve optimal product mix, and what will be the total contribution margin earned from the optimal mix? Please provide detailed calculations and explanations to support your answer.

Step by Step Solution

★★★★★

3.37 Rating (141 Votes )

There are 3 Steps involved in it

Step: 1

1 Special Order for Kettlebells a Calculate the incremental contribution per unit for the special order Selling price per unit for the special order 2000 Additional cost to add the Fitness brand 200 I...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started