Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Eggs Ltd. produces customised outdoor egg chairs. On 1st May, there were three jobs in process, Jobs 1, 2 and 3, and Job 4

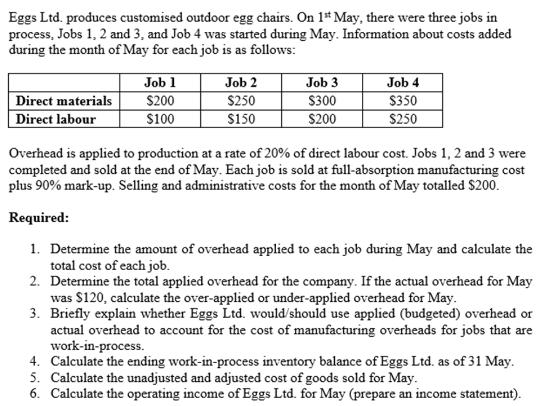

Eggs Ltd. produces customised outdoor egg chairs. On 1st May, there were three jobs in process, Jobs 1, 2 and 3, and Job 4 was started during May. Information about costs added during the month of May for each job is as follows: Direct materials Direct labour Job 1 $200 $100 Job 2 $250 $150 Job 3 $300 $200 Job 4 $350 $250 Overhead is applied to production at a rate of 20% of direct labour cost. Jobs 1, 2 and 3 were completed and sold at the end of May. Each job is sold at full-absorption manufacturing cost plus 90% mark-up. Selling and administrative costs for the month of May totalled $200. Required: 1. Determine the amount of overhead applied to each job during May and calculate the total cost of each job. 2. Determine the total applied overhead for the company. If the actual overhead for May was $120, calculate the over-applied or under-applied overhead for May. 3. Briefly explain whether Eggs Ltd. would/should use applied (budgeted) overhead or actual overhead to account for the cost of manufacturing overheads for jobs that are work-in-process. 4. Calculate the ending work-in-process inventory balance of Eggs Ltd. as of 31 May. 5. Calculate the unadjusted and adjusted cost of goods sold for May. 6. Calculate the operating income of Eggs Ltd. for May (prepare an income statement).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To answer the questions well go step by step 1 Determine the amount of overhead applied to each job during May and calculate the total cost of each job To calculate the applied overhead for each job w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started